Futures Automation Platforms Compared: Pricing and Features

Compare QuantVue, TradersPost, PickMyTrade, and ClearEdge for futures automation. See pricing ($50-$14K+), features, and which platform fits your trading needs.

Choosing the right futures automation platform requires comparing options across price, features, complexity, and fit for your specific trading needs. The futures automation market has grown significantly, with platforms ranging from simple signal-execution bridges to comprehensive done-for-you automation systems. Each platform makes different tradeoffs between price and features, customization and simplicity, and DIY flexibility versus turnkey solutions. Understanding these differences helps you select the platform that matches your situation rather than the one with the best marketing.

This comparison guide examines the major players in futures automation: QuantVue, TradersPost, PickMyTrade, and ClearEdge. We analyze pricing structures, feature sets, target audiences, and honest assessments of strengths and weaknesses for each platform. The goal is not to declare a universal winner but to help you identify which platform fits your specific circumstances, whether you are a beginner seeking simplicity, an experienced trader wanting maximum customization, or someone seeking the best value for your budget.

Comparison shopping for automation platforms is wise because switching costs are real. Once you configure a platform, learn its interface, and integrate it with your broker and trading workflow, moving to another platform requires significant effort. Investing time upfront to select the right platform prevents the frustration and lost trading time of switching later. This guide provides the information needed to make that decision confidently.

Futures automation platforms differ significantly in pricing, included features, target audience, and whether they require you to bring your own strategy or provide strategies included. Comparing QuantVue, TradersPost, PickMyTrade, and ClearEdge reveals distinct approaches suited to different trader profiles and budgets.

- QuantVue offers comprehensive automation but at premium prices ($447/month plus $8,800+ buildout for full ATS)

- TradersPost provides multi-asset signal execution at moderate pricing ($49-299/month) but requires you to bring your own strategy

- PickMyTrade offers the lowest price point ($50/month flat) for unlimited futures execution but with minimal included features

- ClearEdge combines automation infrastructure with included proprietary strategies at mid-market pricing ($129-179/month)

- The best platform depends on whether you have existing strategies, your technical comfort level, and your budget

- Price alone is misleading; total cost includes platform fees, required add-ons, and the value of your time

- The Futures Automation Platform Landscape

- QuantVue Review: Premium Automation at Premium Prices

- TradersPost Review: Multi-Asset Signal Execution

- PickMyTrade Review: Budget-Friendly Execution Bridge

- ClearEdge Review: Strategy-Included Automation

- Complete Pricing Comparison

- Feature-by-Feature Comparison

- Best Platform for Beginners

- Best Platform for Experienced Traders

- Best Value for Money

- Switching Platform Considerations

- Frequently Asked Questions

The Futures Automation Platform Landscape

The futures automation market divides into two fundamental categories: signal-execution platforms that translate your trading signals into broker orders, and strategy-included platforms that provide both the automation infrastructure and the trading strategies themselves. This distinction matters more than any feature comparison because it determines whether you need to develop profitable strategies before the platform becomes useful.

Signal-Execution Platform: An automation platform that connects signal sources (like TradingView alerts) to broker execution, requiring users to provide their own trading strategies. The platform handles execution mechanics but not strategy development.

Signal-Execution Platforms

Platforms like TradersPost and PickMyTrade assume you already have a profitable trading strategy and need infrastructure to execute it automatically. They receive signals from TradingView, custom applications, or other sources and translate those signals into orders at your broker. Their value proposition is execution reliability, broker connectivity, and risk management features.

Advantages of signal-execution platforms:

- Maximum flexibility to use any strategy you develop

- Lower ongoing costs since you are not paying for strategy development

- Full control over your trading approach

- Ability to iterate and modify strategies without platform constraints

Disadvantages of signal-execution platforms:

- Require you to develop profitable strategies, which most traders cannot do

- Platform is worthless until you have working strategies

- Strategy development time and learning curve not included in price

- No guidance on what strategies to trade

Strategy-Included Platforms

Platforms like ClearEdge and QuantVue ATS provide trading strategies alongside automation infrastructure. Users select from available strategies rather than developing their own. The platform handles both what to trade and how to execute.

