Automated ISM Data Futures Trading Strategy Guide

Trade ISM Manufacturing PMI releases with precision. Use automated futures strategies to capture ES and NQ volatility while managing risk and prop firm rules.

An automated futures trading ISM data strategy uses algorithmic execution to trade futures contracts based on the ISM Manufacturing PMI report, released on the first business day of each month at 10:00 AM ET. The strategy automates entry and exit rules around this economic indicator, which measures manufacturing sector health and often triggers significant price moves in ES, NQ, and other equity index futures. Automation removes manual execution delays during the volatile minutes following the ISM release, when futures can move 10-30 points in seconds.

Key Takeaways

- ISM Manufacturing PMI releases occur monthly at 10:00 AM ET and typically generate 15-40 point moves in ES futures within the first 5 minutes

- Automated strategies execute predefined rules in milliseconds, capturing initial volatility that manual traders often miss due to reaction delays

- Effective ISM automation requires economic calendar integration, pre-configured position sizing, and volatility-adjusted stop losses of 8-15 points

- Most prop firms restrict news trading during major economic releases, requiring rule verification before automating ISM strategies on funded accounts

Table of Contents

- What Is the ISM Manufacturing PMI and Why Does It Move Futures

- How to Set Up Automated ISM Trading Rules

- Why Execution Timing Matters for ISM Releases

- Risk Parameters for Automated ISM Strategies

- ISM Trading Automation and Prop Firm Rules

- Frequently Asked Questions

- Conclusion

What Is the ISM Manufacturing PMI and Why Does It Move Futures

The ISM Manufacturing PMI (Purchasing Managers' Index) is a monthly economic indicator measuring manufacturing sector activity across the United States. Released by the Institute for Supply Management on the first business day of each month at 10:00 AM ET, the index surveys purchasing managers about new orders, production, employment, supplier deliveries, and inventories. A reading above 50 indicates expansion, while below 50 signals contraction.

PMI (Purchasing Managers' Index): A diffusion index where values above 50 represent expansion and below 50 indicate contraction. The ISM PMI is considered a leading economic indicator because purchasing managers make decisions based on forward-looking business conditions.

ES and NQ futures react strongly to ISM releases because the data provides early insight into GDP trends and Federal Reserve policy expectations. When ISM beats consensus by 2+ points, ES typically rallies 10-25 points in the first 3 minutes. Misses of similar magnitude often trigger 15-40 point drops. This volatility creates trading opportunities but also execution challenges for manual traders.

The ISM report includes subcomponents that futures algorithms often parse: new orders, production, employment, and prices paid. The prices paid index particularly impacts Treasury futures and Fed policy expectations. According to CME Group data, ES futures volume increases 200-400% in the 10 minutes following ISM releases compared to the prior hour average.

How to Set Up Automated ISM Trading Rules

Automated ISM strategies require economic calendar integration to identify release times and pre-configured execution rules that trigger when price moves beyond defined thresholds. Most traders use a breakout approach: when price moves 5-8 points in the first minute post-release, automation enters in the direction of the break with predetermined targets and stops. This removes the decision-making lag that causes manual traders to miss the initial move.

