TradingView Automation: Webhooks to Futures Broker Setup

Connect TradingView alerts to Tradovate, NinjaTrader, and other futures brokers via webhooks. Setup guide for Pine Script strategies, message formatting, and more.

TradingView automation connects the world's most popular charting platform to futures brokers, enabling traders to execute strategies automatically based on TradingView alerts without manual order entry. TradingView serves over 50 million users worldwide with its intuitive charting interface, extensive indicator library, and powerful alert system, but the platform itself does not execute trades on futures exchanges [1]. Automation bridges this gap by translating TradingView alerts into live orders at brokers like Tradovate, NinjaTrader, and Interactive Brokers, transforming TradingView from a charting tool into a complete trading system.

The automation process relies on webhooks, which are automated messages sent from TradingView to external systems when alert conditions are met. When price crosses a moving average, RSI reaches oversold territory, or any other condition triggers an alert, TradingView can send a webhook containing trade instructions to an automation platform. That platform then translates the instructions into properly formatted orders and submits them to your futures broker. The entire process typically completes in milliseconds to seconds, enabling systematic trading execution that would be impossible manually.

Understanding TradingView automation requires knowledge of several interconnected components: TradingView's alert system and Pine Script language, webhook technology and message formatting, automation platform capabilities and limitations, and broker API integration. This guide covers each component comprehensively, providing the foundation needed to successfully automate TradingView strategies for futures trading. Whether you use built-in indicators, custom Pine Script strategies, or third-party signals, the principles and processes described here apply to your automation implementation.

TradingView automation uses webhooks to send alert signals to automation platforms that execute trades at futures brokers, enabling systematic strategy execution without manual order entry. This transforms TradingView's charting capabilities into a complete automated trading system for futures markets.

- TradingView alerts can trigger webhooks that send trade instructions to external automation platforms

- Automation platforms translate webhook messages into orders executed at futures brokers via API

- Common broker integrations include Tradovate, NinjaTrader, Interactive Brokers, and AMP Futures

- Webhook messages must follow specific formatting requirements for each automation platform

- TradingView Pro, Pro+, or Premium subscription is required for webhook functionality

- Pine Script strategies can generate automated alerts, but require proper configuration for live execution

- What Is TradingView Automation?

- How TradingView Webhooks Work

- Automation Platform Options for TradingView

- TradingView to Tradovate Automation Setup

- TradingView to NinjaTrader Bridge Configuration

- Alert Message Formatting for Automation

- Pine Script Strategy Automation

- Risk Management Configuration

- Troubleshooting Common Issues

- Advanced Automation Techniques

- Comparing TradingView Automation Platforms

- Frequently Asked Questions

What Is TradingView Automation?

TradingView automation is the process of using TradingView's alert system to trigger automated trade execution at external brokers, bypassing the need for manual order entry when trading signals occur. While TradingView excels at charting, technical analysis, and strategy development, it functions primarily as an analysis platform rather than an execution platform for futures. Automation extends TradingView's capabilities by connecting its signal generation to actual order execution.

Webhook: An HTTP callback that sends data to a specified URL when a trigger event occurs. In TradingView automation, webhooks transmit alert information to automation platforms that process the data and execute trades. Learn more

The automation architecture involves three primary components:

- Signal generation (TradingView): Your chart analysis, indicators, or Pine Script strategy identifies trading opportunities and triggers alerts

- Signal processing (automation platform): The webhook message is received, validated, and translated into order instructions

- Order execution (futures broker): The automation platform submits orders via the broker's API, and the broker executes on the exchange

This three-component architecture means TradingView automation requires coordination across multiple systems. Each component must be properly configured and connected for the complete workflow to function. A failure at any point in the chain prevents execution, which is why understanding each component matters for successful implementation.

What TradingView Automation Can Do

- Execute market, limit, and stop orders based on alert conditions

- Open and close positions automatically when technical criteria are met

- Manage multiple positions across different instruments simultaneously

- Implement complex entry and exit logic through Pine Script

- Trade futures markets nearly 24 hours per day without manual intervention

- Apply consistent position sizing and risk management to every trade

What TradingView Automation Cannot Do

- Execute faster than the webhook delivery and processing time allows (typically 1-5 seconds)

- Guarantee fills at specific prices in fast-moving markets

- Operate without a paid TradingView subscription (webhooks require Pro or higher)

- Function if TradingView, the automation platform, or the broker experiences outages

- Replace sound strategy development with poor strategies executed automatically

How TradingView Webhooks Work

TradingView webhooks work by sending HTTP POST requests containing alert data to a specified URL whenever alert conditions are triggered. This webhook mechanism is the foundation of all TradingView automation, translating on-chart events into actionable messages that external systems can process. Understanding webhook mechanics is essential for configuring and troubleshooting automation.