Advantages of strategy-included platforms:

- Start trading immediately without strategy development

- Benefit from professional strategy design and backtesting

- Eliminate the largest barrier to automation (having a profitable strategy)

- Ongoing strategy maintenance handled by the platform

Disadvantages of strategy-included platforms:

- Less customization than DIY approaches

- Dependent on platform's strategy quality

- Cannot implement your own unique approaches

- May include strategies that do not fit your risk tolerance

Hybrid Approaches

Some platforms offer both options. QuantVue, for example, sells indicators and educational content at lower price points while reserving done-for-you automation for their expensive ATS tier. Understanding where each platform falls on this spectrum helps match platforms to your needs.

QuantVue Review: Premium Automation at Premium Prices

QuantVue positions itself as the premium option in futures automation, emphasizing its development by "hedge fund professionals" and comprehensive feature set. The platform has built a substantial user base (20,000+ users claimed) and strong community through its Discord server (14,000+ members). QuantVue's reputation is solid, with a 4.7-star Trustpilot rating across 190+ reviews. However, the premium positioning comes with premium pricing that puts full automation out of reach for many retail traders.

QuantVue Pricing Structure

QuantVue operates on a tiered model with dramatically different value propositions at each level:

TierMonthly PriceWhat You GetReality Check Elite Indicators$125/monthPremium indicators for manual tradingNo automation; manual execution required ATS (Automated Trading System)$447/month + $8,800 buildoutDone-for-you automation with training$14,000+ first year cost

The gap between tiers is significant. The $125/month Elite package provides indicators for manual trading but no automation. Actual automated execution requires the ATS tier at $447/month plus an $8,800 buildout fee, bringing first-year costs to approximately $14,000.

QuantVue Strengths

- Established reputation: Years of operation and large user base provide credibility

- Comprehensive ATS package: The expensive tier includes 10+ hours of training and done-for-you setup

- Multi-platform support: Works with TradingView, NinjaTrader, and Sierra Chart

- Active community: Large Discord provides peer support and discussion

- Money-back guarantee: 120-day refund policy on ATS reduces risk

QuantVue Weaknesses

- Extreme price barrier: $14,000+ first-year cost excludes most retail traders

- Not for beginners: QuantVue explicitly states their ATS is "not for beginners" and targets intermediate to advanced traders

- Requires AlertDragon: Prop firm execution requires their separate AlertDragon platform, adding complexity

- Annual commitment: Best pricing requires annual prepayment

- Gap between tiers: No middle option between $125 manual indicators and $14,000+ automation

Who QuantVue Is Best For

QuantVue ATS suits traders with substantial capital who want comprehensive done-for-you automation and are willing to pay premium prices for established reputation and extensive support. If budget is not a primary concern and you want the perceived security of an established player, QuantVue delivers. However, the $14,000+ first-year cost means you need significant account size to justify the expense as a percentage of capital.

Who Should Look Elsewhere

Traders seeking affordable automation, beginners (whom QuantVue explicitly excludes), and anyone unable to commit $14,000+ in the first year should explore alternatives. The Elite tier at $125/month does not provide automation, so purchasing it expecting automated trading leads to disappointment.

TradersPost Review: Multi-Asset Signal Execution

TradersPost operates as a signal-execution platform supporting stocks, options, crypto, and futures across multiple brokers. The platform focuses on webhook-based automation, receiving signals from TradingView or custom sources and executing them at connected brokers. TradersPost has processed significant volume (10M+ trades executed) and built a solid reputation for reliability. It represents the middle ground in pricing and targets technically comfortable traders who bring their own strategies.

