Systematic Trading Vs Discretionary Trading: Key Differences For Futures Traders

Navigate the choice between algorithmic rules and human intuition. Compare systematic vs discretionary trading to find the perfect balance for your strategy.

Systematic trading uses predefined rules and algorithms to make all trading decisions, removing human emotion and discretion from execution. Discretionary trading relies on a trader's judgment, experience, and real-time analysis to make buy and sell decisions based on market conditions. Systematic approaches execute trades automatically when criteria are met, while discretionary traders manually evaluate each opportunity and adjust strategies based on intuition and market feel.

Key Takeaways

- Systematic trading executes trades based on coded rules and algorithms, while discretionary trading depends on human judgment for each trade decision

- Systematic approaches eliminate emotional bias and maintain consistency, but lack flexibility during unusual market conditions

- Discretionary trading adapts quickly to changing markets but suffers from emotional interference and execution inconsistency

- Most professional traders combine both approaches—systematic execution with discretionary oversight and strategy selection

Table of Contents

- What Is Systematic Trading?

- What Is Discretionary Trading?

- Key Differences Between Systematic and Discretionary Trading

- Advantages and Disadvantages of Each Approach

- Which Approach Works Best for Futures Traders?

- The Hybrid Approach: Combining Both Methods

- Frequently Asked Questions

- Conclusion

What Is Systematic Trading?

Systematic trading uses predefined algorithms and rules to identify trade setups, manage positions, and execute orders without human intervention during the trading process. The trader codes their strategy logic—entry conditions, exit rules, position sizing, risk parameters—and the system executes trades automatically when conditions align. This approach is common in algorithmic trading, where speed and consistency matter more than subjective interpretation.

Systematic Trading: A trading approach where all decisions follow predetermined rules coded into algorithms or trading systems. Human involvement occurs during strategy development and monitoring, not during trade execution.

Systematic traders spend their time developing, testing, and refining their rule sets through backtesting historical data. Once a strategy proves profitable across various market conditions, they deploy it live and monitor performance. The system handles all execution decisions—when to enter, where to place stops, when to take profits, how much size to use. ES and NQ futures traders often use systematic approaches for Opening Range breakouts, VWAP reversion, or momentum strategies that depend on precise timing.