The Webhook Process Flow

- Alert condition met: Price action satisfies the conditions defined in your TradingView alert

- Webhook triggered: TradingView's servers detect the condition and initiate the webhook

- HTTP POST sent: TradingView sends an HTTP POST request to your configured webhook URL

- Message delivered: The POST body contains your alert message with trade instructions

- Platform receives: Your automation platform's servers receive and parse the message

- Order created: The platform translates the message into a broker order

- Execution confirmed: The broker executes the order and returns confirmation

This entire process typically completes in 1-5 seconds under normal conditions, though delays can occur during high-volume periods on any system in the chain.

Webhook URL Configuration

Each automation platform provides a unique webhook URL where TradingView should send alerts. This URL typically looks like:

https://automation-platform.com/webhook/your-unique-identifier

The URL contains authentication information that identifies your account, so it must be kept private. Sharing your webhook URL would allow others to trigger trades in your account.

Alert Message Structure

The alert message is the text content sent via webhook, containing instructions for the automation platform. Message format varies by platform but typically includes:

- Action: Buy, sell, close, or other trade action

- Symbol: The instrument to trade (e.g., ES, NQ, GC)

- Quantity: Number of contracts or position sizing instruction

- Order type: Market, limit, stop, or other order type

- Price: For limit orders, the execution price

- Account: If managing multiple accounts, which account to use

Most platforms accept JSON-formatted messages for complex instructions or simplified text formats for basic orders. The exact syntax requirements depend on your chosen automation platform.

TradingView Subscription Requirements

Webhook functionality requires a paid TradingView subscription:

TradingView PlanWebhooksActive AlertsAlerts per Second Basic (Free)Not available1N/A EssentialNot available20N/A PlusAvailable1001 PremiumAvailable4001 ExpertAvailable8001 UltimateAvailable10001

Note: Plan names and limits change periodically. Verify current offerings at TradingView.com.

Automation Platform Options for TradingView

Several automation platforms compete to connect TradingView signals to futures brokers, each with different features, pricing, and broker support. Selecting the right platform depends on your specific needs regarding broker compatibility, feature requirements, and whether you need the platform to provide strategies or simply execute your own signals.

Signal-to-Execution Platforms

These platforms focus on translating your TradingView signals into broker orders, assuming you provide your own trading strategy:

TradersPost: A popular choice offering multi-broker support, paper trading capabilities, and detailed execution logs. Pricing is subscription-based with tiers based on features and trade volume. TradersPost supports stocks, options, crypto, and futures across multiple brokers.

PickMyTrade: Focuses specifically on futures automation with a flat monthly fee regardless of trade volume. Known for straightforward setup and Tradovate integration. Unlimited trades at fixed cost appeals to active traders.

AlertBot: Provides webhook-to-broker automation with support for multiple asset classes. Offers both free and premium tiers with varying feature access.

Strategy-Included Platforms

These platforms provide both the automation infrastructure and proprietary trading strategies:

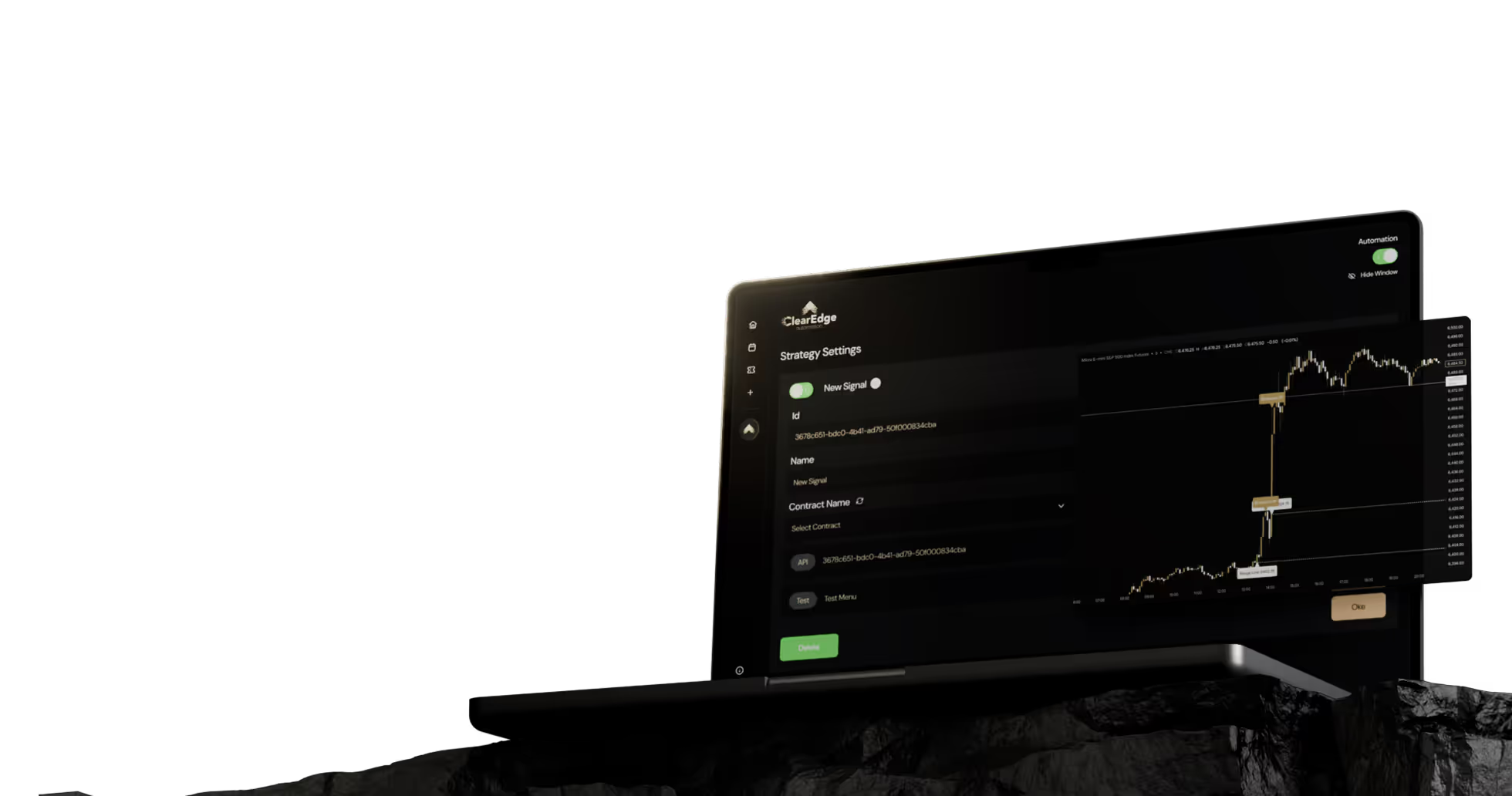

ClearEdge: Combines automation infrastructure with pre-built futures strategies, eliminating the need for users to develop their own approaches. Rather than configuring TradingView alerts and webhook messages, users select from available strategies that execute automatically. This approach suits traders who want automation benefits without strategy development complexity.

QuantVue ATS: Offers done-for-you automation with extensive strategy configuration, though at significantly higher price points including substantial setup fees.

Platform Selection Criteria

When evaluating automation platforms, consider:

- Broker compatibility: Does the platform support your preferred futures broker?

- Strategy requirements: Do you need to bring your own strategy or want included strategies?

- Pricing structure: Fixed monthly fee, per-trade charges, or tiered pricing?

- Risk controls: What position sizing, daily loss limits, and other safeguards are available?

- Reliability history: What do users report about uptime and execution quality?

- Support quality: How responsive is the platform when issues arise?

API (Application Programming Interface): A set of protocols allowing different software applications to communicate. In trading, broker APIs allow automation platforms to submit orders, receive confirmations, and access account data programmatically. Learn more

TradingView to Tradovate Automation Setup

Tradovate is one of the most popular futures brokers for TradingView automation due to its modern API, competitive commissions, and widespread support across automation platforms. Setting up TradingView to Tradovate automation involves connecting your Tradovate account to an automation platform, then configuring TradingView alerts to send webhooks to that platform.

Tradovate Account Preparation

Before connecting automation:

- Verify account status: Ensure your Tradovate account is funded and approved for trading

- Enable API access: In Tradovate settings, enable API access for third-party applications

- Generate API credentials: Create the API key and secret required by your automation platform

- Note account ID: Record your Tradovate account ID for platform configuration

Platform Connection Steps

The exact process varies by automation platform, but generally follows this pattern:

- Create automation platform account: Sign up for your chosen platform (TradersPost, PickMyTrade, etc.)

