Algorithmic Trading Strategies For Futures Markets - Complete Automation Guide

Elevate your futures trading by automating ES and NQ strategies. Learn how no-code tools execute trend following and mean reversion systems via TradingView.

Algorithmic trading strategies for futures markets automate trade execution based on predefined rules, removing emotional decision-making and manual delays. Common approaches include trend following, mean reversion, breakout strategies, and Opening Range systems—each designed to capitalize on specific market behaviors in contracts like ES, NQ, GC, and CL. Retail traders can now access these strategies through no-code platforms that connect TradingView alerts to broker accounts, executing trades in milliseconds without programming knowledge.

Key Takeaways

- Algorithmic futures strategies execute trades automatically when predefined conditions are met, with typical execution speeds of 3-40ms depending on broker connectivity

- The four main strategy types—trend following, mean reversion, breakout, and market making—each perform differently based on market conditions and volatility

- ES and NQ futures are the most popular contracts for retail algo trading due to high liquidity (ES averages 1.5M+ contracts daily) and tight spreads of 0.25 points during RTH

- No-code automation platforms now allow traders to implement algorithmic strategies without programming by converting TradingView alerts into broker orders via webhooks

- Backtesting is essential before live deployment—historical testing helps identify strategy parameters but cannot guarantee future performance due to changing market conditions

Table of Contents

- What Are Algorithmic Trading Strategies for Futures Markets?

- How Do Algorithmic Trading Strategies Execute Trades?

- What Are the Main Types of Algorithmic Futures Strategies?

- Trend Following Strategies

- Mean Reversion Strategies

- Breakout and Range Strategies

- Which Futures Contracts Work Best for Algo Trading?

- Do You Need Programming Skills for Algorithmic Futures Trading?

- Risk Management in Algorithmic Futures Strategies

- How to Get Started with Algorithmic Futures Trading

What Are Algorithmic Trading Strategies for Futures Markets?

Algorithmic trading strategies for futures markets are rule-based systems that automatically enter and exit positions based on technical indicators, price patterns, or statistical models. Unlike discretionary trading, these strategies remove human emotion from execution by following predefined logic without hesitation or second-guessing. The automation handles everything from order placement to position management based on criteria you establish during strategy development.

Algorithmic Trading: A method of executing trades using automated, pre-programmed instructions that account for variables like price, timing, and volume. For futures traders, this means your TradingView indicators or custom logic trigger actual broker orders without manual clicking.

These strategies work across all major futures contracts including equity index futures (ES, NQ), commodities (GC, CL), and currencies. The core advantage is execution speed—algorithmic systems can place orders within milliseconds of signal generation, while manual traders typically need 2-5 seconds to recognize a signal and click through order entry. During fast-moving markets like FOMC announcements or NFP releases, this speed difference often determines whether you get filled at your intended price.

According to the Futures Industry Association, algorithmic trading now accounts for approximately 70% of futures market volume. While institutional traders dominated this space for decades, retail automation platforms have made these strategies accessible to individual traders managing accounts from $5,000 to $100,000+.

How Do Algorithmic Trading Strategies Execute Trades?

Algorithmic strategies execute through a three-step process: signal generation, order transmission, and position management. Your strategy logic (built in TradingView, NinjaTrader, or other platforms) monitors market data in real-time and generates trading signals when conditions match your rules. These signals convert to broker orders through API connections or webhook integrations, typically executing in 3-40ms depending on your platform and broker infrastructure.

The execution chain works like this: Your indicator fires an alert → The alert triggers a webhook → Your automation platform receives the webhook → The platform formats and sends the order to your broker's API → Your broker executes the order on the exchange. Each step adds latency, which is why platform selection and broker connectivity matter for strategies sensitive to slippage.

Webhook: An automated HTTP message sent from one application to another when a specific event occurs. TradingView sends webhook alerts containing your signal data to automation platforms, which then execute the corresponding trade at your broker.

