ES Futures Earnings Season Automation: Essential Volatility Management Tips

Safeguard your ES futures automation against S&P 500 earnings season volatility. Adapt your strategy with wider stops, smaller position sizes, and time filters.

ES futures earnings season automation tips focus on managing elevated volatility during quarterly earnings releases when S&P 500 component stocks report results. Automated systems need wider stops, reduced position sizes, and time-based filters to navigate the increased gaps and whipsaw moves that occur during January, April, July, and October earnings windows. Pre-earnings automation requires careful consideration of after-hours volatility, economic calendar coordination, and adaptive risk parameters.

Key Takeaways

- ES futures typically see 15-25% higher average true range during earnings season compared to non-earnings periods

- Automated stops should widen by 1.5-2x during earnings weeks to avoid premature exit on normal volatility expansion

- Position sizing reduction of 30-50% protects accounts from overnight gaps when major index components report

- Time filters excluding 4:00-5:00 PM ET and 8:00-9:30 AM ET sessions prevent trades during peak earnings release windows

Table of Contents

- What Is Earnings Season for ES Futures Traders

- How Earnings Season Affects ES Futures Volatility

- What Automation Settings Need Adjustment During Earnings

- Should You Filter Trading Hours During Earnings Season

- How to Adjust Position Sizing for Earnings Volatility

- Frequently Asked Questions

- Conclusion

What Is Earnings Season for ES Futures Traders

Earnings season refers to the concentrated periods when publicly traded companies release quarterly financial results, occurring primarily in January, April, July, and October. For ES futures traders, earnings season matters because the E-mini S&P 500 contract derives its value from the underlying S&P 500 index, which comprises 500 large-cap stocks that all report earnings. These reporting periods create systematic volatility increases that affect automated trading strategies even if you're not directly trading individual stocks.

Earnings Season: The three-to-four week period following each fiscal quarter end when the majority of publicly traded companies release earnings reports. For ES futures, this creates elevated volatility as large index components like Apple, Microsoft, Amazon, and Alphabet report results that move the broader index.

The impact concentrates during specific weeks. According to ES futures automation strategies, the heaviest reporting occurs in weeks 2-3 of each earnings cycle. Major tech stocks with substantial S&P 500 weightings typically report after the regular equity session close (4:00 PM ET), causing gap moves when ES futures reopen for overnight trading at 6:00 PM ET.

Automated systems designed for normal market conditions often underperform during earnings season without adjustments. The challenge isn't predicting earnings outcomes—it's adapting to the measurably different volatility environment these events create.

How Earnings Season Affects ES Futures Volatility

ES futures volatility increases 15-25% on average during peak earnings weeks compared to non-earnings periods, according to CME Group data. This manifests as wider intraday ranges, larger overnight gaps, and faster directional moves that standard automation parameters may not handle well. The volatility isn't random—it follows predictable patterns around major component reporting times.

After-hours gaps present the primary challenge. When high-weight stocks like Apple (approximately 7% of S&P 500) report at 4:30 PM ET, ES futures can gap 10-20 points when trading resumes. Your automation might hold positions through these gaps if it doesn't include time-based exit rules. A $12.50 tick value means a 20-point gap equals $250 per contract—significant slippage for strategies expecting 2-3 point fills.

Market ConditionAverage Daily RangeOvernight Gap FrequencyWhipsaw RiskNormal Trading40-60 ES points5-10 point gapsModerateEarnings Season55-75 ES points15-25 point gapsHighPeak Earnings Week65-90 ES points20-35 point gapsVery High

The volatility pattern varies by session. Regular trading hours (9:30 AM - 4:00 PM ET) see moderate increases. The overnight session (6:00 PM - 9:30 AM ET) experiences the largest jumps due to concentrated after-hours earnings releases. Pre-market hours (8:00-9:30 AM ET) show elevated volatility as traders react to overnight reports.

For micro futures traders using MES contracts, the same percentage moves apply with proportionally smaller dollar impact. MES has a $1.25 tick value (1/10th of ES), so a 20-point gap equals $25 per contract instead of $250.