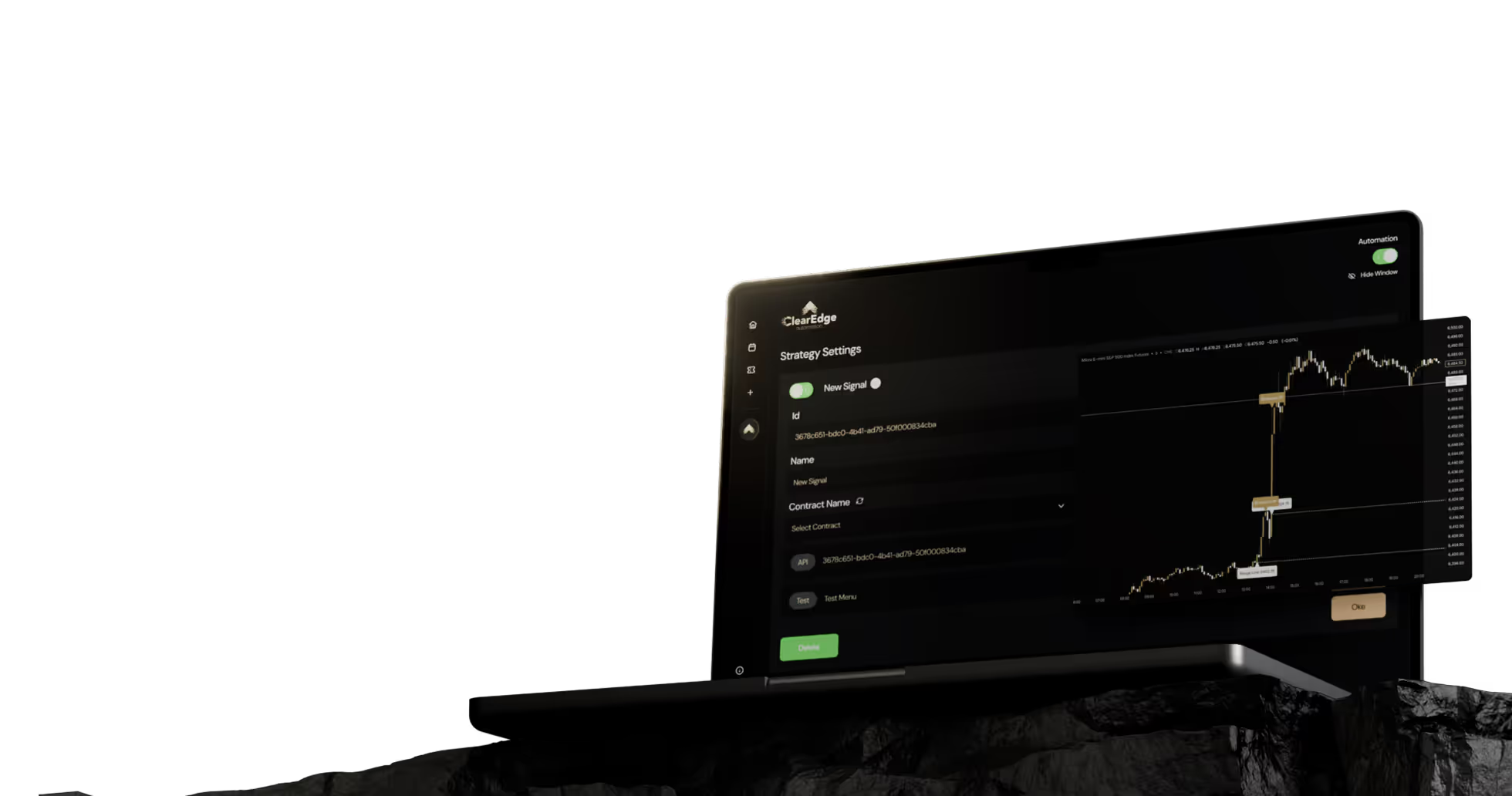

Platforms like ClearEdge Trading enable systematic execution by connecting TradingView alerts to broker APIs. When your indicator fires an alert, the trade executes automatically within 3-40ms, removing the delays and second-guessing that come with manual clicking.

What Is Discretionary Trading?

Discretionary trading gives the trader complete control over each trade decision based on their analysis, experience, and interpretation of current market conditions. The trader evaluates setups manually, decides whether to take them, adjusts position size based on conviction, and manages exits in real time. No two trades follow identical rules because each decision incorporates the trader's judgment about that specific moment.

Discretionary traders use technical analysis, price action reading, order flow data, and market context to make decisions. They might see a chart pattern that technically meets their criteria but choose to skip it because volume looks weak or because a major economic report is due in 15 minutes. This flexibility allows adaptation to unusual conditions that systematic rules might not handle well.

Discretionary Trading: A trading approach where the trader makes individual decisions for each trade based on analysis, experience, and judgment rather than following fixed algorithmic rules.

Professional discretionary traders often specialize in reading specific market conditions—identifying institutional order flow in ES futures, recognizing distribution patterns before reversals, or trading around FOMC announcements when systematic strategies typically shut down. Their edge comes from pattern recognition skills developed over years of screen time, not from coded algorithms.

Key Differences Between Systematic and Discretionary Trading

The fundamental difference lies in who or what makes the trading decision at the moment of execution. Systematic trading delegates that decision to an algorithm following predetermined logic. Discretionary trading keeps that decision with the human trader who evaluates current conditions. This creates cascading differences in how each approach handles consistency, emotion, adaptability, and scalability.

FactorSystematic TradingDiscretionary TradingDecision MakingAlgorithm-based, predefined rulesHuman judgment, real-time analysisEmotional ImpactEliminates emotion from executionRequires discipline to manage emotionsConsistencyExecutes every valid signal identicallyVaries by trader mood, energy, convictionAdaptabilityLimited to coded scenariosAdjusts to unusual conditions quicklyExecution SpeedMilliseconds via automationSeconds to minutes manuallyScalabilityCan monitor unlimited instrumentsLimited by human attention spanLearning CurveRequires backtesting and coding knowledgeRequires screen time and pattern recognitionTime RequiredUpfront development, minimal monitoringActive monitoring during trading hours

Systematic approaches excel at maintaining discipline during volatile periods when emotions run high. During a 50-point ES drop, the systematic trader's algorithm continues executing its rules without fear or hesitation. The discretionary trader must fight the urge to override their plan, freeze up, or revenge trade after a loss.