TradersPost Pricing Structure

TierMonthly PriceFeaturesBest For Free$0Paper trading only, limited featuresTesting the platform Basic$49/monthLive trading, basic featuresLow-volume traders Plus$99/monthMore features, higher limitsActive traders Pro$199/monthAdvanced features, priority supportSerious automation users Premium$299/monthFull feature access, highest limitsHigh-volume professionals

TradersPost Strengths

- Multi-asset support: Stocks, options, crypto, and futures on one platform

- Flexible pricing: Multiple tiers accommodate different usage levels

- Free tier available: Test with paper trading before committing

- Strong broker support: Connects to many major brokers including Tradovate

- Established platform: Years of operation and significant trade volume

- Good documentation: Comprehensive guides for setup and configuration

TradersPost Weaknesses

- No included strategies: You must develop or source your own trading strategies

- Complexity for beginners: Webhook configuration requires technical understanding

- Per-feature pricing: Advanced features require higher tiers

- Multi-asset focus: Not specialized for futures; futures-specific features may lag

- Strategy development not addressed: Platform assumes you have profitable strategies

Who TradersPost Is Best For

TradersPost suits traders who already have profitable strategies (from TradingView Pine Script, for example) and want reliable execution infrastructure across multiple asset classes. If you trade stocks, options, and futures, consolidating on one platform provides efficiency. The tiered pricing works well for traders who can start small and scale up.

Who Should Look Elsewhere

Traders without existing strategies will find TradersPost infrastructure without content to automate. If you need help with what to trade rather than how to execute, strategy-included platforms better fit your needs. Futures-only traders may find better value in futures-specialized platforms rather than paying for multi-asset capabilities they do not use.

PickMyTrade Review: Budget-Friendly Execution Bridge

PickMyTrade offers the simplest value proposition in futures automation: $50/month flat for unlimited trade execution. The platform focuses exclusively on connecting TradingView signals to futures brokers, particularly Tradovate. This no-frills approach appeals to cost-conscious traders who want basic automation without paying for features they do not need.

PickMyTrade Pricing Structure

PlanMonthly PriceFeatures Standard$50/monthUnlimited trades, basic features

The flat $50/month pricing with no tiers or upsells is PickMyTrade's primary differentiator. What you see is what you pay.

PickMyTrade Strengths

- Lowest price point: $50/month is the cheapest option for futures automation

- Simple pricing: No tiers, no confusion, no upsells

- Unlimited trades: No per-trade fees regardless of volume

- Futures focused: Built specifically for futures rather than multi-asset

- Straightforward setup: Less complexity than enterprise-oriented platforms

PickMyTrade Weaknesses

- No included strategies: Like TradersPost, you must bring your own strategies

- Limited broker support: Primarily Tradovate-focused; fewer broker options

- Basic feature set: Fewer advanced features than higher-priced competitors

- Smaller community: Less peer support available compared to larger platforms

- Limited support resources: Documentation and support may be less comprehensive

Who PickMyTrade Is Best For

PickMyTrade is ideal for traders with working TradingView strategies who want the cheapest possible execution bridge. If you already have profitable Pine Script strategies and trade futures through Tradovate, PickMyTrade delivers the essential functionality at minimal cost. High-volume traders particularly benefit from unlimited execution without per-trade fees.

Who Should Look Elsewhere

Traders needing included strategies, multiple broker support, advanced features, or extensive support should look at other options. The low price reflects a basic feature set; traders wanting more will need to pay more elsewhere. If you do not already have strategies to automate, PickMyTrade's low cost is irrelevant since you have nothing to execute.