- Add Tradovate connection: Navigate to broker connections and select Tradovate

- Enter API credentials: Input your Tradovate API key and secret

- Authorize connection: Complete any OAuth or verification steps required

- Test connection: Use the platform's test feature to verify successful connection

- Obtain webhook URL: Copy the webhook URL provided by the platform

TradingView Alert Configuration

With the platform connected, configure TradingView alerts:

- Create alert: On your TradingView chart, click the alert icon or use the keyboard shortcut

- Set conditions: Define the trigger conditions for your alert

- Enable webhook: Check the "Webhook URL" option in the alert dialog

- Enter webhook URL: Paste your automation platform's webhook URL

- Configure message: Enter the alert message in the format required by your platform

- Set alert options: Configure expiration, frequency, and notification preferences

- Save alert: Create the alert and verify it appears in your alert list

Example Alert Message for Tradovate

A typical JSON-formatted alert message might look like:

{ "action": "buy", "symbol": "ESZ2025", "quantity": 1, "orderType": "market", "account": "your-account-id" }

Platform-specific syntax varies. Consult your automation platform's documentation for exact formatting requirements.

Testing the Complete Workflow

Before live trading, test the complete workflow:

- Paper trading test: Configure the automation platform for paper/simulation trading

- Trigger test alert: Manually trigger an alert or wait for natural trigger

- Verify webhook delivery: Check that the platform received the webhook

- Confirm order execution: Verify that the paper trade executed correctly

- Review all parameters: Ensure symbol, quantity, and order type matched expectations

The ClearEdge FAQ addresses common setup questions for traders connecting futures brokers to automation platforms.

TradingView to NinjaTrader Bridge Configuration

NinjaTrader is a powerful futures trading platform with its own charting and strategy development capabilities, but many traders prefer TradingView's interface for analysis while using NinjaTrader for execution. Connecting TradingView to NinjaTrader requires bridging two sophisticated platforms, which can be accomplished through several methods.

Integration Options

Option 1: Third-party automation platforms

Platforms like TradersPost support NinjaTrader Brokerage accounts, enabling the same webhook-based automation used with other brokers. This approach is straightforward if you use NinjaTrader Brokerage (the brokerage service, not just the platform).

Option 2: Custom webhook receiver

Technical users can build a local application that receives TradingView webhooks and translates them into NinjaTrader orders via NinjaTrader's ATI (Automated Trading Interface) or custom C# development. This requires programming skills and ongoing maintenance.

Option 3: Indicator-based bridges

Some third-party tools create bridges between TradingView and NinjaTrader by monitoring files or network traffic. These solutions vary in reliability and support.

NinjaTrader Brokerage Setup

For traders using NinjaTrader Brokerage with a supported automation platform:

- Verify account type: Confirm you have a NinjaTrader Brokerage account (not just the platform with another broker)

- Enable API access: Contact NinjaTrader support to enable API access if required

- Obtain credentials: Generate or locate API credentials for third-party connection

- Connect via platform: Follow the automation platform's NinjaTrader connection guide

- Test thoroughly: Verify order execution in simulation before live trading

Considerations for NinjaTrader Integration

- Platform complexity: NinjaTrader's power comes with complexity; ensure you understand order handling

- Dual platform management: You will manage both TradingView and NinjaTrader, increasing potential failure points

- Latency: The bridge between platforms adds latency compared to native NinjaTrader automation

- Support limitations: Issues spanning two platforms may be difficult to troubleshoot

Many traders find that if their primary goal is TradingView-based futures automation, brokers with more straightforward integration (like Tradovate) provide a simpler path than NinjaTrader bridging.

Alert Message Formatting for Automation

Alert message formatting is critical for successful TradingView automation because the automation platform parses these messages to determine what orders to place. Incorrect formatting results in failed executions, wrong order parameters, or no action at all. Each platform has specific formatting requirements that must be followed precisely.