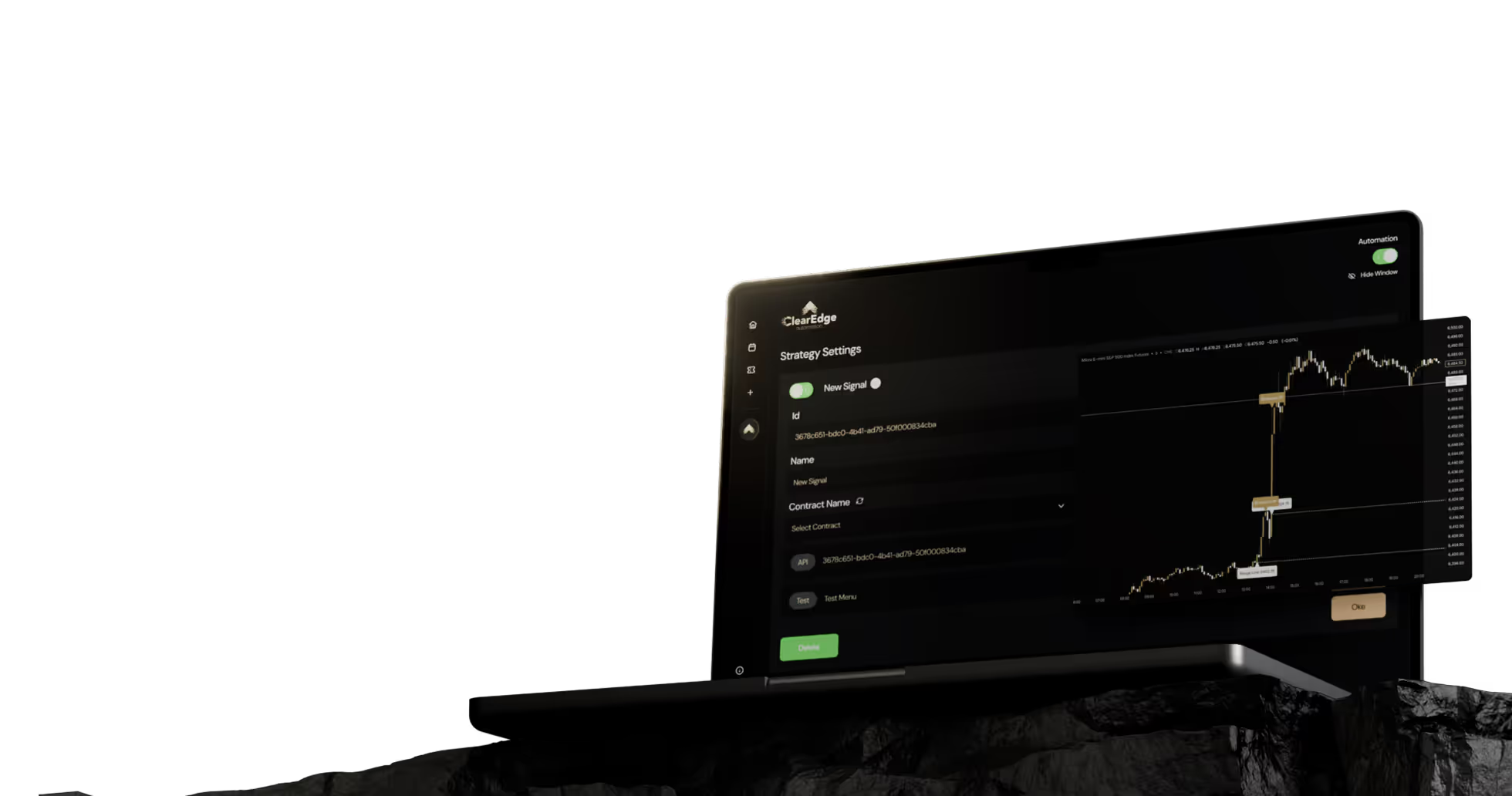

Modern retail platforms like ClearEdge Trading handle this connection without programming knowledge. You configure your TradingView alert with the webhook URL, specify position size and risk parameters, and the system manages order routing. The platform translates your alert into proper order syntax for your specific broker, handles authentication, and confirms fills back to your interface.

Position management runs continuously once a trade is active. Your strategy monitors unrealized P&L, applies trailing stops, scales out at profit targets, or closes positions when exit conditions trigger. This happens automatically based on your predefined rules—no manual intervention unless you choose to override the automation.