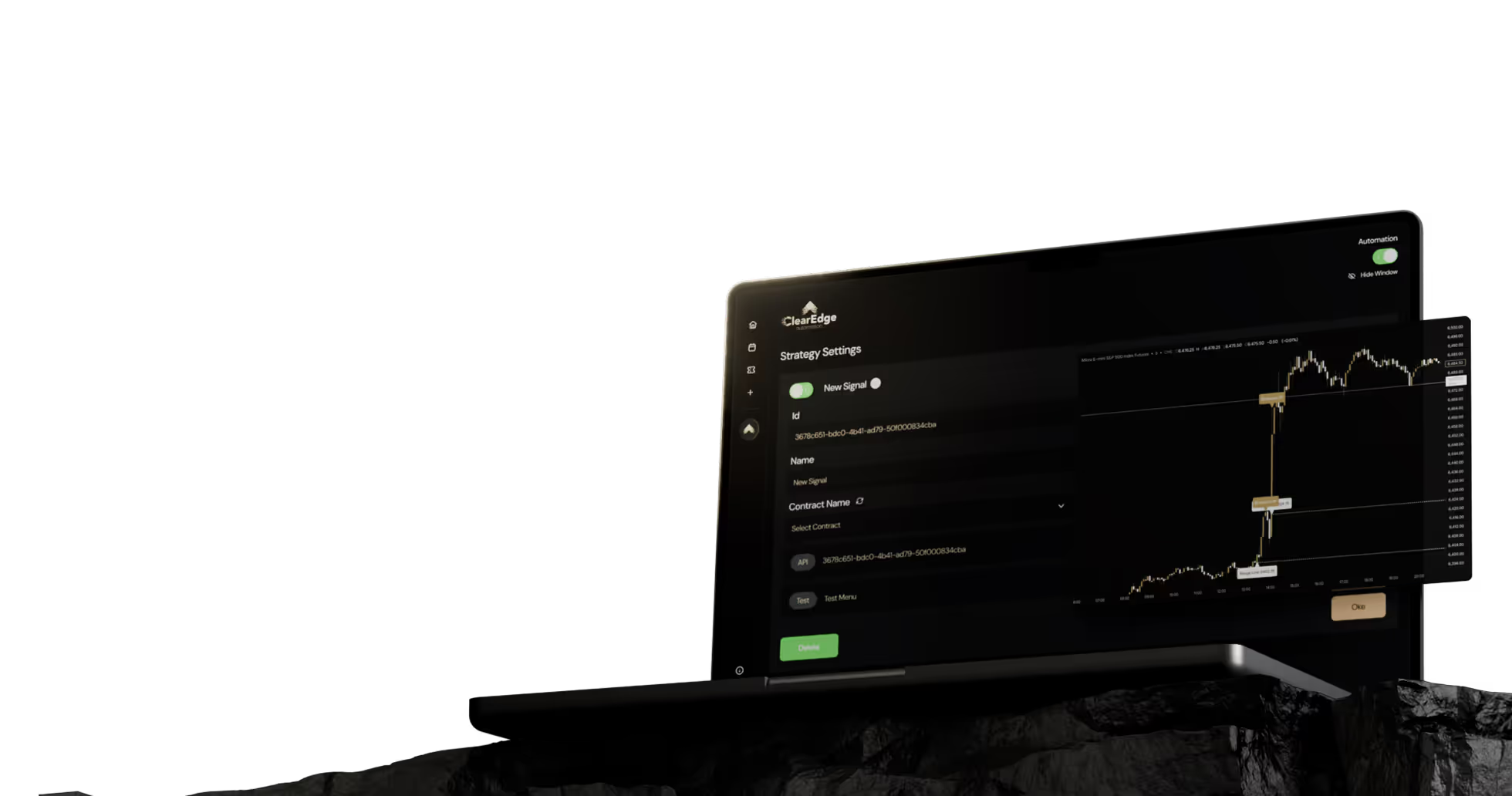

ClearEdge Review: Strategy-Included Automation

ClearEdge takes a different approach than signal-execution platforms by including proprietary trading strategies alongside automation infrastructure. Rather than requiring users to develop strategies and configure webhook messages, ClearEdge provides ready-to-trade strategies that users can deploy without technical setup. This approach targets traders who want automation benefits without the strategy development barrier.

ClearEdge Pricing Structure

PlanMonthly PriceWhat Is Included Standard$129/monthAutomation platform + proprietary strategies Premium$179/monthAdditional strategies and features

At $129-179/month, ClearEdge sits in the mid-market between budget execution bridges ($50) and premium done-for-you systems ($447+). The key difference is that the price includes strategies, not just execution infrastructure.