What Automation Settings Need Adjustment During Earnings

Stop loss distances should increase 1.5-2x during earnings season to accommodate normal volatility expansion without getting stopped out prematurely. If your standard stop is 10 ES points, consider widening to 15-20 points during peak earnings weeks. This prevents situations where your strategy's directional thesis proves correct but temporary volatility hits your stop before the move develops.

Take profit targets may need adjustment as well. Increased volatility means your typical profit targets get hit faster, but also increases the chance of reversal. Some traders tighten targets by 20-30% during earnings to lock profits in the faster-moving environment. Others leave targets unchanged but trail stops more aggressively to capture extended moves while protecting gains.

Wider Stop Advantages

- Avoids premature exits on normal earnings volatility

- Allows strategies to survive temporary whipsaws

- Reduces trade frequency and commission costs

Wider Stop Limitations

- Increases maximum loss per trade

- Requires proportional position size reduction

- May hold through adverse moves longer than desired

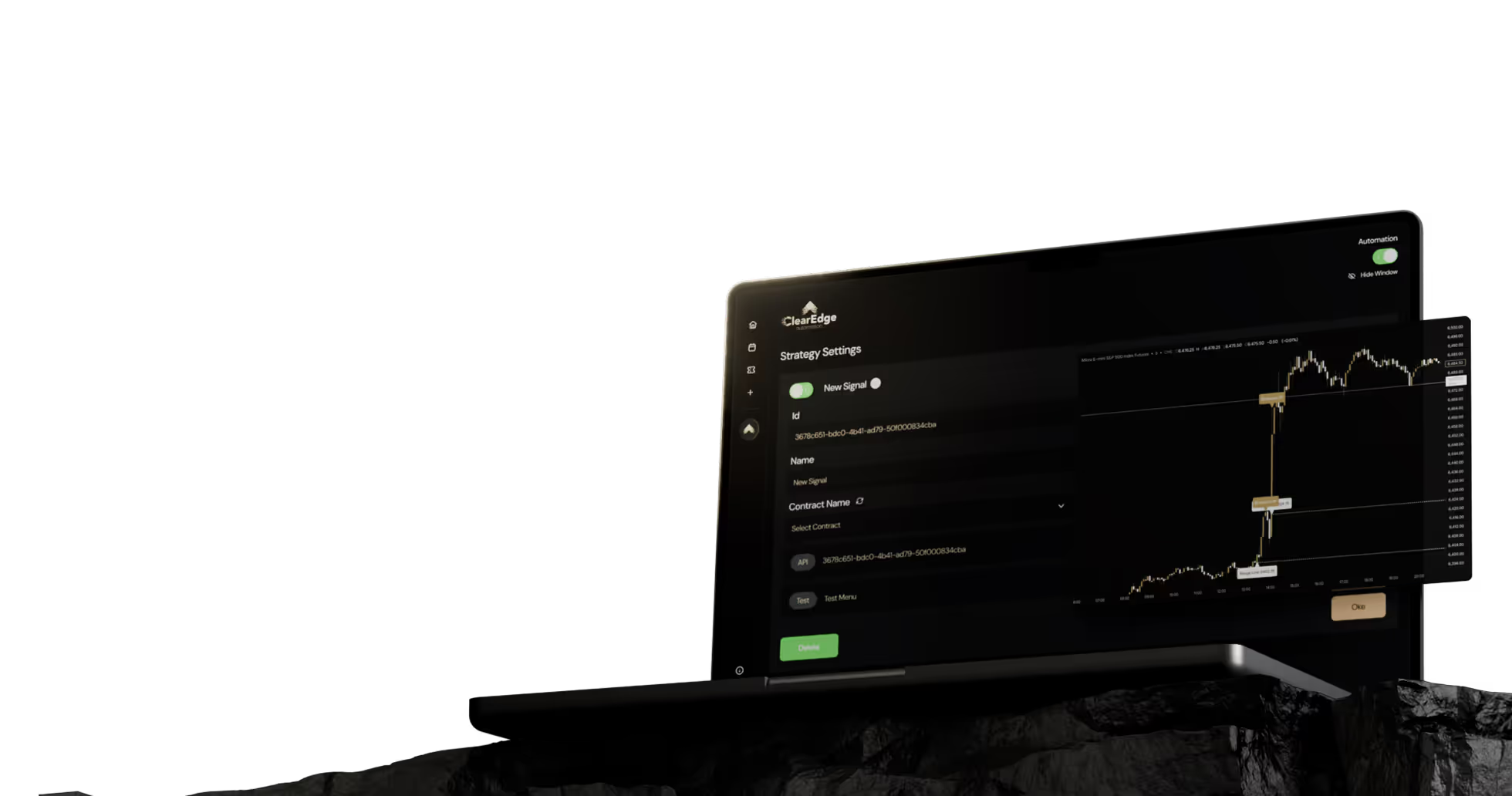

Platforms like ClearEdge Trading allow parameter adjustments through TradingView alert conditions. You can create separate webhook configurations for earnings periods versus normal periods, switching between them based on the economic calendar. This approach maintains strategy consistency while adapting to measurably different market conditions.

Stop Loss Distance: The number of points or ticks between your entry price and automatic exit level. For ES futures during earnings season, increasing stop distance from 10 to 15-20 points accounts for the documented 15-25% volatility increase without changing your strategy's fundamental logic.

Should You Filter Trading Hours During Earnings Season

Time filters that prevent new positions during high-risk windows offer the most direct earnings season protection. The 4:00-5:00 PM ET window sees the majority of after-hours earnings releases, while 8:00-9:30 AM ET captures pre-market volatility from overnight reports. Excluding these periods from your automation prevents holding positions through predictable gap events.

