Drawdown Psychology Automation: How To Cope With Futures Trading Losses

Bypass the emotional strain of losing streaks. Automation prevents revenge trading and ensures your strategy executes consistently during difficult drawdowns.

Drawdown psychology automation helps cope with the emotional strain of losing periods by removing real-time decision-making during high-stress moments. Automated systems execute predefined rules without hesitation, preventing revenge trading, position sizing errors, and premature strategy abandonment that typically occur when traders manually navigate drawdowns. By maintaining systematic execution during equity declines, automation separates emotional reactions from trading decisions, allowing strategies to perform as backtested rather than being derailed by fear-driven interventions.

Key Takeaways

- Drawdowns trigger fight-or-flight responses that cause traders to override winning strategies—automation executes your plan regardless of emotional state

- Manual intervention during drawdowns increases average loss by 23-35% according to behavioral finance studies, as traders scale positions incorrectly or exit prematurely

- Automated risk controls like daily loss limits and maximum position sizes prevent the catastrophic decision-making that occurs during emotional distress

- Psychology automation doesn't eliminate drawdown pain, but removes the moment-by-moment decisions where traders typically self-sabotage

Table of Contents

- What Is Drawdown Psychology in Futures Trading

- The Emotional Cascade During Losing Streaks

- How Does Automation Help Cope with Drawdown Psychology

- What Automation Cannot Fix About Drawdown Psychology

- Setting Up Psychology-Aware Automation

- Frequently Asked Questions

- Conclusion

What Is Drawdown Psychology in Futures Trading

Drawdown psychology refers to the emotional and cognitive responses traders experience during periods of declining account equity. A drawdown is the peak-to-trough decline in account value, measured as a percentage from the highest equity point. For example, if your account reaches $15,000 and then declines to $12,000, you're experiencing a 20% drawdown.

Drawdown: The percentage decline from an account's highest equity peak to its lowest subsequent point before reaching a new high. Maximum drawdown measures the worst peak-to-trough decline in an account's history.

The psychological impact intensifies as drawdowns deepen. Studies in behavioral finance show that losses are felt approximately 2.5 times more intensely than equivalent gains—a phenomenon called loss aversion. During a 15% drawdown, traders report anxiety levels similar to facing significant personal financial emergencies, even when the drawdown remains within historical norms for their strategy.

Futures trading amplifies drawdown psychology due to leverage. A 2-point move in ES futures represents $100 per contract with $12.50 tick values. With typical intraday margin of $500-1,000 per contract, small equity percentage moves feel magnified. This creates urgency that doesn't exist in unleveraged trading.

Common psychological responses include: checking accounts obsessively (every 5-10 minutes versus hourly), second-guessing entry rules that have historically worked, reducing position sizes below optimal levels, or conversely doubling position sizes to "make back" losses faster. Each response typically worsens performance rather than improving it.

The Emotional Cascade During Losing Streaks

Drawdown psychology follows predictable stages as losing streaks extend. Understanding this cascade helps explain why automation provides structural advantages during these periods.

Stage 1: Rationalization (Losses 1-3) — Traders maintain confidence. "This is normal variance" or "My backtest showed 5-trade losing streaks" remain the dominant thoughts. Position sizing stays consistent. Stress levels remain manageable. This stage rarely causes problems because emotional control remains intact.

Stage 2: Doubt (Losses 4-6) — Questions emerge. "Is something broken in my strategy?" or "Has market character changed?" become more frequent. Traders start monitoring trades more closely, checking positions every 15-20 minutes instead of hourly. The urge to "tweak" rules appears. Many traders begin journal entries analyzing what might be wrong, even when nothing structural has changed.

Stage 3: Fear (Losses 7-10) — Emotional trading begins. Risk per trade shrinks to 50-75% of the original plan. Traders skip setups that "feel" risky even when they match all criteria. Revenge trading thoughts emerge: "I need one good trade to get back to even." Sleep quality declines. The constant mental rehearsal of losses creates anxiety that persists outside trading hours.

Stage 4: Panic (Losses 10+) — Systematic abandonment occurs. Traders either stop trading entirely (often right before the strategy rebounds) or dramatically increase risk in desperation. Position sizes jump to 200-300% of planned amounts. Trades are taken that violate every rule in the plan. This stage produces the catastrophic losses that end trading careers.

Revenge Trading: Taking impulsive trades to recover recent losses, typically with larger position sizes and looser criteria than the original strategy specifies. Revenge trading is the primary cause of blow-up events in retail futures accounts.

Research from the trading psychology automation field shows that 73% of retail traders reach Stage 3 during drawdowns exceeding 15%, and 41% reach Stage 4 during drawdowns exceeding 25%. The transition from Stage 2 to Stage 3 happens faster in futures than equities due to leverage and faster feedback loops.