ClearEdge Strengths

- Strategies included: No need to develop your own trading strategies

- Simplified setup: No webhook configuration or message formatting required

- Accessible to beginners: Designed to be "simple enough for anyone to use"

- Futures specialized: Built specifically for futures rather than multi-asset

- Mid-market pricing: 70%+ cheaper than QuantVue ATS with similar outcome

- Active Discord community: Peer support and platform discussion

- Transparent approach: Clear pricing without hidden buildout fees

ClearEdge Weaknesses

- Less customization: Cannot implement your own custom strategies

- Strategy dependency: Performance depends on provided strategies

- Newer platform: Less established track record than older competitors

- Smaller user base: Fewer users means smaller community than giants like QuantVue

- Fixed strategy selection: Limited to strategies the platform offers

Who ClearEdge Is Best For

ClearEdge fits traders who want automation without strategy development, beginners who need a simpler entry point than DIY platforms, and traders who found QuantVue ATS appealing but cannot justify $14,000+ in the first year. If you prefer ready-to-trade solutions over build-it-yourself approaches, ClearEdge delivers automation benefits without the complexity barrier. The ClearEdge approach prioritizes accessibility over maximum customization.

Who Should Look Elsewhere

Traders with existing profitable strategies they want to automate should consider signal-execution platforms that accommodate custom approaches. If you specifically want to develop and test your own Pine Script strategies, platforms like TradersPost provide more flexibility. Traders wanting the absolute lowest price who already have strategies should consider PickMyTrade.

Complete Pricing Comparison

Direct pricing comparison reveals the true cost differences between platforms. However, price alone does not tell the complete story since platforms include different features and may require add-ons or have hidden costs.

First-Year Total Cost Comparison

PlatformMonthlyAnnualFirst-Year TotalIncludes Strategies? PickMyTrade$50$600$600No TradersPost Basic$49$588$588No TradersPost Pro$199$2,388$2,388No ClearEdge Standard$129$1,548$1,548Yes ClearEdge Premium$179$2,148$2,148Yes QuantVue Elite$125$1,500$1,500No (indicators only) QuantVue ATS$447$5,364$14,164+Yes (with buildout)

Note: QuantVue ATS includes $8,800 buildout fee in first-year total. Annual discounts may apply with some platforms.

Cost Per Included Feature

When comparing platforms with different feature sets, consider what you actually receive:

- PickMyTrade ($50): Execution infrastructure only; no strategies, basic features

- TradersPost ($49-299): Execution infrastructure with varying feature levels; no strategies

- ClearEdge ($129-179): Execution infrastructure plus proprietary strategies included

- QuantVue Elite ($125): Indicators for manual trading; no automation

- QuantVue ATS ($447+$8,800): Full done-for-you automation with training

True Cost Analysis

Platform fees are only part of total cost. Consider:

- Strategy development time: If using signal-execution platforms, how many hours will strategy development take? Value your time appropriately

- Learning curve: Complex platforms require more time to master

- Failed automation attempts: Poor strategy development may lead to losses before finding something profitable

- Add-on services: Some platforms require additional tools or services for full functionality

A $50/month platform that requires 100 hours of strategy development and testing may cost more than a $179/month platform with strategies included, depending on how you value your time.

Feature-by-Feature Comparison

Beyond pricing, platform selection depends on specific features that matter for your use case. This comparison covers the most important automation features.

FeatureQuantVue ATSTradersPostPickMyTradeClearEdge Proprietary Strategies IncludedYesNoNoYes TradingView IntegrationYesYesYesYes Tradovate SupportVia AlertDragonYesYesYes NinjaTrader SupportYesYesLimitedYes Multi-Asset TradingFutures focusYesFutures onlyFutures only Paper TradingYesYesYesYes Daily Loss LimitsYesYesYesYes Discord Community14,000+ membersActiveAvailableActive Beginner FriendlyNo (explicitly)ModerateModerateYes (explicitly) Free TrialNo (120-day refund)Free tierNoVaries

Risk Management Features

All serious platforms provide risk management features, but implementation varies:

- Position size limits: All platforms offer maximum position controls

- Daily loss limits: Available on all platforms; critical for prop firm trading

- Trading hour restrictions: Most platforms allow session configuration

- Broker-level stops: Depend on broker capabilities rather than platform

Support and Documentation

Support quality varies significantly:

- QuantVue: Extensive training (10+ hours) included with ATS; large community

- TradersPost: Good documentation; tiered support by plan level

- PickMyTrade: Basic support; smaller community

- ClearEdge: Active community support; responsive team

Best Platform for Beginners

Beginners face unique challenges in automation: limited trading experience, no existing strategies, unfamiliarity with technical configuration, and higher risk of costly mistakes. The best platform for beginners minimizes these challenges while providing a path to successful automation.

Why Signal-Execution Platforms Challenge Beginners

Platforms requiring users to bring their own strategies create a significant barrier for beginners:

- Strategy development requires trading experience beginners do not have

- Backtesting and validation require technical skills and critical thinking

- Webhook configuration and message formatting add technical complexity

- Troubleshooting failures requires understanding multiple systems

- Risk of automating poor strategies and accelerating losses

Beginner-Focused Evaluation

PlatformBeginner SuitabilityKey Consideration QuantVue ATSLowExplicitly states "not for beginners"; $14,000+ cost TradersPostModerateRequires strategy development; webhook complexity PickMyTradeModerateRequires strategy development; simpler than TradersPost ClearEdgeHighStrategies included; designed for simplicity

Recommendation for Beginners

Beginners benefit most from platforms that include strategies, minimizing the largest barrier to entry. ClearEdge explicitly targets accessibility, describing itself as "simple enough for anyone to use." The included strategies eliminate strategy development while mid-market pricing keeps costs reasonable.

If budget is extremely constrained and you are willing to invest significant time in learning strategy development, PickMyTrade's $50/month pricing provides the cheapest entry point. However, be realistic about the time and potential losses involved in developing profitable strategies as a beginner.

The ClearEdge FAQ addresses common questions from traders new to automation.

Best Platform for Experienced Traders

Experienced traders bring different requirements: they may have existing profitable strategies, want maximum customization, have higher technical skills, and prioritize execution quality over simplicity. The best platform for experienced traders provides flexibility without unnecessary constraints.

Experienced Trader Requirements

- Ability to implement custom strategies without platform limitations

- Advanced order types and execution options

- Comprehensive logging and analytics

- API access for custom integrations

- Multi-broker support for execution optimization

- Professional-grade reliability and uptime

Experienced Trader Evaluation

PlatformExperienced SuitabilityKey Consideration QuantVue ATSHighComprehensive but expensive; targets advanced traders TradersPostHighFlexible execution for custom strategies; good feature set PickMyTradeModerateBasic features may limit advanced use cases ClearEdgeModerateLess customization; better for hands-off approach

Recommendation for Experienced Traders

Experienced traders with profitable strategies benefit most from flexible signal-execution platforms. TradersPost provides the best balance of features, multi-asset support, and reasonable pricing for custom strategy automation. The tiered pricing allows matching costs to needs.

If budget is unconstrained and you want maximum support with done-for-you setup, QuantVue ATS delivers comprehensive automation for those willing to pay premium prices. The 120-day money-back guarantee reduces risk of the significant investment.

Experienced traders seeking hands-off automation without maintaining custom strategies might still prefer ClearEdge, accepting reduced customization in exchange for eliminating ongoing strategy maintenance.

Best Value for Money

Value assessment requires considering what you receive relative to what you pay, not just absolute price. The cheapest option is not necessarily the best value if it does not provide what you need.

Value Analysis by Trader Type

For traders without existing strategies:

ClearEdge provides the best value by including strategies that would otherwise require significant time and money to develop. At $129-179/month versus $14,164+ for QuantVue ATS (the other strategy-included option), ClearEdge delivers similar outcomes at roughly 10% of the cost.

For traders with existing strategies:

PickMyTrade provides the best value for simple execution needs at $50/month. For more advanced requirements, TradersPost's tiered pricing allows paying only for needed features. ClearEdge and QuantVue's included strategies provide no additional value to traders with profitable strategies.