Common Message Formats

JSON Format:

Most platforms accept JSON (JavaScript Object Notation) for structured messages:

{ "action": "buy", "symbol": "NQZ2025", "qty": 2, "orderType": "market" }

Simple Text Format:

Some platforms accept simplified text commands:

buy NQ 2 market

Platform-Specific Syntax:

Many platforms define their own message syntax. For example:

TICKER=NQ;ACTION=BUY;QTY=2;TYPE=MKT

Dynamic Message Variables

TradingView supports placeholder variables in alert messages that are replaced with actual values when the alert fires:

VariableDescriptionExample Output {{ticker}}Symbol of the chartNQ1! {{close}}Current close price15234.50 {{time}}Alert trigger time2025-12-04T14:30:00Z {{strategy.order.action}}Strategy order directionbuy {{strategy.order.contracts}}Strategy order quantity1 {{strategy.position_size}}Current position size2

Using dynamic variables enables alerts that automatically adapt to different symbols or strategy-generated signals.

Message Formatting Best Practices

- Follow platform documentation exactly: Even minor deviations (wrong quotes, missing commas) cause failures

- Test with paper trading: Verify message parsing before live execution

- Use consistent symbol naming: Ensure symbol names match what the broker expects

- Include all required fields: Omitting required fields causes rejection

- Avoid special characters: Limit messages to alphanumeric characters and standard punctuation

- Log and review: Monitor execution logs to catch formatting issues early

JSON (JavaScript Object Notation): A lightweight data format using human-readable text to store and transmit data objects. JSON is commonly used for webhook message formatting due to its structured yet readable nature. Learn more

Pine Script Strategy Automation

Pine Script is TradingView's proprietary scripting language for creating custom indicators and strategies. Pine Script strategies can generate automated trading signals that, when combined with webhook alerts, enable fully automated execution of custom trading logic. Understanding how to connect Pine Script strategies to automation is essential for traders developing their own approaches.

Strategy vs. Indicator Scripts

Pine Script offers two main script types with different automation implications:

Indicators: Calculate and display values on charts but do not generate strategy orders. Automation requires manual alert configuration based on indicator conditions.

Strategies: Include built-in backtesting and can generate entry/exit orders with strategy.entry() and strategy.exit() functions. These orders can trigger alerts automatically when configured properly.

For automation, strategies are generally preferred because they generate explicit order signals that map directly to automated execution.

Configuring Strategy Alerts

To automate a Pine Script strategy:

- Add strategy to chart: Apply your Pine Script strategy to the relevant chart

- Create alert on strategy: Click the alert icon and select the strategy as the condition source

- Select "Order fills only": This triggers alerts only when the strategy generates orders

- Configure webhook: Enable webhook and enter your automation platform URL

- Format message: Use strategy placeholder variables to create dynamic messages

Example strategy alert message using placeholders:

{ "action": "{{strategy.order.action}}", "symbol": "{{ticker}}", "qty": {{strategy.order.contracts}}, "price": {{close}} }

Pine Script Considerations for Automation

Repainting: Some Pine Script logic "repaints," meaning historical signals change as new data arrives. Repainting strategies show better backtests than live performance because alerts fire based on conditions that may later change. Use non-repainting logic for automation.

Alert frequency: TradingView limits alerts to approximately one per second. High-frequency strategies may miss signals if they fire faster than this limit.

Strategy properties: Configure strategy properties (initial capital, position size, commission) to match your actual trading parameters for accurate backtesting.

Execution differences: Backtests assume execution at exact prices; live trading experiences slippage and partial fills. Account for this discrepancy in strategy design.

Converting Indicators to Strategy Alerts

If you have an indicator you want to automate (rather than a strategy), you must manually create alerts based on indicator conditions:

- Add the indicator to your chart

- Create an alert with condition set to the indicator

- Specify the trigger condition (crosses above, crosses below, etc.)

- Configure webhook and message for buy/sell actions

- Create separate alerts for entry and exit conditions

This approach requires more manual configuration but works for any indicator-based trading logic.

Risk Management Configuration

Risk management in TradingView automation spans multiple system layers, from Pine Script strategy logic through automation platform settings to broker-level controls. Proper configuration ensures that no single failure point can cause catastrophic losses. The most common automation mistakes involve inadequate risk management configuration.