Discretionary trading shines during market regime changes or unusual events. When the Fed makes an unexpected policy shift or geopolitical news breaks, discretionary traders can step aside or adjust their approach immediately. Systematic strategies often need time to recognize the new environment through their rules, potentially taking losses during the transition.

Advantages and Disadvantages of Each Approach

Each approach carries distinct trade-offs between consistency and flexibility, scalability and adaptability, development time and execution time. Understanding these helps traders choose the method that fits their personality, available time, and skill set.

Systematic Trading Advantages

- Eliminates emotional decision-making during execution

- Maintains perfect consistency across all trades

- Enables precise backtesting with historical data

- Scales to monitor multiple instruments and timeframes simultaneously

- Executes orders faster than manual clicking (3-40ms with automation)

- Reduces screen time requirements once strategy is deployed

- Provides clear performance metrics for strategy evaluation

Systematic Trading Limitations

- Cannot adapt to unprecedented market conditions outside coded rules

- Requires significant upfront time for development and testing

- May need programming knowledge or no-code platforms

- Can experience drawdowns during market regime changes

- Optimization risks overfitting to historical data

- Technology failures create execution risk

Discretionary Trading Advantages

- Adapts quickly to changing market conditions and news events

- Can skip trades when "something feels off" about the setup

- No coding or backtesting infrastructure required

- Learns from each trade through direct experience

- Can size positions based on conviction level

- Handles unusual events better than rigid algorithms

Discretionary Trading Limitations

- Vulnerable to emotional biases like fear, greed, revenge trading

- Consistency varies based on trader's mental and physical state

- Difficult to backtest or quantify edge statistically

- Requires constant screen time during trading hours

- Slower execution leads to slippage on fast-moving trades

- Limited to monitoring few instruments effectively

- Takes years to develop reliable pattern recognition skills

For futures traders dealing with fast markets like ES and NQ during economic releases, systematic execution speed becomes crucial. A discretionary trader seeing a setup during NFP might take 2-5 seconds to analyze and click—enough time for the market to move several ticks. Systematic execution through TradingView automation captures the intended price more consistently.

Which Approach Works Best for Futures Traders?

Neither approach is universally superior—the right choice depends on your trading style, available time, technical skills, and psychological makeup. Systematic trading fits traders who value consistency and can invest time upfront in strategy development. Discretionary trading suits those who enjoy real-time analysis and have developed strong pattern recognition through experience.

Consider systematic trading if you want to eliminate emotional decision-making, trade multiple instruments simultaneously, or maintain a full-time job while trading. Traders with algorithmic trading strategies benefit most from systematic execution because their edge depends on speed and consistency rather than subjective interpretation. Opening Range breakouts, VWAP reversion, and momentum strategies typically perform better systematically.

Choose discretionary trading if you excel at reading price action nuances, prefer staying actively involved in each decision, or trade around major news events that require quick adaptation. Discretionary approaches work well for order flow trading, support/resistance scalping, or any strategy where context matters more than rigid rules. Many professional floor traders who transitioned to electronic markets maintain discretionary approaches because their edge comes from decades of pattern recognition.

Market Regime: A sustained period where markets exhibit consistent behavior patterns and correlations. Regime changes occur when volatility, trends, or correlations shift significantly, often requiring strategy adjustments.

Time availability matters significantly. Systematic trading requires substantial upfront development—weeks or months building and testing strategies—but minimal ongoing attention once deployed. Discretionary trading demands less preparation but requires active monitoring during all trading hours. Full-time workers often find systematic approaches more practical.

Technical skill plays a role too. Systematic traders need backtesting capabilities and either coding knowledge or access to no-code automation platforms. Discretionary traders need chart reading skills and psychological discipline but no technical development infrastructure.

The Hybrid Approach: Combining Both Methods

Most successful professional traders use hybrid approaches that capture advantages from both systematic and discretionary methods. They apply systematic rules for trade execution and risk management while using discretion for strategy selection, position sizing, and override decisions during unusual conditions. This combination maintains consistency where it matters while preserving adaptability when needed.

A common hybrid structure uses systematic rules for entries and exits but discretionary decisions about when to activate or pause strategies. The trader might have an automated Opening Range breakout system that executes mechanically, but they discretionally shut it down on FOMC days or during low-volume overnight sessions when the strategy performs poorly. The system handles precise execution timing while the trader manages strategy deployment.