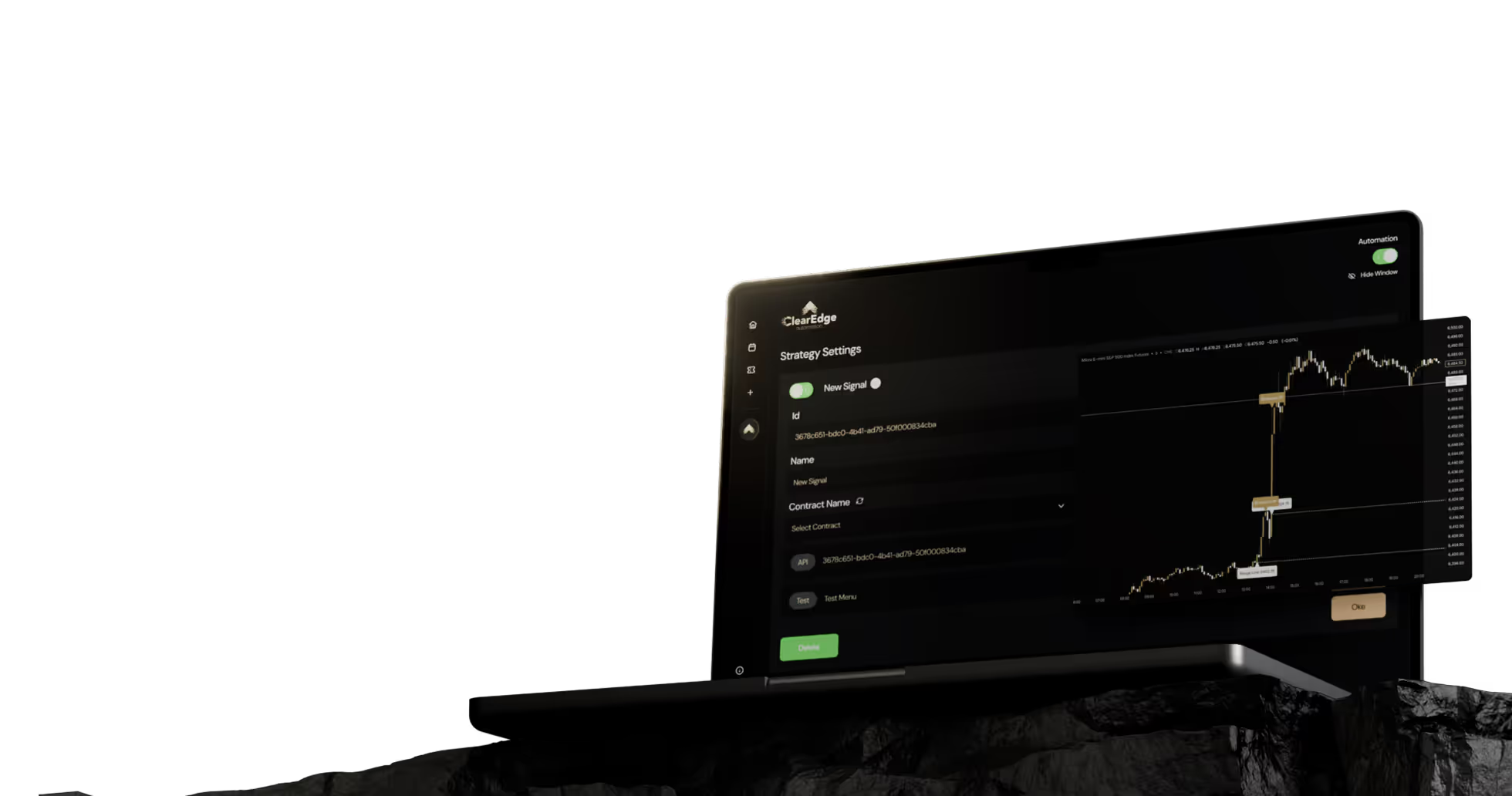

Setting up ISM automation in platforms like ClearEdge Trading involves three components: calendar triggers, entry conditions, and risk parameters. Calendar triggers identify 10:00 AM ET on ISM release days. Entry conditions might include "if ES moves above 9:59 AM high by 5 points within 90 seconds of 10:00 AM release, enter long 1 contract." Risk parameters define stops (typically 10-15 points for ES) and targets (15-30 points for initial targets).

ISM Automation Setup Checklist

- ☐ Add ISM release dates to economic calendar (first business day monthly)

- ☐ Define pre-release reference price (9:59 AM close or opening range high/low)

- ☐ Set breakout threshold (5-8 points for ES, 15-25 points for NQ)

- ☐ Configure position size based on increased volatility (often 50% of normal size)

- ☐ Set wider stops to accommodate ISM volatility (12-15 points vs. 6-8 points normal)

- ☐ Define profit targets or trailing stops for exit automation

- ☐ Verify prop firm rules allow news trading if using funded account

TradingView users can create alerts that fire when price crosses ISM breakout levels, sending webhooks to automation platforms. The alert message includes direction (long/short), contract quantity, and order type. For ISM releases, limit orders often result in missed fills due to speed, so most automated strategies use market orders despite slightly higher slippage costs of 1-2 ticks.