For traders prioritizing support and hand-holding:

QuantVue ATS's extensive training and established community provide value for traders who need comprehensive guidance, justifying higher costs for those who benefit from the support structure.

Value Comparison Summary

PlatformBest Value ForPoor Value For PickMyTradeBudget-conscious traders with strategiesBeginners; traders needing advanced features TradersPostMulti-asset traders with custom strategiesFutures-only traders; beginners without strategies ClearEdgeBeginners; traders wanting turnkey automationExperienced traders with custom strategies QuantVue ATSWealthy traders wanting premium supportBudget-conscious traders; anyone seeking value

Switching Platform Considerations

If you are currently using one platform and considering switching, understand the costs and complications involved. Switching platforms is not trivial and should be weighed against potential benefits.

Switching Costs

- Time investment: Learning new platform interface, configuration, and quirks

- Strategy migration: Recreating alert configurations, webhook messages, and risk settings

- Broker reconnection: Setting up new API connections and verifying execution

- Testing period: Paper trading to verify correct operation before live trading

- Potential downtime: Gap between stopping old platform and going live on new one

When Switching Makes Sense

- Current platform costs significantly more for equivalent features

- Reliability issues causing missed trades or execution errors

- Missing features critical to your trading approach

- Support quality preventing problem resolution

- Platform direction moving away from your needs

When to Stay Put

- Minor cost differences that do not justify switching effort

- Current platform working reliably for your needs

- Switching would interrupt profitable trading

- Grass-is-greener thinking without specific problems to solve

Migration Best Practices

If you decide to switch:

- Run new platform in paper trading while maintaining live trading on old platform

- Verify equivalent performance in simulation before live migration

- Migrate during low-volatility periods if possible

- Keep old platform accessible (not cancelled) until new platform proves reliable

- Document all configuration settings before and after migration

Frequently Asked Questions

1. What is the cheapest futures automation platform?

PickMyTrade at $50/month offers the lowest-cost futures automation. However, this price assumes you have profitable strategies to automate. If you need strategies included, ClearEdge at $129/month provides the cheapest option that includes trading strategies, making it the most affordable complete solution for traders without existing strategies.

2. Which platform is best for TradingView automation?

All major platforms support TradingView webhook integration. TradersPost offers the most flexible TradingView integration for custom strategies across multiple asset classes. PickMyTrade provides simple TradingView-to-Tradovate connection at the lowest cost. ClearEdge eliminates the need for TradingView configuration by including strategies directly. Choose based on whether you want to use your own TradingView strategies or prefer included strategies.

3. Is QuantVue worth the price?

QuantVue ATS's $14,164+ first-year cost is worth it only for traders with substantial capital who highly value established reputation, comprehensive training, and extensive support. For most retail traders, the price is difficult to justify when alternatives like ClearEdge provide similar outcomes at roughly 10% of the cost. The Elite tier at $125/month does not include automation, so do not purchase it expecting automated trading.

4. Can I use these platforms for prop firm trading?

Yes, all platforms discussed support prop firm trading to varying degrees. ClearEdge, TradersPost, and PickMyTrade all connect to Tradovate, which is compatible with many prop firms. QuantVue requires their separate AlertDragon platform for prop firm execution, adding complexity and potentially cost. Verify specific prop firm compatibility before committing to any platform.

5. Which platform has the best customer support?

QuantVue ATS provides the most extensive support with 10+ hours of training and a large community, but at premium prices. TradersPost offers tiered support based on subscription level with good documentation. ClearEdge provides active community support with responsive team engagement. PickMyTrade offers basic support consistent with its budget positioning. Your support needs should match your technical comfort level and platform complexity.

6. Do I need my own strategy for these platforms?

TradersPost and PickMyTrade require you to bring your own strategies; they provide execution infrastructure only. ClearEdge and QuantVue ATS include proprietary strategies, allowing you to start trading without developing your own approach. If you do not have profitable strategies, choose a platform with strategies included or plan significant time for strategy development.