Another hybrid approach systematizes risk management while keeping trade selection discretionary. The trader manually identifies setups and decides which to take, but once entered, automated systems handle stop placement, position sizing, and profit targets according to predefined rules. This prevents emotional exit decisions—the most common failure point for discretionary traders—while preserving flexibility in trade selection.

For prop firm traders, hybrid approaches help maintain rule compliance systematically while adapting strategies discretionally. The system enforces daily loss limits, maximum position sizes, and consistency rules automatically, preventing rule violations during emotional moments. The trader focuses discretional attention on finding quality setups rather than monitoring account rules.

Building Your Hybrid System

- ☐ Identify which decisions benefit most from automation (typically execution timing and risk management)

- ☐ Determine where your judgment adds value (usually strategy selection and position sizing)

- ☐ Backtest systematic components with historical data to verify edge

- ☐ Define clear criteria for when to override or pause automated strategies

- ☐ Set up monitoring systems to track both systematic and discretionary performance separately

- ☐ Use paper trading to validate your hybrid approach before risking capital

The goal is creating a framework where systematic rules handle repetitive decisions requiring consistency, while human judgment addresses situations requiring context, experience, or adaptation. This structure reduces cognitive load—you're not fighting emotional urges on every execution—while maintaining the flexibility to respond when markets behave unusually.

Frequently Asked Questions

1. Can I start with discretionary trading and transition to systematic later?

Yes, this progression is common and often beneficial. Discretionary trading teaches you market behavior and helps identify patterns that work, which you can then code into systematic rules. Many successful systematic traders started discretionally, developed profitable approaches through experience, then automated them for consistency.

2. Do I need to know programming to use systematic trading?

Not necessarily—no-code platforms like ClearEdge Trading let you automate TradingView strategies without programming knowledge. You build your logic in TradingView using indicators and alerts, then connect them to your broker through webhooks. However, coding skills expand your options for custom strategy development and backtesting.

3. Which approach works better for beginners?

Most beginners benefit from starting with simple systematic rules to build discipline and consistency before adding discretionary elements. Systematic approaches force you to define your edge clearly and test it objectively. Pure discretionary trading often leads beginners into emotional decision-making before they've developed the pattern recognition skills needed.

4. How do prop firms view systematic versus discretionary trading?

Most prop firms accept both approaches as long as you follow their rules. Systematic trading often makes rule compliance easier because you can code position limits, daily loss stops, and consistency requirements directly into your automation. Some firms restrict certain systematic strategies like high-frequency scalping or news trading bots.

5. Can systematic strategies adapt to different market conditions?

Yes, but adaptation requires building regime detection into your system. You can code rules that identify trending versus ranging markets, high versus low volatility, or other regime characteristics, then adjust strategy parameters accordingly. Advanced systematic traders run multiple strategies designed for different conditions and algorithmically select which to deploy.

Conclusion

Systematic trading vs discretionary trading differences center on who makes execution decisions—algorithms following predefined rules or human traders using judgment and experience. Systematic approaches excel at consistency and emotional control but lack adaptability to unprecedented conditions. Discretionary trading provides flexibility and nuanced decision-making but struggles with emotional biases and execution consistency. Most professional traders eventually adopt hybrid approaches that systematize repetitive decisions while applying discretion to strategy selection and unusual market conditions.

For futures traders seeking to improve execution consistency, automating at least your entry timing and risk management removes common failure points while preserving your ability to choose which setups to trade. Consider starting with systematic execution of your most mechanical strategies while maintaining discretion over strategy activation and market selection.

Want to explore automation options? Read our complete algorithmic trading guide for detailed information on systematic strategy development and execution.

References

- CME Group. "E-mini S&P 500 Futures Contract Specs." https://www.cmegroup.com/markets/equities/sp/e-mini-sandp500.html

- Futures Industry Association. "FIA Annual Volume Survey 2024." https://www.fia.org/resources/fia-annual-volume-survey

- TradingView. "Webhook Alerts Documentation." https://www.tradingview.com/support/solutions/43000529348-about-webhooks/

- CFTC. "CFTC Rule 4.41 - Hypothetical Performance Disclosure." https://www.cftc.gov/LawRegulation/CommodityExchangeAct/index.htm

Disclaimer: This article is for educational and informational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About Us

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.