Strategy-Level Risk Management

Within Pine Script strategies:

- Position sizing: Use strategy.entry() qty parameter to control position size

- Stop losses: Implement strategy.exit() with stop parameter for automatic stop loss orders

- Profit targets: Use limit parameter in strategy.exit() for take-profit orders

- Maximum position: Logic to prevent adding to positions beyond defined limits

Example Pine Script with risk management:

strategy.entry("Long", strategy.long, qty=1) strategy.exit("Exit Long", "Long", stop=close - 10, limit=close + 20)

Automation Platform Risk Controls

Most automation platforms provide additional risk layers:

- Maximum position size: Hard limit on contracts regardless of signal quantity

- Daily loss limit: Stops trading when daily losses reach threshold

- Maximum daily trades: Limits trade count to prevent overtrading

- Trading hours: Restricts execution to specified session windows

- Symbol restrictions: Limits which instruments can be traded

Broker-Level Controls

Configure additional safeguards at your broker:

- Margin limits: Ensure margin requirements prevent oversized positions

- Order size limits: Set maximum order sizes at the broker level

- Daily loss limits: Some brokers offer account-level daily loss limits

- Position limits: Maximum open position restrictions

Layered Risk Management Example

A comprehensive risk management configuration might include:

LayerControlSetting Pine Script StrategyPosition size1 contract per signal Pine Script StrategyStop loss10 points Automation PlatformMax position3 contracts total Automation PlatformDaily loss limit$500 Automation PlatformTrading hours9:30am-4:00pm ET only BrokerAccount marginSufficient for max position only

This layered approach ensures that even if one layer fails, others prevent catastrophic outcomes.

Troubleshooting Common Issues

TradingView automation involves multiple interconnected systems, and issues can arise at any point in the chain. Systematic troubleshooting identifies where problems occur so they can be resolved. Most issues fall into recognizable categories with established solutions.

Webhook Not Firing

Symptoms: Alert conditions appear met, but no webhook is sent.

Possible causes and solutions:

- Alert expired: Check alert expiration settings; renew if needed

- Alert paused: Verify alert is active in alert manager

- Webhook URL missing: Confirm webhook URL is entered in alert settings

- TradingView plan: Verify subscription includes webhook capability

- Condition not actually met: Review alert condition logic; may differ from visual interpretation

Webhook Sent but Order Not Executed

Symptoms: Automation platform shows webhook received, but no order placed.

Possible causes and solutions:

- Message format error: Review message syntax against platform requirements

- Invalid symbol: Ensure symbol name matches broker's expected format

- Authentication failure: Verify broker connection is active and authenticated

- Risk limit triggered: Check if daily loss limit or position limit was reached

- Outside trading hours: Verify market is open and platform allows trading at current time

Order Executed with Wrong Parameters

Symptoms: Order executes but with wrong quantity, direction, or symbol.

Possible causes and solutions:

- Message variable error: Check that placeholder variables resolve correctly

- Symbol mapping issue: Some platforms require symbol translation (e.g., "ES1!" to "ESZ2025")

- Quantity calculation error: Review position sizing logic in message

- Stale message: Old alert messages may have incorrect static values

Duplicate Orders

Symptoms: Multiple orders placed for single alert.

Possible causes and solutions:

- Alert frequency setting: Check if alert is set to "Once Per Bar Close" vs "Once Per Bar" vs "Every Time"

- Multiple alerts on same condition: Review alert list for duplicates

- Platform retry logic: Some platforms retry failed orders; check retry settings

Connection Failures

Symptoms: Broker connection shows disconnected or orders fail with connection errors.

Possible causes and solutions:

- API credentials expired: Regenerate and update API keys

- Broker maintenance: Check broker status page for scheduled downtime

- Platform issues: Check automation platform status for outages

- Account issues: Verify broker account is in good standing

Diagnostic Checklist

When troubleshooting any automation issue:

- Check TradingView alert status and recent trigger history

- Review automation platform webhook logs

- Verify broker connection status

- Test with a simple, known-working alert configuration

- Check each system's status page for reported issues

- Review any recent configuration changes

Advanced Automation Techniques

Beyond basic alert-to-order automation, advanced techniques enable more sophisticated trading systems. These approaches require deeper technical knowledge but provide capabilities beyond simple signal execution.

Multi-Symbol Automation

Trading multiple instruments from TradingView automation requires careful organization:

- Symbol-specific alerts: Create separate alerts for each instrument with appropriate symbol in the message

- Dynamic symbol messages: Use {{ticker}} variable to automatically include chart symbol

- Portfolio-level risk management: Configure platform limits that span all symbols

- Correlation awareness: Monitor for correlated positions that compound risk

Conditional Order Logic

Advanced webhook messages can include conditional logic:

- OCO (One-Cancels-Other): Stop loss and take profit orders that cancel each other when one fills

- Bracket orders: Entry with automatic stop and target placement

- Trailing stops: Stops that follow price movement by defined offset

- Scaled entries/exits: Multiple partial positions at different prices

Support for these order types depends on your automation platform and broker capabilities.