7. Can I switch platforms later if I choose wrong?

Yes, but switching involves costs: learning curve for the new platform, reconfiguring all settings, potential trading downtime, and verification testing. These switching costs make initial platform selection important. If uncertain, start with lower-commitment options (month-to-month billing, free trials where available) before committing long-term.

8. Which platform is most reliable?

All established platforms maintain reasonable reliability, but no platform guarantees 100% uptime. QuantVue and TradersPost have longer track records and larger user bases, providing more data points on reliability. Newer platforms may have less proven track records but also potentially newer infrastructure. Regardless of platform choice, always use broker-level stop losses that function independently of any automation platform.

9. Are there free futures automation options?

TradersPost offers a free tier limited to paper trading, useful for testing the platform before committing. True free automation options for live futures trading are rare and typically involve building custom solutions, which requires programming skills and ongoing maintenance. The $50-129/month range represents the lowest practical cost for turnkey automation.

10. How do I decide between strategy-included and bring-your-own-strategy platforms?

Honest self-assessment is key. If you have profitable strategies you have tested and traded successfully, bring-your-own platforms (TradersPost, PickMyTrade) provide flexibility at lower cost. If you do not have strategies, lack time for strategy development, or have struggled to develop profitable approaches, strategy-included platforms (ClearEdge, QuantVue ATS) eliminate the largest barrier. Do not overestimate your strategy development abilities; most traders cannot develop profitable systematic strategies regardless of platform.

Conclusion

The futures automation platform market offers genuine choice, with each platform optimizing for different trader needs and budgets. QuantVue provides premium done-for-you automation at premium prices for traders who prioritize established reputation and comprehensive support above all else. TradersPost delivers flexible multi-asset execution for technically comfortable traders with existing profitable strategies. PickMyTrade offers the lowest-cost entry for traders who need only basic execution infrastructure. ClearEdge provides the middle path with strategies included at accessible prices for traders who want automation benefits without strategy development barriers.

The right choice depends on honest assessment of your situation. Do you have profitable strategies to automate? Choose signal-execution platforms like TradersPost or PickMyTrade. Need strategies included? ClearEdge or QuantVue ATS, depending on budget. Are you a beginner? Platforms explicitly welcoming beginners (ClearEdge) will serve you better than those explicitly excluding them (QuantVue). Is cost the primary concern? PickMyTrade's $50/month cannot be beaten for basic execution, while ClearEdge provides the cheapest complete solution with strategies included.

Avoid choosing based on marketing claims or what works for others. Your specific needs, budget, and technical abilities determine which platform is right for you. Use the comparisons in this guide to match platform strengths to your requirements, and do not hesitate to take advantage of free tiers or trials where available to verify fit before committing. The ClearEdge pricing page provides current plan details for traders interested in the strategy-included approach.

References

- QuantVue. (2025). Products and Pricing. https://quantvue.io/

- TradersPost. (2025). Pricing Plans. https://traderspost.io/pricing

- PickMyTrade. (2025). Platform Overview. https://pickmytrade.trade/

- Trustpilot. (2025). QuantVue Reviews. https://www.trustpilot.com/review/quantvue.io

- CME Group. (2025). Retail Futures Trading Resources. https://www.cmegroup.com/education.html

- National Futures Association. (2025). Investor Protection Resources. https://www.nfa.futures.org/investors/

This content is for educational purposes only and does not constitute financial advice. Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance of any trading system or strategy is not indicative of future results. Platform features and pricing may change; verify current offerings directly with each provider.

RISK WARNING: Futures trading carries a high level of risk and may not be suitable for all investors. You could lose more than your initial investment. Only trade with capital you can afford to lose. Automated trading systems cannot guarantee profits and may experience periods of drawdown.

ClearEdge Automation is a futures automation platform and is reviewed in this comparison. This content attempts to provide balanced analysis but readers should conduct independent research.

Published: December 2025 · Last updated: 2025-12-04

Author: ClearEdge Team, 100+ years combined trading and development experience, including 29-year CME floor trading veteran

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.