Prop Firm Tax Guide: Automated Trading Income And Deductions For Funded Traders

Navigate prop firm tax obligations. Learn why payouts are self-employment income, which trading expenses are deductible, and how to avoid costly IRS penalties.

Prop firm income from automated trading creates specific tax obligations that vary based on your trading entity structure, account type, and jurisdiction. Most funded traders report profits as self-employment income subject to ordinary income tax rates (10-37%) plus self-employment tax (15.3%), though specific treatment depends on whether you receive 1099-NEC income, pass-through distributions, or direct payouts from offshore entities. Proper record-keeping, quarterly estimated payments, and understanding deductible trading expenses are essential for compliance.

Key Takeaways

- Prop firm payouts typically generate self-employment income taxed at ordinary rates plus 15.3% self-employment tax, not capital gains treatment

- Funded traders must track every automated trade, payout, and deductible expense including software costs, data fees, and home office allocation

- Quarterly estimated tax payments are required when you expect to owe $1,000+ annually to avoid IRS penalties and interest charges

- Deductible expenses for automated prop trading include platform subscriptions, TradingView fees, VPS hosting, and percentage of home internet costs

- Mark-to-market (MTM) election under IRC Section 475(f) may benefit high-volume traders but requires filing by tax deadline of the prior year

Table of Contents

- How Prop Firm Income Is Taxed

- Tax Implications by Account Structure

- What Trading Expenses Are Deductible

- Record-Keeping Requirements for Automated Trading

- Managing Quarterly Estimated Tax Payments

- Should You Make the Mark-to-Market Election

- Frequently Asked Questions

- Conclusion

How Prop Firm Income Is Taxed

Prop firm payouts are generally treated as self-employment income, not capital gains, because you're performing trading services for the firm rather than trading your own capital. This means your profit splits face ordinary income tax rates (10-37% depending on total income) plus self-employment tax of 15.3% on the first $160,200 (2023 threshold) for Social Security and Medicare.

Most prop firms issue Form 1099-NEC (Non-Employee Compensation) if you earn $600 or more annually. Some offshore prop firms may not issue tax forms at all, but you're still legally required to report all income to the IRS. The distinction matters because capital gains treatment (0-20% rates) doesn't apply to prop firm trading income under current IRS guidance.

Self-Employment Tax: A 15.3% tax covering Social Security (12.4%) and Medicare (2.9%) that self-employed individuals pay on net earnings. Unlike W-2 employees whose employers pay half, independent contractors and funded traders pay the full amount.

Your effective tax rate depends on total household income. A funded trader earning $80,000 in prop firm payouts would face approximately 22% federal income tax plus 15.3% self-employment tax, resulting in a combined rate near 37% before state taxes and deductions.

