Prop Firm Weekend Holding Rules Automation Setup Guide

Automate prop firm weekend holding rules to avoid gap risk and account violations. Implement time-based logic to flatten all positions before the Friday close.

Prop firm weekend holding rules automation setup refers to configuring automated trading systems to comply with proprietary trading firm policies regarding open positions over weekends. Most prop firms restrict or prohibit holding positions through market closures to limit gap risk exposure, requiring automated systems to include time-based exit logic that flattens all positions before Friday's close and prevents new entries until Sunday's open.

Key Takeaways

- Most prop firms prohibit weekend holding to avoid gap risk from news events during market closures, requiring automation to close all positions by 4:00 PM ET Friday

- Weekend holding violations typically trigger immediate evaluation failures or account suspensions, making compliant automation critical for funded traders

- Automated systems need time-based logic that stops new entries after 3:45 PM ET Friday and force-closes any open positions before the weekly settlement

- Some firms allow weekend holding with reduced position sizes (typically 25-50% of intraday limits) if specifically stated in their rules documentation

Table of Contents

- What Are Prop Firm Weekend Holding Rules?

- Why Do Prop Firms Restrict Weekend Positions?

- How to Configure Automation for Weekend Compliance

- Implementing Time-Based Exit Logic

- Common Weekend Holding Violations and How to Avoid Them

- Frequently Asked Questions

- Conclusion

What Are Prop Firm Weekend Holding Rules?

Weekend holding rules are compliance policies that restrict or prohibit traders from maintaining open futures positions during market closures between Friday's settlement and Sunday's reopen. These rules exist in approximately 70-80% of prop firm evaluation programs and funded accounts to protect firm capital from gap risk caused by weekend news events.

Weekend Holding: Maintaining an open futures position through the market closure period from Friday 5:00 PM ET until Sunday 6:00 PM ET. Most prop firms consider this a high-risk practice that violates their risk management protocols.

The specific implementation varies by firm. Some enforce absolute prohibition with automatic evaluation failure if any position remains open past 4:59 PM ET Friday. Others allow reduced position sizes (typically 25-50% of normal limits) if traders explicitly accept additional risk parameters.

For automated systems, this creates a critical compliance requirement. Your prop firm automation must include explicit time-based logic that prevents weekend exposure regardless of your strategy's normal entry and exit signals.

Why Do Prop Firms Restrict Weekend Positions?

Prop firms prohibit weekend holding primarily to limit gap risk exposure from geopolitical events, economic announcements, or unexpected news that occurs during the 61-hour weekend closure period. A futures contract can gap 2-5% or more on Sunday's open following significant weekend developments, potentially triggering maximum daily loss violations immediately.

The evaluation phase structure amplifies this concern. Most prop firm challenges use daily loss limits of 2-5% and trailing drawdown rules of 3-6% from account peaks. A single weekend gap against your position can simultaneously violate both thresholds before you can react, resulting in immediate evaluation failure.

Gap Risk: The probability that a futures contract opens significantly higher or lower than its previous close due to news or events during market closure. ES futures commonly gap 10-30 points (worth $125-$375 per contract) following major weekend developments.

From the firm's capital management perspective, allowing weekend positions across hundreds of evaluation accounts creates concentrated directional exposure. If 200 traders hold long ES positions into a weekend and the market gaps down 50 points on Monday, the firm faces $125,000 in losses per contract before any protective stops can execute.

How to Configure Automation for Weekend Compliance

Compliant prop firm automation requires three core components: time-based entry filters, forced exit logic, and position verification checks. Your automated system must actively prevent new positions after a cutoff time (typically 3:45-3:55 PM ET Friday) and force-close any remaining positions before 4:59 PM ET.

The entry filter component blocks new signals from executing during the restricted timeframe. If your TradingView strategy generates a buy signal at 3:50 PM Friday, the automation layer must reject it regardless of setup quality. This prevents situations where a late-day entry leaves you scrambling to exit before the close.

Weekend Compliance Automation Checklist

- ☐ Time-based entry filter that blocks new positions after 3:45 PM ET Friday

- ☐ Forced exit logic that closes all positions by 4:55 PM ET Friday (5-minute buffer before settlement)

- ☐ Position verification check at 4:58 PM ET to confirm zero open contracts

- ☐ Entry block that prevents signals until 6:01 PM ET Sunday (or firm's specified reopening time)