Webhook: An automated HTTP message sent from TradingView to your futures automation platform when an alert condition is met. Webhooks enable sub-second execution of your predefined trading rules without manual intervention.

Why Execution Timing Matters for ISM Releases

ISM data releases trigger price moves that develop within 30-90 seconds, making execution speed the difference between catching the move and chasing it. Manual traders typically need 3-8 seconds to read the headline, assess deviation from consensus, and place an order. Automated execution happens in 20-200 milliseconds once the price trigger fires, capturing entries 5-15 points better on average.

The ISM number hits newswires at exactly 10:00:00 AM ET. Algorithmic traders with direct news feeds react within 10-50 milliseconds. Retail automation platforms respond to price movement rather than news parsing, typically entering 200-500 milliseconds after the initial spike begins. This is still 5-10x faster than manual execution, which matters when ES moves 15 points in the first 45 seconds.

Execution MethodTypical Response TimeEntry Quality (ES Points)Manual chart watching4-10 secondsEnters 8-18 points into moveTradingView alert → manual entry2-6 secondsEnters 5-12 points into moveWebhook automation (market order)0.2-0.8 secondsEnters 1-4 points into moveDirect news feed algorithms0.01-0.05 secondsEnters at initial tick

Overnight positions create additional timing risk around ISM releases. If holding ES futures through the 10:00 AM release, a worse-than-expected ISM can gap price 20-35 points against your position before stops execute. Most automated ISM strategies either flatten all positions by 9:55 AM or widen stops to 25-40 points to accommodate gap risk. The automated futures trading guide covers pre-news position management in detail.

Risk Parameters for Automated ISM Strategies

ISM releases generate 2-3x normal volatility, requiring adjusted risk parameters compared to standard day trading futures automation. Stop losses for ES should widen from typical 6-8 point ranges to 12-15 points during ISM releases to avoid premature stop-outs from initial whipsaw. Position sizing often drops to 50-75% of normal contract quantity to keep dollar risk equivalent despite wider stops.

Automated risk controls for ISM strategies include maximum daily loss limits, per-trade risk caps, and time-based exit rules. If the ISM trade hasn't reached its profit target within 15-30 minutes, many algorithms exit at breakeven or small profit to avoid holding through subsequent price chop. This prevents a quick directional winner from turning into a ranging loser as the initial volatility subsides.

Advantages of ISM Automation

- Eliminates emotional hesitation during high-speed price moves

- Executes consistently per predefined rules every release

- Captures initial momentum missed by manual reaction times

- Removes need to watch charts during 10:00 AM release window

Limitations of ISM Automation

- Cannot interpret nuanced report details like subcomponent divergences

- May trigger on head fakes before true direction establishes

- Requires monthly recalibration as market ISM sensitivity changes

- Higher slippage costs during extreme volatility spikes (2-4 ticks vs. 0.5-1 tick normal)

Margin requirements for futures brokers often increase ahead of major economic releases. Standard ES margin of $500-1,200 per contract may rise to $1,500-2,000 on ISM release days at some brokers. Check supported brokers for specific margin policies around economic events. Automation platforms should include margin buffer checks to prevent order rejection due to insufficient buying power.

Slippage: The difference between expected trade price and actual execution price. During ISM releases, slippage on market orders typically runs 1.5-3.5 ticks ($18.75-$43.75 per ES contract) compared to 0.5-1 tick during normal trading hours.

ISM Trading Automation and Prop Firm Rules

Most proprietary trading firms restrict or prohibit trading during Tier 1 economic releases, which typically include ISM Manufacturing PMI along with FOMC, NFP, and CPI. Restrictions exist because the 2-5% account swings possible during news releases conflict with daily loss limits of 3-5% and consistency rules requiring steady profit distribution. Before automating ISM strategies on prop firm accounts, verify the specific firm's economic calendar restrictions.