What Are the Main Types of Algorithmic Futures Strategies?

The four primary algorithmic strategy categories for futures are trend following, mean reversion, breakout/range strategies, and market making. Each approach capitalizes on different market behaviors and performs optimally under specific conditions. Understanding these categories helps you select or build strategies that match your trading style and the market environments you want to trade.

Strategy TypeMarket ConditionTypical Holding TimeWin Rate RangeTrend FollowingDirectional, volatileHours to days35-45%Mean ReversionRange-bound, low volatilityMinutes to hours55-70%Breakout/RangeConsolidation periodsMinutes to hours40-50%Market MakingHigh liquidity requiredSeconds to minutes70-85%

Trend following strategies identify directional momentum and hold positions as long as the trend persists. These systems typically use moving average crossovers, ADX readings above 25-30, or price channel breakouts to confirm trend strength. They work well during strong directional moves but suffer during choppy, range-bound periods where frequent stop-outs erode capital.

Mean reversion strategies assume prices will return to an average or equilibrium level after extreme moves. Common implementations use Bollinger Bands, RSI oversold/overbought levels (below 30 or above 70), or standard deviation bands. These strategies excel in stable, range-bound markets but can experience severe drawdowns during trending periods if position sizing isn't properly constrained.

Breakout strategies enter when price moves beyond established support or resistance levels, betting that the breakout will continue. Range strategies do the opposite, fading moves to range extremes expecting reversal. Opening Range Breakout (ORB) is particularly popular among ES and NQ traders, entering when price breaks the high or low of the first 15-60 minutes after the 9:30 AM ET open.

Trend Following Strategies

Trend following strategies aim to capture sustained directional moves by entering in the direction of established momentum. These systems typically combine multiple confirmation factors—price above/below a moving average, ADX indicating trend strength, and volume supporting the move. The key is waiting for confirmation rather than trying to predict trend starts, which reduces false signals during consolidation.

A basic trend following implementation might enter long when price crosses above the 50-period EMA, ADX rises above 25, and a higher high forms. The system rides the position with a trailing stop (often 1.5-2 times ATR) until the trend reverses. This approach accepts many small losses during choppy periods in exchange for occasional large wins during strong trends.

ATR (Average True Range): A volatility indicator measuring the average price range over a specified period, typically 14 bars. Algo traders use ATR to dynamically size stops and profit targets—a 2 ATR stop on ES might be 20-30 points during calm markets but 40-60 points during high volatility.

The challenge with trend following is the inherent win rate—typically 35-45%—which requires strong risk management discipline. Your average winner must significantly exceed your average loser, often targeting risk/reward ratios of 1:2 or better. For futures traders, this means accepting that 55-65% of your trades will lose money, with profitability coming from the occasional large trending move that produces 3-5x your typical loss.

Many successful trend followers combine timeframes, using daily charts to identify the primary trend direction and smaller timeframes (5-15 minute) for precise entry timing. This reduces the chance of entering just before a counter-trend pullback. For more on combining timeframe analysis, see the algorithmic trading guide.

Mean Reversion Strategies

Mean reversion strategies profit from the tendency of prices to return to average levels after extreme moves. These systems identify overbought or oversold conditions and take positions betting on a move back toward equilibrium. The statistical basis is that most price movements are random walks with a tendency toward the mean rather than sustained directional trends.

Common mean reversion implementations use Bollinger Bands (entering when price touches the lower band and exits near the middle), RSI extremes (buying below 30, selling above 70), or Z-score calculations that measure how many standard deviations price has moved from its average. For ES futures, a simple approach might buy when price drops 15+ points from the day's VWAP during RTH, targeting a move back toward VWAP.

The advantage of mean reversion is higher win rates—often 55-70%—because most extreme moves do retrace at least partially. The risk is catastrophic loss during genuine trend breakouts, when price continues moving away from the mean rather than reverting. This is why mean reversion systems require tight stops and position size limits to prevent a single trending day from wiping out weeks of small gains.

Timing matters significantly for mean reversion. These strategies work best during specific market hours when institutional order flow creates predictable patterns. The first 30 minutes after RTH open (9:30-10:00 AM ET) often shows mean reversion opportunities as overnight gaps fill. Similarly, the last 30 minutes before close (3:30-4:00 PM ET) can present reversion setups as traders close positions. Overnight sessions typically show less reliable mean reversion due to lower liquidity and wider spreads.