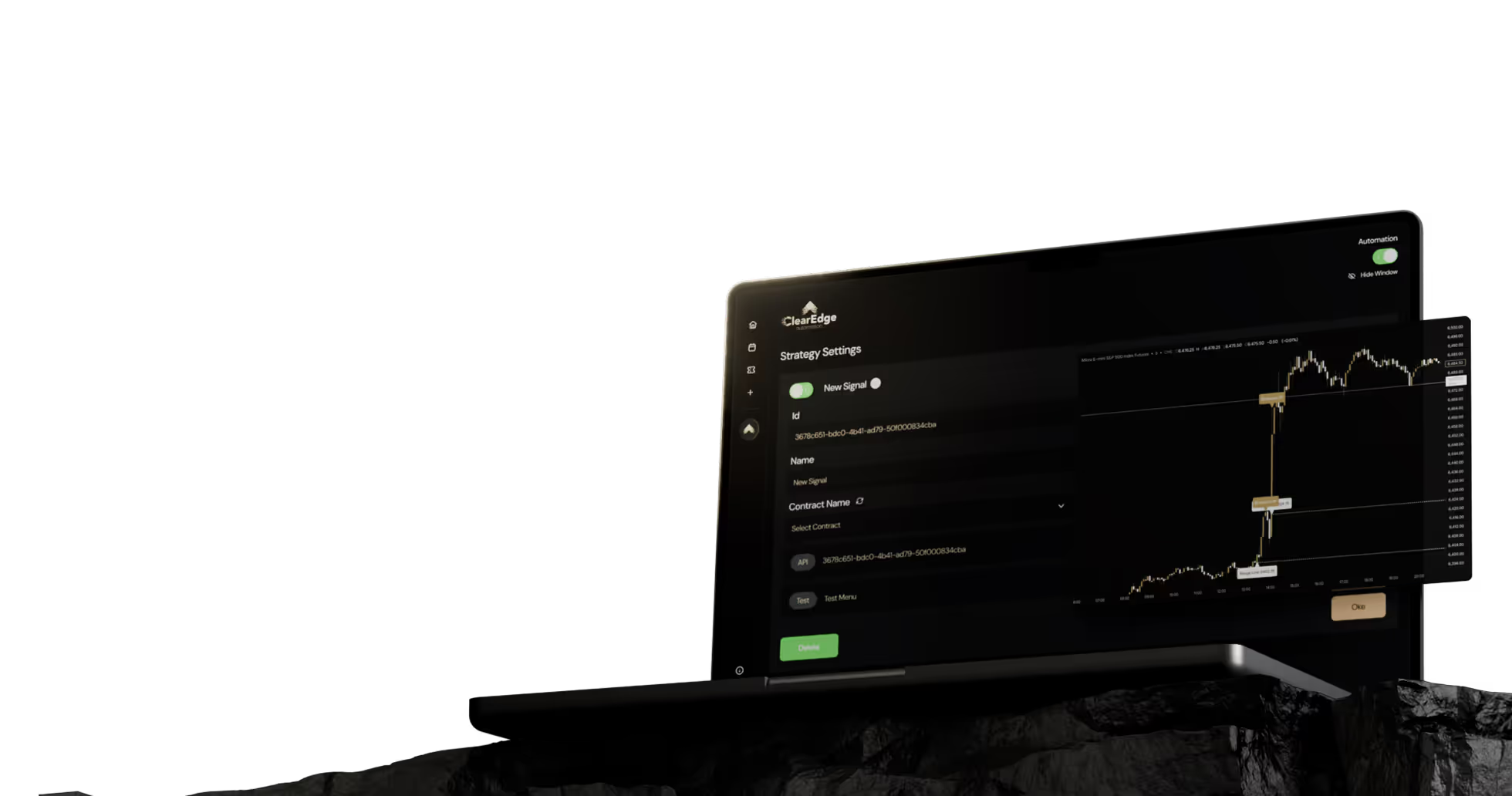

Automated trading doesn't change tax treatment. Whether you execute trades manually or through automation platforms like ClearEdge Trading, the income classification remains the same. What changes is the volume of trades you need to document for tax records.

Tax Implications by Account Structure

Your tax obligations vary significantly based on whether you trade as an individual, LLC, S-Corp, or through certain prop firm models. Individual traders using their SSN report income on Schedule C (Form 1040) and pay self-employment tax on net profit. This is the default structure for most funded traders starting out.

Forming an LLC provides liability protection but doesn't change tax treatment by default—you still pay self-employment tax as a sole proprietor. However, electing S-Corp status allows you to split income between reasonable salary (subject to payroll tax) and distributions (not subject to self-employment tax), potentially saving 15.3% on a portion of earnings.

StructureSelf-Employment TaxComplexityBest ForIndividual (Schedule C)Full 15.3% on profitLowStarting traders, <$60K annuallyLLC (default)Full 15.3% on profitLow-MediumLiability protection, any income levelS-CorpOnly on salary portionHigh$80K+ profit, willing to manage payrollC-CorpNone (corporate tax instead)Very HighRarely beneficial for traders

S-Corp election requires paying yourself a "reasonable salary" for your trading activities. The IRS expects this salary to reflect what you'd pay someone else to perform your role. For a full-time automated trader, $40,000-$60,000 might be reasonable, with remaining profits taken as distributions.

Some prop firms operate on a "challenge fee" model where you pay upfront fees and receive profit splits that may be structured differently. Offshore prop firms may not withhold taxes or issue 1099s, but U.S. taxpayers must still report all worldwide income. Consult a tax professional familiar with prop firm automation scenarios before structuring your entity.

What Trading Expenses Are Deductible

Ordinary and necessary business expenses directly related to your prop firm trading are tax-deductible, reducing your taxable income dollar-for-dollar. For automated traders, common deductions include platform subscriptions, market data fees, charting software, VPS hosting, and educational resources about trading strategies.

Deductible Expenses for Automated Prop Trading

- ☐ Automation platform subscriptions (ClearEdge, similar services)

- ☐ TradingView Pro/Pro+/Premium plans

- ☐ VPS hosting for 24/7 automation ($10-50/month typical)

- ☐ Market data fees (real-time futures data)

- ☐ Trading education (courses, books, seminars on automation)

- ☐ Home office deduction (percentage based on dedicated space)

- ☐ Computer equipment and monitors (depreciated over time)

- ☐ Internet service (percentage used for trading)

- ☐ Professional fees (accountant, tax prep, trading attorney)

- ☐ Prop firm challenge fees (if treated as business expense)

Home office deduction requires exclusive and regular use of a dedicated space for trading. You can use the simplified method ($5 per square foot, max 300 sq ft) or actual expense method (percentage of rent, utilities, insurance). A 150 sq ft dedicated trading office would yield a $750 annual deduction using the simplified method.