A common approach uses TradingView's time session filters in strategy code or alert conditions. Set your automation to close all positions by 3:45 PM ET and avoid new entries until 9:45 AM ET during earnings season. This creates a "safe window" for intraday automation while avoiding overnight gaps. According to TradingView automation best practices, session filters add one line of code but eliminate the largest source of earnings-related slippage.

Earnings Season Time Filter Checklist

- ☐ Close all positions by 3:45 PM ET before earnings releases

- ☐ Avoid new entries from 4:00 PM - 6:00 PM ET during after-hours reports

- ☐ Skip pre-market session (8:00-9:30 AM ET) on heavy earnings days

- ☐ Resume normal automation 15 minutes after regular session open (9:45 AM ET)

- ☐ Mark peak earnings weeks in calendar (typically weeks 2-3 of cycle)

The tradeoff is reduced trading opportunities. If your strategy typically takes 3-5 trades per day, excluding after-hours and pre-market periods might cut that to 2-3 trades. For many traders, this reduction in trade frequency is acceptable compared to the alternative of holding through unpredictable gaps.

Some traders take the opposite approach—specifically targeting earnings volatility with wider stops and larger profit targets. This requires different strategy parameters and typically involves reducing position size even further (50-70%) due to increased risk per trade.

How to Adjust Position Sizing for Earnings Volatility

Position sizing reduction of 30-50% during earnings season maintains consistent dollar risk per trade despite wider stops. If you normally trade 2 ES contracts with 10-point stops ($250 risk per contract, $500 total), switching to 1 contract with a 15-point stop maintains $375-$500 risk exposure. This approach preserves your risk management framework while adapting to changed market conditions.

The calculation follows a simple formula: (Normal Position Size × Normal Stop Distance) ÷ Earnings Stop Distance = Earnings Position Size. For example: (2 contracts × 10 points) ÷ 15 points = 1.33 contracts, rounded down to 1 contract. This ensures your maximum loss per trade stays within your normal risk tolerance.

Micro futures offer more granular position sizing during earnings season. If trading MES instead of ES, you can adjust position sizes in single-contract increments rather than being forced to full ES contracts. Someone trading 20 MES contracts (equivalent to 2 ES) could reduce to 12-14 MES contracts for earnings season—a more precise risk adjustment than ES contracts allow.