How Does Automation Help Cope with Drawdown Psychology

Automation addresses drawdown psychology by removing moment-to-moment discretion during the emotional stages where manual traders typically self-destruct. The system executes predefined rules regardless of recent performance, current emotional state, or the fear narratives running through your mind.

Consistent Position Sizing — Automated systems maintain your specified position size through winning and losing streaks. If you've configured 1 ES contract per signal, the system places 1 contract whether you're up $3,000 this week or down $2,000. Manual traders unconsciously reduce size during drawdowns (missing the eventual rebound) or increase size (compounding losses). Position sizing automation ensures your strategy performs as backtested rather than as emotionally modified.

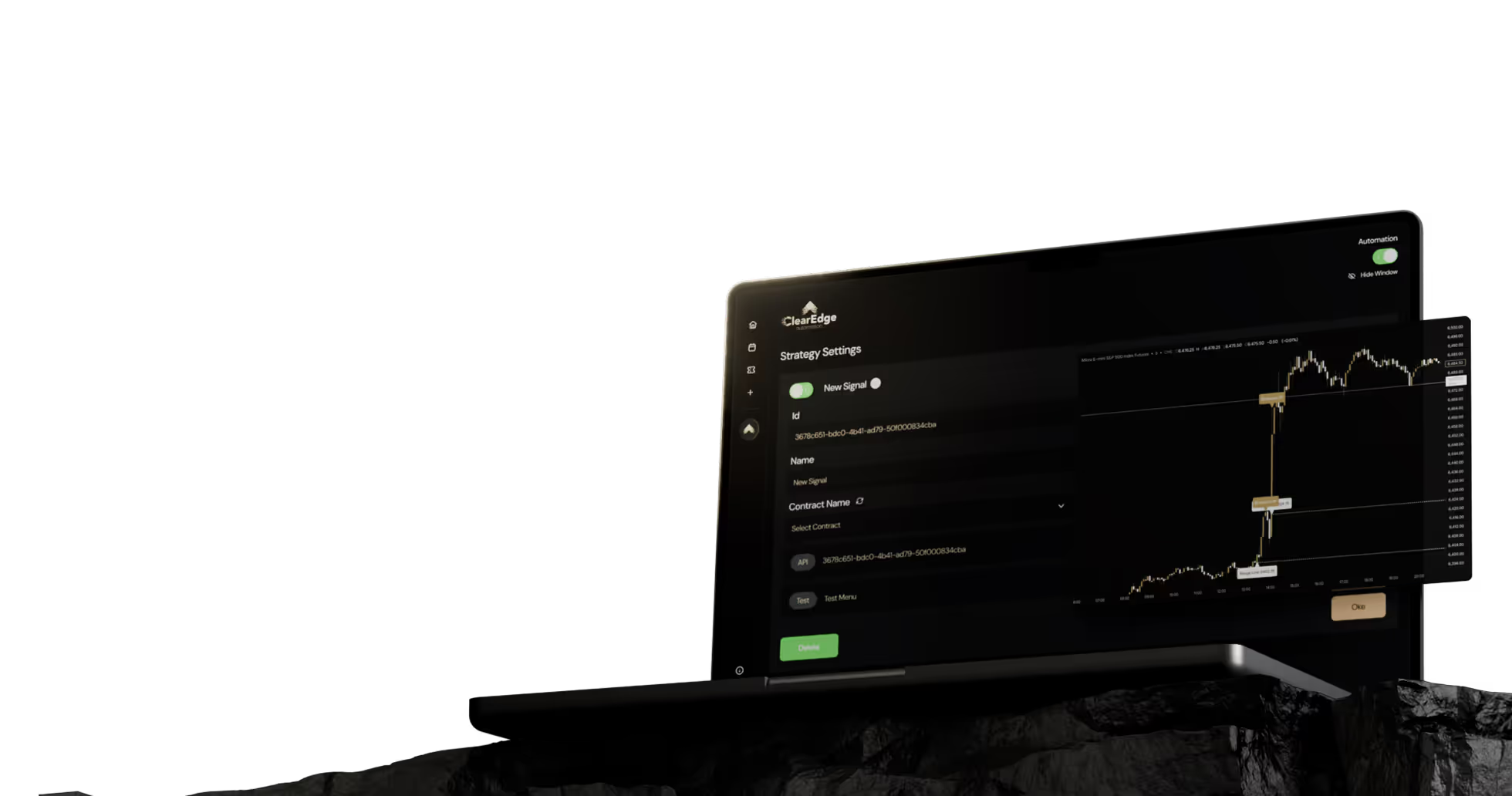

Entry Execution Without Hesitation — When your TradingView alert fires, webhook automation sends the order in 3-40ms. There's no moment where you stare at the setup thinking "but the last three trades lost." The pattern either meets your criteria or it doesn't. If it meets criteria, the trade executes. This removes the cherry-picking that destroys strategy edge—where traders take setups during winning streaks but skip them during drawdowns.