- ☐ Alert notification system that confirms weekend flattening occurred

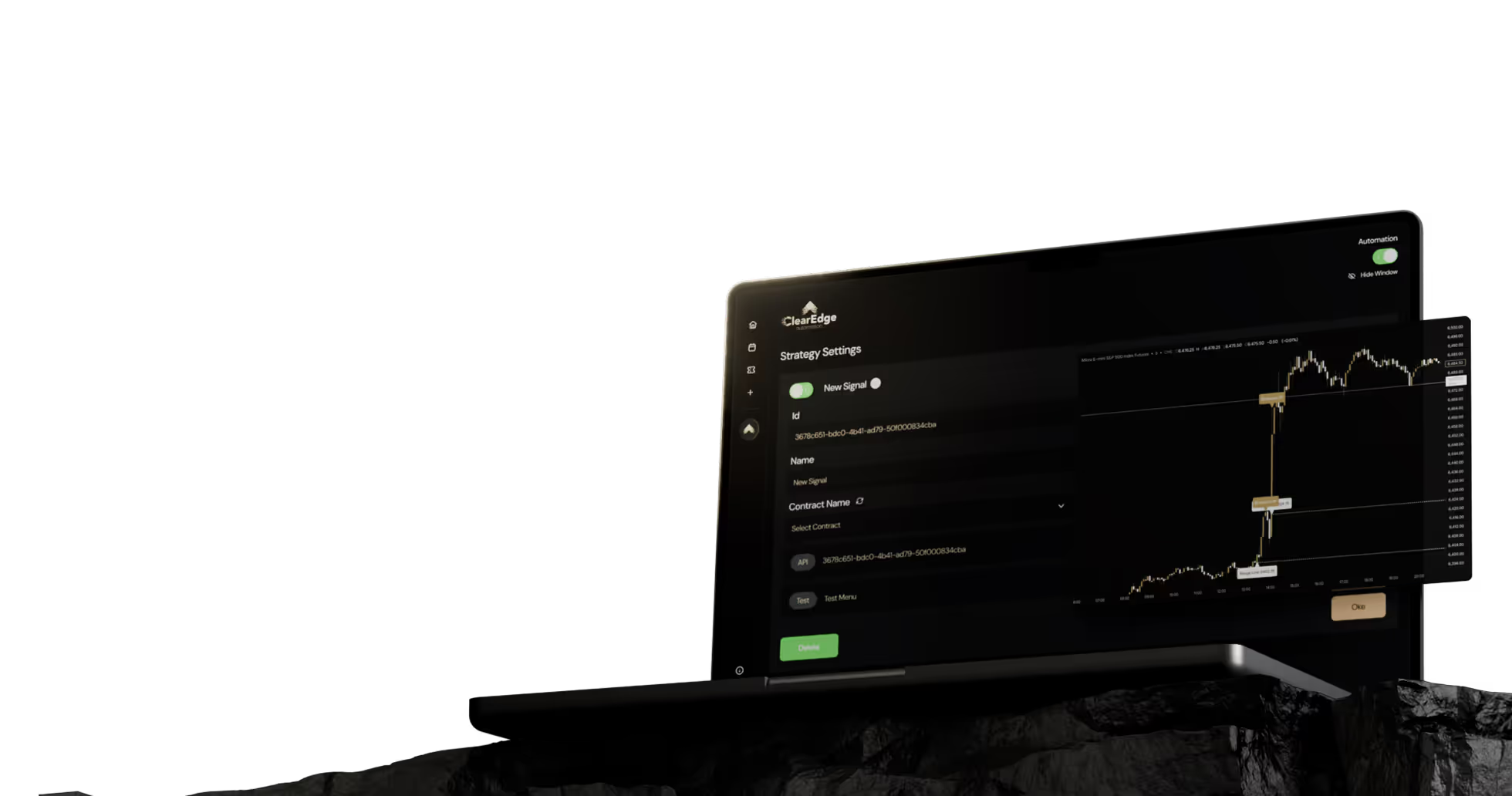

Platforms like ClearEdge Trading allow configuration of time-based rules without coding. You specify the restricted hours in your automation settings, and the platform automatically rejects signals during those periods while executing forced exits at your designated cutoff time.

The verification component is critical but often overlooked. After your forced exit logic runs, implement a final position check at 4:58 PM ET. If any positions remain open due to fill delays or execution issues, this triggers an emergency market order to flatten the account before settlement.

Implementing Time-Based Exit Logic

Time-based exit logic closes positions based on clock time rather than your strategy's normal technical signals. For weekend compliance, this means overriding any active trade's stop loss or take profit levels to exit at market price when Friday's cutoff time arrives.

The implementation approach depends on whether you're using a trading platform's native automation or a third-party execution layer. In TradingView's Pine Script, you can add time conditions to your strategy's exit logic. In webhook-based automation connected to your broker, you configure time-based exit rules in the execution platform.