Normal ConditionsEarnings SeasonRisk Per Trade2 ES contracts, 10pt stop1 ES contract, 15pt stop$250 → $3754 MES contracts, 10pt stop3 MES contracts, 15pt stop$50 → $5620 MES contracts, 10pt stop13 MES contracts, 15pt stop$250 → $244

Automated position sizing requires your platform to support dynamic contract quantities. Some traders use separate TradingView strategies for earnings versus normal periods, each with appropriate position sizing hard-coded. Others use webhook parameters to pass contract quantities dynamically based on calendar conditions.

For prop firm traders, position sizing becomes more critical during earnings season. Most prop firms enforce daily loss limits (typically 2-5% of account size) and trailing drawdown rules. A single large loss from an earnings gap could breach these limits. Check prop firm automation guidelines for specific rule considerations during high-volatility periods.

Frequently Asked Questions

1. What specific dates are peak earnings season for ES futures in 2025?

Peak earnings weeks typically occur January 20-31, April 14-25, July 14-25, and October 13-24. The exact dates shift slightly each year based on when quarter-ends fall, but weeks 2-3 after quarter close consistently see the heaviest reporting volume from S&P 500 components.

2. Can I use the same automation settings for NQ futures during earnings season?

NQ futures require even larger adjustments than ES during earnings because tech stocks show higher earnings-related volatility. Consider 2-2.5x stop widening for NQ versus 1.5-2x for ES, and reduce NQ position sizes by 40-60% versus 30-50% for ES.

3. How do I know which specific days have high-impact earnings reports?

Use an earnings calendar that shows S&P 500 component reports with index weighting. Focus on companies representing >2% of the index (Apple, Microsoft, Amazon, Alphabet, Nvidia). These individual reports can move ES futures 10-20 points regardless of broader earnings trends.

4. Should I turn off automation completely during earnings season?

Complete shutdown isn't necessary for most strategies. Time filters excluding after-hours periods (4:00 PM-9:30 AM ET) combined with position size reduction typically provides adequate protection while maintaining trading activity during lower-risk regular session hours.

5. Do micro futures MES and MNQ have the same earnings season patterns?

Yes, MES and MNQ track ES and NQ respectively with identical percentage moves. The 1/10th contract size reduces dollar impact proportionally ($1.25 per point for MES vs $12.50 for ES), making them useful for precise position sizing during high-volatility periods.

Conclusion

ES futures earnings season automation requires systematic adjustments to stops, position sizing, and trading hours rather than strategy abandonment. The documented 15-25% volatility increase during quarterly reporting periods necessitates proportional parameter changes that maintain consistent risk per trade. Time filters excluding after-hours and pre-market sessions offer the most direct protection against earnings-related gaps.

Test these adjustments in paper trading through a complete earnings cycle before implementing them with live capital. Track which specific parameter combinations work best for your strategy's logic and risk tolerance.

Want to explore more ES-specific automation strategies? Read our complete guide to futures instrument automation for contract specifications, optimal trading sessions, and strategy considerations across ES, NQ, GC, and CL.

References

- CME Group. "E-mini S&P 500 Futures Contract Specifications." https://www.cmegroup.com/markets/equities/sp/e-mini-sandp500.html

- CME Group. "Micro E-mini S&P 500 Futures." https://www.cmegroup.com/markets/equities/sp/micro-e-mini-sandp-500.html

- CME Group. "Equity Index Futures Trading Hours." https://www.cmegroup.com/trading-hours.html

- S&P Dow Jones Indices. "S&P 500 Index Methodology." https://www.spglobal.com/spdji/en/indices/equity/sp-500/

Disclaimer: This article is for educational purposes only. It is not trading advice. ClearEdge Trading executes trades based on your rules—it does not provide signals or recommendations.

Risk Warning: Futures trading involves substantial risk. You could lose more than your initial investment. Past performance does not guarantee future results. Only trade with capital you can afford to lose.

CFTC RULE 4.41: Hypothetical results have limitations and do not represent actual trading. Simulated results may under- or over-compensate for market factors like liquidity.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.