Some prop firms allow news trading but require explicit disclosure and may apply stricter loss limits on those days. For example, a firm with a standard 4% daily loss limit might reduce it to 2% on ISM release days. Automation platforms with prop firm compatibility features can enforce these variable risk limits based on the economic calendar. The prop firm automation guide details rule implementation for funded accounts.

When ISM trading is permitted, prop firm automation should include hard stops at the daily loss threshold minus expected slippage. If your daily limit is $1,000 and you're trading 2 ES contracts with expected slippage of $100 during ISM volatility, your aggregate stop should trigger at $800 loss ($400 per contract). This buffer prevents rule violations from execution delays during fast markets.

Prop Firm TypeISM Trading AllowedTypical RestrictionsEvaluation phaseUsually restrictedNo trading 10 min before to 15 min after releaseFunded phase (conservative firms)Usually restrictedSame as evaluationFunded phase (aggressive firms)Allowed with limitsReduced position size or tighter daily loss limitProfit-split phaseVaries by firmOften allowed once consistency established

Frequently Asked Questions

1. What time does ISM data release and when should automated strategies activate?

ISM Manufacturing PMI releases at exactly 10:00 AM ET on the first business day of each month. Automated strategies should activate 1-2 minutes before (9:58-9:59 AM) to establish reference prices, then execute entry rules based on price movement in the first 90 seconds after 10:00 AM.

2. How much capital do you need to automate ISM futures strategies?

For ES futures with proper risk management, you need $3,000-5,000 minimum to handle a 12-15 point stop loss on 1 contract while maintaining 5:1+ margin cushion. This allows for $150-187.50 risk per trade while keeping total account risk under 5% and avoiding margin calls during volatility.

3. What's the typical win rate for automated ISM breakout strategies?

ISM breakout automation typically achieves 40-55% win rates with profit factors of 1.3-1.8 when risk:reward is set to 1:1.5 or better. The strategy profits from fewer, larger winning trades that capture the initial 15-30 point directional moves, offsetting more frequent smaller stop-outs from false breaks.

4. Should ISM automation use market orders or limit orders?

Market orders are generally necessary for ISM automation because price moves too quickly for limit orders to reliably fill at desired levels. Accept 1.5-3.5 tick slippage ($18.75-$43.75 per ES contract) as the cost of guaranteed execution during the critical first 60-90 seconds.

5. How do you backtest automated ISM strategies when releases only occur monthly?

With only 12 ISM releases per year, statistical significance requires 2-3 years of data (24-36 events). Use TradingView's replay feature or platform backtesting with tick data to simulate your automation rules across past releases, but recognize that 24-36 sample size limits confidence in results compared to strategies with daily signals.

Conclusion

Automated futures trading strategies for ISM data releases remove the execution delays and emotional hesitation that prevent manual traders from capturing initial volatility. By pre-configuring breakout thresholds, position sizing, and risk parameters, automation executes consistently within milliseconds of price triggers while you focus on strategy refinement rather than split-second decisions.

Start by paper trading your ISM automation rules across 3-4 releases to validate entry timing and stop placement before committing live capital. Review automated futures trading fundamentals for comprehensive setup guidance, and verify prop firm news trading policies if using funded accounts.

Want to explore more economic event automation? Read our complete guide to automated futures trading for FOMC, NFP, and CPI strategy frameworks.

References

- Institute for Supply Management. "ISM Report On Business - Manufacturing PMI." https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/

- CME Group. "E-mini S&P 500 Futures Contract Specs." https://www.cmegroup.com/markets/equities/sp/e-mini-sandp500.html

- Federal Reserve Bank of St. Louis. "Economic Research - ISM Manufacturing PMI." https://fred.stlouisfed.org/series/NAPM

- TradingView. "Webhooks and Alerts Documentation." https://www.tradingview.com/support/solutions/43000529348-about-webhooks/

Disclaimer: This article is for educational and informational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.