Breakout and Range Strategies

Breakout strategies enter when price moves beyond defined support or resistance levels, anticipating continuation of the move. Opening Range Breakout (ORB) is particularly popular among futures algo traders, defining a range based on the first 15-60 minutes of trading and entering when price breaks above or below that range. For ES futures, a 30-minute ORB measured from 9:30-10:00 AM ET provides a concrete high/low to trade against.

Opening Range: The high and low prices established during the first specific period after market open, typically 15, 30, or 60 minutes. The range serves as intraday support and resistance, with breaks often leading to sustained moves in the breakout direction.

Implementation requires clear breakout confirmation to avoid false breaks. Many traders add a filter requiring price to break the range by a minimum amount (0.25-0.50% for ES) or wait for a candle close beyond the level rather than just a wick touch. Volume confirmation helps too—breakouts accompanied by volume 20%+ above the 20-period average show higher continuation probability.

Range strategies do the opposite, fading moves to range extremes. When price reaches the top of a defined range, the strategy sells short expecting reversion to the middle or bottom. When price hits range support, it goes long. This works during consolidation periods but fails badly when range breaks lead to genuine breakouts. Risk management must include stops just beyond the range boundaries to limit damage from failed fades.

The Initial Balance (IB) concept from Market Profile extends the Opening Range idea. IB represents the price range during the first hour of trading (9:30-10:30 AM ET for equity futures). Algo strategies trade IB extensions—moves that carry price significantly beyond the initial hour's range—expecting either continuation or exhaustion. For specific ORB and IB automation approaches, see the futures instrument automation guide.

Which Futures Contracts Work Best for Algo Trading?

ES (E-mini S&P 500) and NQ (E-mini Nasdaq-100) are the most suitable futures contracts for retail algorithmic trading due to exceptional liquidity, tight spreads, and 23-hour trading. ES averages over 1.5 million contracts daily with typical spreads of 0.25 points ($12.50) during regular trading hours and 0.25-0.50 points overnight. NQ provides similar liquidity with 0.25-point spreads worth $5 per contract.

ContractAvg Daily VolumeTypical RTH SpreadTick ValueAutomation SuitabilityES1.5M+0.25 pts ($12.50)$12.50ExcellentNQ400K+0.25 pts ($5.00)$5.00ExcellentGC300K+0.10 pts ($10.00)$10.00GoodCL600K+0.01 pts ($10.00)$10.00GoodMES250K+0.25 pts ($1.25)$1.25Good (smaller accounts)

Micro contracts (MES, MNQ) offer identical price movements with 1/10th the contract size, making them ideal for accounts under $10,000 or for testing strategies with smaller position sizes. MES requires approximately $1,300 in overnight margin versus $13,000 for full-size ES. The main tradeoff is slightly wider percentage spreads and less volume depth for larger orders.

Commodity futures like GC (gold) and CL (crude oil) also work well for algo trading but with different characteristics. GC shows strong trending behavior during risk-off periods and around FOMC meetings, making it suitable for trend following strategies. CL responds to inventory reports (Wednesday 10:30 AM ET) and geopolitical events, creating volatility spikes that can trigger wide stop losses if not managed properly.

Currency futures (6E, 6J, 6B) have sufficient liquidity but trade more quietly than equity indices, requiring longer timeframes or wider targets to capture meaningful moves. Agricultural futures (ZC, ZS, ZW) can work for specific seasonal or weather-driven strategies but often lack the consistent volatility that algo systems need for regular signal generation.

Do You Need Programming Skills for Algorithmic Futures Trading?

No, you don't need programming skills to implement algorithmic futures strategies in 2026—no-code platforms now handle strategy automation through visual interfaces and TradingView integrations. You can build indicators in TradingView's Pine Script (which has extensive documentation and examples), set up alerts, and connect those alerts to automation platforms via webhooks without writing execution code.

The typical no-code workflow: Build or import your strategy logic in TradingView → Configure alert conditions when your entry/exit signals trigger → Add a webhook URL pointing to your automation platform → Define position size, stops, and targets in the platform interface → Enable automation. The platform handles all broker API communication, order formatting, and error handling automatically.