Ordinary and Necessary: IRS standard requiring business expenses to be common and accepted in your industry (ordinary) and helpful and appropriate for your business (necessary). Luxury or personal expenses don't qualify even if used occasionally for trading.

Equipment purchases over $2,500 must typically be depreciated over multiple years rather than deducted immediately, though Section 179 allows immediate expensing up to $1,160,000 (2023 limit) for qualifying property. A $3,000 trading computer could be fully deducted in year one under Section 179.

Keep receipts and documentation for all expenses. Credit card statements alone aren't sufficient—you need vendor invoices showing the business purpose. For percentage-based deductions like internet service, document your calculation method and usage estimate.

Record-Keeping Requirements for Automated Trading

The IRS requires detailed records of every trade including date, instrument, entry/exit prices, position size, P&L, and fees. Automated trading generates hundreds or thousands of trades monthly, making systematic record-keeping essential. Your broker provides trade confirmations, but you need organized records linking trades to specific strategies and tax periods.

Most automation platforms export trade data in CSV format. Download monthly reports and store them with clear naming conventions like "2024-03-ES-Trades.csv". This historical data proves invaluable during audits or when calculating wash sale adjustments—though wash sale rules technically don't apply to futures under Section 1256 treatment.

For prop firm income specifically, track each payout separately with date, amount, associated trading period, and any fees deducted. If you trade multiple prop accounts simultaneously, maintain separate P&L tracking for each even though you'll report combined income on your tax return.

Record TypeRetention PeriodStorage MethodTrade confirmations7 years minimumCSV exports + cloud backup1099 forms (NEC, B, MISC)7 years minimumPaper + digital scanExpense receipts7 years minimumDigital with business purpose notesPayout records7 years minimumBank statements + prop firm portal screenshotsMileage logs (if applicable)7 years minimumSpreadsheet or mileage app

Automated systems make accurate record-keeping easier but don't eliminate the requirement. Your TradingView automation setup should include data export procedures as part of your monthly routine. Set calendar reminders to download reports before prop firms purge old data.

Consider using accounting software like QuickBooks Self-Employed or specialized trading tax software like TradeLog. These tools import trade data automatically and categorize income and expenses, simplifying quarterly tax estimates and year-end filing.

Managing Quarterly Estimated Tax Payments

If you expect to owe $1,000 or more in taxes for the year after withholding and credits, you must make quarterly estimated payments to avoid underpayment penalties. Prop firm traders receive payouts without tax withholding, making quarterly payments essential for most funded accounts generating consistent income.

Quarterly due dates are April 15, June 15, September 15, and January 15 (of the following year). Calculate estimated tax by projecting annual profit, applying your effective tax rate, and dividing by four. A trader expecting $100,000 profit with a 37% combined rate should pay roughly $9,250 per quarter.

Safe Harbor Rule: You avoid underpayment penalties if you pay either 90% of current year tax liability or 100% of prior year liability (110% if AGI exceeded $150,000). This provides protection when income fluctuates significantly between years.

Automation can cause income volatility. A highly profitable month might be followed by drawdown periods. Use the safe harbor method based on prior year tax to avoid penalties even if this year's income differs significantly. Alternatively, use Form 2210 to calculate payments based on actual quarterly income (annualized income installment method).

Pay estimated taxes online through IRS Direct Pay, EFTPS, or by mailing Form 1040-ES with a check. Keep confirmation receipts proving timely payment. Late payments accrue interest at the federal short-term rate plus 3 percentage points (currently around 8% annually).

Benefits of Quarterly Payments

- Avoids large year-end tax bills and cash flow problems

- Prevents underpayment penalties and interest charges

- Spreads tax burden across the year as you earn

- Provides quarterly checkpoints to review profitability

Challenges

- Requires discipline to set aside funds from each payout

- Estimating taxes with volatile automated trading income is complex

- Overpayments tie up capital until refund (no interest paid)

- Administrative burden of tracking and submitting payments

Set aside 30-40% of each prop firm payout in a separate savings account designated for taxes. This ensures funds are available when quarterly payments are due and prevents spending money that belongs to the IRS.

Should You Make the Mark-to-Market Election

Mark-to-market accounting under IRC Section 475(f) treats your trading gains and losses as ordinary income rather than capital gains, eliminating the $3,000 annual capital loss deduction limit and wash sale rule complications. For high-volume automated traders, MTM election can simplify taxes significantly, but it's an irrevocable decision with specific filing requirements.