Multi-Timeframe Strategies

Implementing multi-timeframe analysis in automation:

- Higher timeframe filters: Use security() function in Pine Script to reference other timeframes

- Multiple chart alerts: Create alerts on different timeframe charts that coordinate through message logic

- Platform-level filtering: Some platforms allow filtering signals based on external conditions

Strategy Rotation and Switching

Managing multiple strategies through automation:

- Account allocation: Assign different strategies to different sub-accounts

- Market regime filters: Enable/disable strategies based on volatility or trend conditions

- Time-based rotation: Different strategies for different sessions or market phases

Hybrid Manual/Automated Approaches

Combining automation with manual discretion:

- Automated entries, manual exits: Automation captures entry signals; trader manages positions

- Manual entries, automated stops: Trader enters positions; automation manages risk

- Signal confirmation: Automation sends alerts for review rather than direct execution

The advanced automation strategies guide explores these techniques in greater detail.

Comparing TradingView Automation Platforms

Selecting the right automation platform significantly impacts your TradingView automation experience. This comparison highlights key differences among popular options to inform your decision.

FeatureTradersPostPickMyTradeClearEdge Primary FocusMulti-asset executionFutures executionFutures with strategies Strategy RequirementBring your ownBring your ownStrategies included Pricing ModelTiered subscriptionFlat monthlyFlat monthly Tradovate SupportYesYesYes NinjaTrader SupportYes (Brokerage)LimitedYes Paper TradingYesYesYes Daily Loss LimitsYesYesYes Best ForMulti-asset traders with strategiesFutures-only, cost-consciousTraders wanting turnkey automation

Decision Framework

Choose a signal-execution platform (TradersPost, PickMyTrade) if:

- You have existing profitable strategies to automate

- You prefer maximum control over signal generation

- You want to use your own TradingView indicators or Pine Script

- You trade multiple asset classes beyond futures

Choose a strategy-included platform (ClearEdge) if:

- You want automation without developing strategies

- You prefer simpler setup without webhook message configuration

- You focus specifically on futures trading

- You value turnkey solutions over maximum customization

The ClearEdge approach eliminates the TradingView configuration complexity by providing complete automation including strategies, rather than requiring users to build and connect their own signal sources.

Frequently Asked Questions

1. Can I automate TradingView without coding?

Yes, TradingView automation is possible without coding. You can create alerts based on built-in indicators and conditions using TradingView's visual interface, then connect these alerts to automation platforms via webhooks. Many traders successfully automate using simple moving average crossovers, RSI levels, or price breakouts without writing any Pine Script code. For even simpler approaches, platforms like ClearEdge provide complete automation with pre-built strategies, eliminating both coding and alert configuration requirements.

2. Which TradingView subscription do I need for automation?

Webhook functionality, which is essential for automation, requires TradingView Plus or higher subscription. The free Basic and Essential plans do not support webhooks. Plus provides webhooks with 100 active alerts, while Premium, Expert, and Ultimate tiers offer more alerts (400, 800, and 1000 respectively). Choose your tier based on how many simultaneous alerts your automation strategy requires. Most traders find Plus or Premium sufficient for futures automation.

3. How fast is TradingView webhook automation?

Total latency from alert trigger to order execution typically ranges from 1-5 seconds under normal conditions. This includes TradingView processing time, webhook transmission, automation platform processing, and broker order submission. During high-volume periods on any system in the chain, latency may increase. This speed is sufficient for most swing trading and position trading strategies but may be too slow for scalping approaches requiring sub-second execution.

4. Can I automate TradingView alerts to multiple brokers?

Yes, most automation platforms support multiple broker connections. You can configure alerts to execute at different brokers simultaneously or route specific symbols to specific brokers. This enables strategies like running the same signals on both a personal account and prop firm account (where permitted). Configuration varies by platform; some charge additional fees for multiple broker connections.

5. What happens if TradingView or my automation platform goes down?

System outages can leave positions unmanaged. To mitigate this risk: use broker-level stop losses that execute regardless of automation status, avoid position sizes that would be catastrophic if unmanaged, monitor positions when possible even with automation running, and consider redundant alert mechanisms for critical positions. No automation system is 100% reliable; plan for occasional failures.