Platforms supporting no-code futures automation include ClearEdge Trading (TradingView webhooks to 20+ brokers), TradersPost (multi-platform alert aggregation), and broker-specific solutions like TradeStation's EasyLanguage automation. Each handles the technical complexity of order routing while letting you focus on strategy logic and risk management rules.

That said, programming skills provide advantages for complex strategies requiring custom calculations, multi-timeframe analysis, or sophisticated position management. Python with libraries like ccxt or broker-specific APIs (InteractiveBrokers API, TradeStation WebAPI) offers maximum flexibility but requires software development knowledge and infrastructure management.

The decision point: Use no-code platforms if your strategy can be expressed through TradingView indicators and simple position rules. Consider custom programming if you need portfolio-level risk management across multiple contracts, machine learning integration, or complex order types not supported by standard platforms. For most retail traders focusing on single-contract strategies, no-code automation provides sufficient capability. Learn more about TradingView integration at the TradingView automation guide.

Risk Management in Algorithmic Futures Strategies

Risk management is more critical in algorithmic futures trading than discretionary trading because automated systems will continue executing (and potentially losing) without human judgment to override poor conditions. Every algo strategy must include predefined stop losses, position size limits, daily loss caps, and drawdown thresholds that automatically halt trading when exceeded.

Position sizing should account for contract volatility and account size. A common approach allocates 1-2% of account equity per trade as risk capital. For a $25,000 account risking 1.5% ($375) on ES with a 15-point stop, your position size would be 2 contracts (15 points × $12.50 × 2 = $375 risk). During high volatility periods like FOMC days, many traders reduce position size by 25-50% to account for wider potential swings.

Daily Loss Limit: A hard cap on total losses allowed in a single trading day before the system stops executing new trades. Prop firms typically require 2-5% daily limits, and retail traders should implement similar protections to prevent catastrophic single-day losses from system errors or adverse market conditions.

Stop losses must be wide enough to avoid normal market noise but tight enough to limit damage from adverse moves. ATR-based stops adapt to changing volatility—a 2 ATR stop on ES might be 25 points during calm periods but expand to 50 points during earnings season or economic events. Time-based stops close positions after a specified duration regardless of P&L, preventing overnight hold risk if your strategy is designed for intraday only.

Advantages of Automated Risk Management

- Stops execute immediately without emotional override

- Position size calculations are consistent and error-free

- Daily loss limits prevent revenge trading

- Correlation checks across multiple strategies prevent overexposure

Limitations

- Cannot adapt to unexpected news or flash crashes without programming

- Stop losses can be hit by brief spikes before price recovers

- System failures or connectivity loss can leave positions unprotected

- Backtested risk parameters may not reflect future volatility regimes

Many prop firms require specific risk rules for funded accounts: 2-5% daily loss limits, 6-10% trailing drawdowns from peak equity, maximum position sizes, and minimum trading day requirements. If trading with prop capital, your automation must enforce these rules automatically. Learn about prop firm compliance at the prop firm automation guide.

How to Get Started with Algorithmic Futures Trading

Start by paper trading your strategy for at least 30-60 days before risking real capital. Use TradingView's paper trading account or your broker's simulation environment to validate that your signals execute correctly, position sizing works as intended, and risk management rules trigger appropriately. This period identifies bugs, unrealistic backtest assumptions, and strategy behaviors that only appear in forward testing.

Algorithmic Futures Trading Setup Checklist

- ☐ Open futures account with supported broker (check margin requirements and data fees)

- ☐ Build or import strategy in TradingView (test on historical data first)

- ☐ Configure alert conditions with webhook URLs

- ☐ Set up automation platform account and connect to broker

- ☐ Define position size, stops, and profit targets in platform

- ☐ Paper trade for 30+ days to validate execution

- ☐ Start live with minimum position size (1 contract or micro contracts)

- ☐ Monitor first 20 trades closely for unexpected behaviors

- ☐ Scale position size gradually as confidence builds

Choose one contract and one strategy initially. ES or MES work well for beginners due to liquidity and tight spreads. Focus on a single strategy type (trend following or mean reversion) rather than running multiple uncorrelated strategies simultaneously—this simplifies debugging and performance analysis.