MTM election must be filed by the tax deadline (without extensions) of the year before it takes effect. To elect MTM for 2025, you must file by April 15, 2024. The election includes filing a statement with your return and attaching it to Form 3115 (Application for Change in Accounting Method) in the first year.

Under MTM, you report all open positions at fair market value as of December 31 each year, recognizing gains or losses even if you haven't closed the trades. This creates taxable income on unrealized gains, requiring cash reserves to pay taxes on profits you haven't actually received yet if you hold positions overnight into the new year.

FactorCapital Gains TreatmentMark-to-Market (475f)Loss limitation$3,000/year max deductionNo limitation on ordinary lossesWash sale rulesApply (delayed loss recognition)Don't applyYear-end positionsNot taxed until closedMarked to market (taxed on unrealized)Self-employment taxNot applicable to capital gainsNot applicable (ordinary income, not SE)QBI deductionMay qualify for 20% deductionDoesn't qualify as SSTB

For prop firm traders specifically, MTM election matters less than for personal account traders because your prop firm income is already ordinary income (from profit splits), not capital gains. The election primarily affects any personal futures account you trade separately.

MTM makes sense if you generate large trading losses that exceed the $3,000 capital loss limit or if wash sale adjustments create significant complexity. It's less beneficial if you hold positions long-term or prefer deferring taxes on unrealized gains. Consult a CPA specializing in trader tax status before making this election.

Frequently Asked Questions

1. Do I pay capital gains tax or income tax on prop firm payouts?

Prop firm payouts are treated as ordinary self-employment income, not capital gains, because you're performing trading services rather than investing your own capital. You'll pay ordinary income tax rates (10-37%) plus self-employment tax (15.3%) on net profit after expenses.

2. What happens if my prop firm is offshore and doesn't issue a 1099?

U.S. taxpayers must report all worldwide income regardless of whether you receive a 1099 form. Track your payouts manually and report them as self-employment income on Schedule C. Failure to report offshore income can result in penalties, interest, and potential criminal charges for tax evasion.

3. Can I deduct prop firm challenge fees as business expenses?

Challenge fees may be deductible as ordinary business expenses if you're operating as a professional trader. If you pass and become funded, the fees are clearly business-related. If you fail multiple challenges, the IRS might question whether you're engaged in a for-profit business or a hobby, which affects deductibility.

4. How does automation software subscription cost affect my taxes?

Automation platform subscriptions are fully deductible as ordinary business expenses on Schedule C. A $100/month automation platform subscription generates a $1,200 annual deduction, reducing taxable income dollar-for-dollar and saving approximately $370 at a 31% effective tax rate.

5. Do I need to report every single automated trade to the IRS?

You must maintain records of every trade, but you don't report individual trades on your tax return. Instead, you report summary totals from your 1099-B (for personal accounts) or net profit from prop firm payouts on Schedule C. Keep detailed trade logs for at least seven years in case of audit.

6. Should I form an LLC or S-Corp for prop firm trading?

An LLC provides liability protection without changing tax treatment (you still pay self-employment tax). S-Corp election can reduce self-employment tax by splitting income between salary and distributions, typically beneficial when net profit exceeds $80,000-$100,000 annually. The added complexity of payroll processing makes S-Corp less worthwhile for lower income levels.

Conclusion

Prop firm income from automated trading faces self-employment tax treatment requiring quarterly estimated payments, detailed record-keeping, and strategic expense tracking to minimize tax liability. Most funded traders pay 30-40% combined federal tax rates before considering state taxes and deductions, making proper tax planning essential for long-term profitability.

Work with a CPA experienced in trader taxation to optimize your entity structure, maximize deductions, and ensure compliance with IRS requirements. Proper tax management protects the profits your automated strategies generate and prevents costly penalties or audit complications down the road.

Want to learn more about prop firm automation? Read our complete prop firm automation guide for detailed strategies, rule compliance, and scaling techniques for funded accounts.

References

- Internal Revenue Service. "Self-Employment Tax (Social Security and Medicare Taxes)." https://www.irs.gov/businesses/small-businesses-self-employed/self-employment-tax-social-security-and-medicare-taxes

- Internal Revenue Service. "Topic No. 429 Traders in Securities." https://www.irs.gov/taxtopics/tc429

- Internal Revenue Service. "Publication 550 (2023), Investment Income and Expenses." https://www.irs.gov/publications/p550

- Internal Revenue Service. "Quarterly Estimated Tax Payments." https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

Disclaimer: This article is for educational and informational purposes only. It does not constitute tax advice, legal advice, or any recommendation regarding specific tax strategies or entity structures. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide tax advice, accounting services, or personalized recommendations. Consult a qualified CPA or tax attorney for advice specific to your situation.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Tax laws change frequently and vary by jurisdiction. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | Futures Automation Specialists | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.