6. Can I use TradingView automation for prop firm trading?

Yes, TradingView automation is commonly used for prop firm trading. Many prop firms explicitly allow automated trading via TradingView webhooks. Ensure your automation configuration complies with prop firm rules regarding position limits, daily loss limits, and any prohibited trading behaviors. Automation naturally enforces the discipline that prop firm rules require, making it well-suited for funded account trading. Verify automation policies with your specific prop firm before deployment.

7. How do I handle TradingView symbol names for futures automation?

TradingView uses continuous contract symbols (like "ES1!" for front-month E-mini S&P 500) while brokers require specific contract months (like "ESZ2025" for December 2025 expiry). Most automation platforms handle this translation automatically, but verify your platform's approach. Some require symbol mapping configuration; others translate automatically. Test with paper trading to ensure correct symbol handling before live execution.

8. What is the difference between alert conditions and strategy orders for automation?

Alert conditions are manual configurations where you specify triggers like "Price crosses above SMA 50." Strategy orders are generated automatically by Pine Script strategies using functions like strategy.entry() and strategy.exit(). Strategy orders are generally preferred for automation because they provide complete trading logic including entries, exits, and position management. Alert conditions require separate alerts for each action and more manual configuration.

9. Can I run multiple strategies simultaneously through TradingView automation?

Yes, you can run multiple strategies by creating separate alerts for each strategy, each with appropriate webhook messages. Configuration considerations include: ensuring unique identification for each strategy in messages, managing aggregate position limits across strategies, monitoring for conflicting signals (one strategy buying while another sells), and tracking performance separately for each strategy. Some automation platforms provide portfolio-level management features to coordinate multiple strategies.

10. How do I test TradingView automation before live trading?

Follow this testing progression: First, verify alert logic fires correctly by reviewing TradingView's alert history. Second, test webhook delivery by checking your automation platform's webhook logs. Third, run in paper trading mode to verify complete order execution without real money. Fourth, test with minimum position sizes in a live account to verify real execution. Only after successful completion of all phases should you scale to normal position sizes. Testing should span at least 1-2 weeks to encounter various market conditions.

Conclusion

TradingView automation transforms the world's most popular charting platform into a complete automated trading system for futures markets. By connecting TradingView's powerful analysis and alert capabilities to futures brokers through webhook-based automation platforms, traders can execute systematic strategies without manual order entry. The technology is accessible to non-programmers through visual alert configuration while offering extensive customization for those with Pine Script skills.

Successful TradingView automation requires understanding and properly configuring each component in the chain: TradingView alerts and webhooks, automation platform connections and settings, and broker execution parameters. Failures at any point prevent successful execution, making systematic testing essential before live deployment. The layered risk management approach, implementing controls at the strategy, platform, and broker levels, protects against technical failures and ensures no single point of failure can cause catastrophic losses.

For traders with existing profitable strategies, TradingView automation through signal-execution platforms like TradersPost or PickMyTrade provides the infrastructure to execute those strategies consistently. For traders who prefer turnkey solutions without strategy development, platforms like ClearEdge offer complete automation including pre-built strategies. Either path enables the core benefit of automation: removing human psychological interference from trade execution while capturing opportunities around the clock. The choice between approaches depends on your strategy development capabilities, technical comfort level, and preference for customization versus simplicity.

References

- TradingView. (2025). About TradingView. https://www.tradingview.com/about/

- TradingView. (2025). Pine Script Language Reference Manual. https://www.tradingview.com/pine-script-reference/

- TradingView. (2025). Alerts - Webhooks. https://www.tradingview.com/support/solutions/43000529348-alerts-webhooks/

- Tradovate. (2025). API Documentation. https://www.tradovate.com/

- NinjaTrader. (2025). Automated Trading Interface. https://ninjatrader.com/

- CME Group. (2025). E-mini Futures Contract Specifications. https://www.cmegroup.com/markets/equities/

This content is for educational purposes only and does not constitute financial advice. Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance of any trading system or strategy is not indicative of future results.

RISK WARNING: Futures trading carries a high level of risk and may not be suitable for all investors. You could lose more than your initial investment. Only trade with capital you can afford to lose. Automated trading systems cannot guarantee profits and may experience periods of drawdown.

ClearEdge Automation is a futures automation platform. This content may reference ClearEdge products and services where contextually relevant to the educational material.

Published: December 2025 · Last updated: 2025-12-04

Author: ClearEdge Team, 100+ years combined trading and development experience, including 29-year CME floor trading veteran

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.