When moving to live trading, start with the smallest position size possible—1 MES contract requires only ~$1,300 in overnight margin and risks $1.25 per tick. Run this for 30-50 trades to confirm live execution matches paper trading results. Many strategies show degraded performance in live trading due to slippage, delayed fills, or psychological factors affecting your willingness to let the system run uninterrupted.

Monitor key performance metrics weekly: win rate, average win/loss ratio, maximum drawdown, and profit factor (gross profit / gross loss). Compare these to your backtest expectations. Deviations of 10-15% are normal, but larger differences suggest your strategy is curve-fit to historical data or market conditions have changed significantly. For platform options and feature comparisons, review the futures automation platform comparison.

Frequently Asked Questions

1. What is the minimum account size needed for algorithmic futures trading?

You can start with $3,000-$5,000 trading micro contracts (MES, MNQ), which require approximately $1,300 overnight margin per contract. For full-size contracts, $15,000-$25,000 provides adequate risk management cushion, allowing 1-2% risk per trade without excessive margin pressure.

2. How much does futures automation software cost?

No-code automation platforms typically charge $50-$150 monthly for basic plans with unlimited alerts and broker connections. Professional plans with advanced features like multi-account management or prop firm compliance tools run $200-$400 monthly. TradingView requires Pro or Premium subscriptions ($14.95-$59.95/month) for webhook alerts.

3. Can algorithmic strategies work during all market conditions?

No—most strategies perform well only in specific conditions matching their design. Trend following strategies suffer during range-bound markets, while mean reversion strategies lose money during strong trends. Many traders run multiple uncorrelated strategies or implement regime filters that pause trading when conditions don't match the strategy's optimal environment.

4. How do I know if my backtested results are realistic?

Include realistic slippage (1-2 ticks per trade for ES/NQ), commission costs ($0.50-$1.50 per contract per side), and test on out-of-sample data not used for optimization. If your strategy shows very high win rates (>70%) or smooth equity curves with minimal drawdowns, it's likely curve-fit and will underperform live.

5. What happens if my internet connection drops during automated trading?

Most automation platforms run on cloud servers, so your home internet outage doesn't affect trade execution. However, if the platform itself experiences downtime, your positions remain open without automated management until connection restores. Always set broker-level stop losses as backup protection independent of your automation platform.

6. Should I run multiple strategies simultaneously?

Running 2-3 uncorrelated strategies (one trend following, one mean reversion) can smooth equity curves and reduce drawdowns. However, start with a single strategy until you understand its behavior thoroughly. Multiple strategies increase complexity, monitoring requirements, and the chance of errors in setup or risk allocation.

Conclusion

Algorithmic trading strategies for futures markets provide systematic execution based on predefined rules, removing emotional decision-making and manual delays from the trading process. Trend following, mean reversion, and breakout strategies each work under specific market conditions, making strategy selection and risk management critical for consistent results. ES and NQ futures offer the best combination of liquidity, tight spreads, and volatility for retail algo trading, with micro contracts allowing smaller accounts to participate with proper position sizing.

No-code automation platforms have made these strategies accessible without programming knowledge, connecting TradingView alerts to broker execution in milliseconds. Start with paper trading for 30-60 days to validate your strategy, then transition to live trading with minimum position sizes before scaling. For automated trade execution that connects your TradingView strategies to futures brokers, explore ClearEdge Trading's no-code automation platform.

Ready to automate your futures strategies? Explore ClearEdge Trading and see how no-code automation connects your TradingView alerts to live broker execution.

References

- Futures Industry Association. "2024 Futures Market Volume Report." https://www.fia.org/

- CME Group. "E-mini S&P 500 Futures Contract Specifications." https://www.cmegroup.com/markets/equities/sp/e-mini-sandp500.html

- CME Group. "E-mini Nasdaq-100 Futures Contract Specifications." https://www.cmegroup.com/markets/equities/nasdaq/e-mini-nasdaq-100.html

- TradingView. "Pine Script Reference Documentation." https://www.tradingview.com/pine-script-docs/

Disclaimer: This article is for educational and informational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.