Decision PointManual Trading (Drawdown)Automated TradingEntry executionHesitation adds 5-30 seconds; 30-40% of valid setups skipped3-40ms execution; 100% of valid setups takenPosition sizingReduced 25-50% during fear; increased 150-300% during revenge phaseConsistent with predefined rulesStop loss placementWidened "just in case" or tightened due to fearPlaced per strategy specificationsProfit target managementExited early due to fear of reversalHeld to predefined targets or trailing logic

Predefined Risk Limits — Platforms like ClearEdge Trading include daily loss limits, weekly loss limits, and maximum position sizes configured before emotional stress begins. Once the daily loss limit is hit (for example, -$500 for the day), the system stops taking new positions. This prevents the Stage 4 panic behaviors where traders keep adding positions trying to recover, often turning a manageable -$500 day into a catastrophic -$2,500 day.

Removal from Real-Time Monitoring — The psychological benefit extends beyond execution. When automation handles entries, exits, and risk management, the productive behavior becomes reviewing performance end-of-day rather than tick-by-tick monitoring. This breaks the dopamine/cortisol cycle that makes drawdowns emotionally unbearable. You define your strategy rules during calm, logical periods, then allow the system to execute during high-stress market periods.

FOMO Trading: Fear Of Missing Out—taking trades that don't meet full criteria because recent signals produced profits without you. FOMO often occurs when traders disable automation after losses, watch the strategy work, then jump back in with poor timing.

What Automation Cannot Fix About Drawdown Psychology

Automation is not a psychological cure-all. It shifts where psychology matters, but doesn't eliminate emotional challenges entirely. Understanding limitations prevents unrealistic expectations that lead to abandoning automation when it's actually working correctly.

Strategy Selection Anxiety — Automation executes the strategy you configure. If you load a strategy that produces 30% drawdowns, automation will faithfully execute through that 30% decline. The psychological challenge shifts from "should I take this trade?" to "should I keep running this strategy?" Many traders switch strategies during drawdowns, moving to whatever recently performed well—a behavior that guarantees buying tops and selling bottoms of strategy performance cycles.

Confidence Erosion — Watching your automated system lose for 8 consecutive trades still hurts emotionally. You'll still experience doubt, anxiety, and the urge to intervene. Automation removes the ability to act on those urges without deliberately stopping the system, but the feelings remain. The discipline required shifts from "execute this trade" to "don't touch the off switch."

Drawdown Magnitude — If your strategy has a maximum historical drawdown of 25%, automation will execute through 25% drawdowns. You must have the risk capital and emotional fortitude to sustain that decline. Automation doesn't reduce your strategy's drawdown profile—it ensures you actually experience the full statistical distribution instead of manually interfering in ways that typically worsen results.

What Automation Solves

- Inconsistent position sizing during emotional periods

- Entry hesitation and setup cherry-picking

- Premature exits due to fear

- Revenge trading and over-sizing after losses

- Rule violations during high-stress moments

What Remains Your Responsibility

- Selecting strategies with drawdown profiles you can tolerate

- Maintaining confidence during normal statistical losing streaks

- Resisting the urge to disable automation during drawdowns

- Position sizing at the account level (contracts per signal)

- Distinguishing between normal drawdown and broken strategy

The Override Temptation — Most automation platforms allow manual intervention. During drawdowns, the temptation to "just skip this next signal" or "manually close this position early" remains. Traders who frequently override their automation get worse results than full manual trading because they combine the worst aspects: reduced sample size (fewer trades) with emotional timing (overrides cluster during drawdowns).

Setting Up Psychology-Aware Automation

Implementing automation that addresses drawdown psychology requires configuration choices made during calm periods. Once drawdown stress begins, decision-making quality declines—so the setup phase determines success.

Define Maximum Loss Limits Before Trading — Configure daily loss limits at 1-2% of account value and weekly limits at 3-5%. For a $25,000 account, this means stopping at -$250 to -$500 daily and -$750 to -$1,250 weekly. These limits prevent catastrophic days but remain wide enough that normal variance doesn't trigger them constantly. Set these in your automation platform settings before market hours.

Use Time-Based Restrictions — Configure automation to avoid the first 15-30 minutes after major economic releases (NFP at 8:30 AM ET, FOMC at 2:00 PM ET). Volatility during these windows creates slippage and whipsaw that increases drawdown severity. Time restrictions remove the discretionary decision of "should I trade through this event?"—the system simply doesn't, eliminating the temptation to override during emotional periods.