Implementation MethodProsConsNative TradingView Strategy LogicNo external dependencies, exits fire automatically from chartRequires Pine Script knowledge, may miss execution if alert failsWebhook Automation PlatformCentralized control, works across multiple strategies, guaranteed executionRequires platform subscription, adds execution layerBroker API Time FilterDirect broker connection, minimal latencyComplex setup, limited to brokers with robust APIs

The timing of your forced exit matters significantly. Exiting exactly at 4:59 PM ET risks poor fills due to settlement volume and wider spreads in the final minute. Best practice is setting your forced exit between 4:50-4:55 PM ET, providing a 5-10 minute buffer for execution confirmation.

For strategies holding multiple positions simultaneously, implement the forced exit as a "flatten all" command rather than individual position closes. This ensures you don't miss any open contracts due to tracking errors or delayed fill confirmations from earlier exits.

Common Weekend Holding Violations and How to Avoid Them

The most frequent weekend holding violation occurs when traders assume their automation closed positions but fail to verify execution before market close. Partial fills, broker connectivity issues, or incorrect time zone settings leave positions open through settlement, triggering immediate evaluation failure Monday morning.

Time zone configuration errors cause approximately 30-40% of weekend violations based on prop firm compliance reports. If your automation platform uses UTC but you set your exit time assuming ET, your forced exit fires at the wrong hour. Always verify time zone settings match your broker's official market close time (typically 5:00 PM ET for CME futures).

Effective Weekend Compliance Practices

- Set forced exit 5-10 minutes before actual close for execution buffer

- Implement position verification check separate from exit logic

- Configure notifications that confirm zero positions at end of day

- Test time-based logic on demo account through multiple weekends

Common Mistakes That Cause Violations

- Relying solely on strategy exit signals without time-based override

- Setting exit time in wrong time zone (UTC vs ET confusion)

- Failing to account for partial fills in position tracking

- Not testing automation through actual weekend closure period

Another common violation involves strategies that scale into positions throughout the day. If your system adds to a position at 3:50 PM Friday, but your entry filter only blocks new trades (not additions to existing positions), you may unintentionally increase size right before forced exit. Configure your automation to treat position additions the same as new entries during the restricted window.

Some traders attempt to work around weekend restrictions by closing positions manually at 4:58 PM then immediately reopening them at 6:01 PM Sunday. Most prop firms explicitly prohibit this practice in their rules, considering it rule circumvention that violates the spirit of their risk management policies.

Frequently Asked Questions

1. Do all prop firms prohibit weekend holding for automated strategies?

Approximately 70-80% of prop firms enforce strict weekend holding prohibitions. A smaller subset (20-30%) allows weekend positions with reduced size limits, typically capped at 25-50% of normal intraday position limits and requiring explicit opt-in through account settings.

2. What happens if my automation fails and leaves a position open over the weekend?

Most firms treat weekend holding violations as immediate evaluation failure during the challenge phase, requiring you to purchase a new evaluation. For funded accounts, violations typically result in account suspension pending review, with potential termination for repeat violations.

3. How do I handle prop firm challenges that allow weekend holding with restrictions?

Configure your automation with position size limits that activate after your Friday cutoff time. If the firm allows 50% of normal size, your automation should either reduce open positions to that threshold or prevent weekend holding entirely if your strategy doesn't support partial positions.

4. Can I use different weekend holding rules for different prop firm accounts?

Yes, but this requires multi-account automation with firm-specific rule profiles. Platforms supporting prop firm compatibility features let you configure distinct time-based rules per connected account, automatically applying the correct restrictions based on which firm's account received the signal.

5. What time zone should I use for weekend holding automation settings?

Always configure your automation using Eastern Time (ET), which is the official time zone for CME futures market hours. Regular trading for ES, NQ, GC, and CL runs Sunday 6:00 PM ET through Friday 5:00 PM ET, with a 61-hour weekend closure.

Conclusion

Proper weekend holding automation setup is non-negotiable for prop firm compliance. Your system must include time-based entry filters, forced exit logic with execution buffers, and verification checks to confirm zero positions before Friday's close.

Test your configuration thoroughly on demo accounts through multiple weekend cycles before deploying to evaluation or funded accounts. For comprehensive guidance on other prop firm automation requirements, see our complete prop firm automation guide.

Need help setting up compliant automation? Read our complete guide to prop firm automation for detailed setup instructions covering drawdown limits, consistency rules, and multi-account management.

References

- CME Group - Trading Hours and Holiday Schedule

- CME Group - E-mini S&P 500 Futures Contract Specifications

- TradingView - Pine Script Time Functions Documentation

- Futures Industry Association - Market Volume Reports

Disclaimer: This article is for educational purposes only. It is not trading advice. ClearEdge Trading executes trades based on your rules—it does not provide signals or recommendations.

Risk Warning: Futures trading involves substantial risk. You could lose more than your initial investment. Past performance does not guarantee future results. Only trade with capital you can afford to lose.

CFTC RULE 4.41: Hypothetical results have limitations and do not represent actual trading.

By: ClearEdge Trading Team | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.