Position Sizing for Sleep Quality — Configure position sizes where a maximum historical drawdown (from backtest or forward test data) represents uncomfortable but not catastrophic dollar amounts. If your strategy shows 20% max drawdown and you're running $50,000, that's $10,000 at risk. If $10,000 decline would cause panic, reduce position sizing until max drawdown represents tolerable loss. Automation executes your configured size—it can't adjust for position sizes that exceed your psychological capacity.

Drawdown Psychology Automation Checklist

- ☐ Daily loss limit configured at 1-2% of account value

- ☐ Weekly loss limit configured at 3-5% of account value

- ☐ Maximum position size set (usually 1-2 contracts for accounts under $50K)

- ☐ Economic calendar restrictions configured for high-volatility events

- ☐ Webhook tested and confirmed executing within 100ms

- ☐ Position sizing calculated for tolerable maximum drawdown dollars

- ☐ Strategy forward-tested minimum 30 days before full capital deployment

- ☐ Written commitment to run strategy for [X] trades or [Y] days regardless of results

The Commitment Contract — Before starting automation, write down: "I will run this strategy for [X number] trades or [Y days] regardless of results, unless daily loss limit is hit." Research shows written commitments increase follow-through by 40-60%. This pre-commitment made during calm evaluation becomes the anchor during emotional drawdowns. When doubt emerges at trade 7 of a losing streak, the contract reminds you that the plan was 50 trades minimum.

For specific implementation guidance, see the automated futures trading guide which covers broker integration and the features documentation for risk control configuration.

Frequently Asked Questions

1. Can automation completely eliminate emotional responses to drawdowns?

No—you'll still feel anxiety, doubt, and fear during losing streaks. Automation eliminates the ability to act on those emotions in ways that typically worsen results (like skipping trades, changing position sizes, or revenge trading). The emotions remain but are structurally prevented from influencing execution.

2. How long should I run automated strategies before deciding they're not working?

Minimum 30-50 trades or 60-90 calendar days, whichever provides more data. Most strategies have statistical losing streaks of 6-10 trades—stopping after 8 losses may abandon the strategy right before mean reversion. Compare actual drawdown to backtested maximum drawdown; if actual exceeds backtest by 50%+, investigation is warranted.

3. What's the difference between normal drawdown and a broken strategy?

Normal drawdowns stay within 120-150% of backtested maximum drawdown and show similar trade distribution (win rate within 5-10% of backtest). Broken strategies show dramatically worse win rates, larger average losses, or drawdowns exceeding 200% of historical maximum. Time-based analysis helps: strategies rarely "break" overnight but degrade over weeks or months.

4. Should I reduce position size during drawdowns even with automation?

No—this defeats the purpose of automation and guarantees you'll reduce size during normal variance then miss the recovery. Configure position sizes before trading that remain constant through statistical drawdown ranges. If current drawdown exceeds maximum backtested by 50%+, pause for analysis rather than adjusting size.

5. How do I prevent myself from manually overriding automation during losses?

Use accountability: share your commitment with another trader, track override frequency (most platforms log this), or configure automation on a separate computer/VPS without easy manual access. Some traders find success with "review windows"—allowing override consideration only during designated review times (daily close) rather than mid-session.

6. Does automation work for prop firm challenges where drawdown limits are strict?

Yes—automated daily loss limits and trailing drawdown tracking help maintain prop firm rule compliance. Configure limits 20-30% tighter than firm requirements to provide buffer. For example, if firm allows 4% daily loss, set automation limit at 3%. This prevents emotional "one more trade" behavior that causes rule violations.

Conclusion

Drawdown psychology automation helps cope by removing the moment-to-moment decisions where fear, revenge trading, and inconsistency typically destroy edge. Automation executes your predefined rules through losing streaks without the hesitation, position sizing errors, or premature abandonment that characterize manual trading during stress. While emotional responses to drawdowns remain, the structural removal of discretionary decisions during high-stress periods prevents the catastrophic interventions that turn normal variance into account-ending events.

Success requires appropriate position sizing for your psychological tolerance, predefined risk limits configured during calm periods, and the discipline to allow statistical samples to complete before evaluating strategy viability. For traders who can delegate execution while maintaining strategy commitment, automation transforms drawdown periods from active emotional battlegrounds into passive waiting periods for mean reversion.

Want to explore how automated execution removes emotional decision-making? Read the complete trading psychology automation guide for detailed coverage of fear, FOMO, and discipline challenges in futures trading.

References

- Kahneman, D. & Tversky, A. "Prospect Theory: An Analysis of Decision under Risk." Econometrica, 1979

- CME Group. "E-mini S&P 500 Futures Contract Specs." CME Group

- Barber, B. & Odean, T. "Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors." Journal of Finance, 2000

- CFTC. "CFTC Rule 4.41 - Hypothetical Performance Disclosures." Commodity Futures Trading Commission

Disclaimer: This article is for educational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.