Automated Unemployment Claims Trading Setup Guide For Futures

Beat Thursday's 8:30 AM volatility spike by automating your unemployment claims futures strategy using webhooks for faster execution and better risk control.

Automated futures trading unemployment claims setup involves configuring trading algorithms to execute positions based on weekly unemployment data releases, which occur every Thursday at 8:30 AM ET. This setup requires defining entry rules for both higher-than-expected and lower-than-expected claims figures, setting risk parameters to handle the initial volatility spike, and connecting your TradingView strategy to broker execution via webhook automation. The key challenge is managing the 30-60 second window of extreme volatility immediately following the data release.

Key Takeaways

- Unemployment claims releases create predictable volatility windows every Thursday at 8:30 AM ET, making them suitable for automated trading strategies

- Automated execution speeds of 3-40ms help capture initial price movements that manual traders typically miss during high-volatility economic releases

- Risk parameters including maximum position size and daily loss limits are critical for unemployment claims automation due to potential whipsaw price action

- Successful automation requires backtesting against at least 52 weeks of historical claims data to validate strategy performance across different market conditions

Table of Contents

- What Is Unemployment Claims Trading Automation

- Why Automate Unemployment Claims Trading

- Setup Requirements for Claims Automation

- How to Configure Your Claims Trading Strategy

- Risk Management for Economic Data Trading

- Testing and Validation Before Live Trading

- Frequently Asked Questions

- Conclusion

What Is Unemployment Claims Trading Automation

Unemployment claims trading automation uses predefined algorithms to execute futures positions based on weekly Initial Jobless Claims data from the U.S. Department of Labor. The data releases every Thursday at 8:30 AM ET and measures the number of first-time unemployment insurance applicants during the previous week. Traders automate this setup because the 30-60 second volatility spike following the release creates opportunities that require faster execution than manual trading allows.

Initial Jobless Claims: A weekly economic indicator measuring the number of people filing for unemployment benefits for the first time. Markets react to this data because it provides early signals about labor market health and potential Federal Reserve policy changes.

The automation process connects economic calendar data to your trading algorithm, which compares the actual claims figure against the consensus forecast. When the deviation exceeds your predefined threshold, the system triggers buy or sell orders on instruments like ES or NQ futures. According to the Bureau of Labor Statistics, claims figures can deviate by 10,000-30,000 from forecasts during periods of economic transition, creating tradable price movements.

Most automated futures trading platforms execute unemployment claims strategies by monitoring TradingView alerts configured to fire when specific data conditions are met. The webhook then sends trade instructions to your connected broker, completing execution before the initial volatility subsides.

Why Automate Unemployment Claims Trading

Manual execution during unemployment claims releases faces a timing problem that automation solves. The initial price movement typically completes within 30-60 seconds of the 8:30 AM ET release. Manual traders spend 3-8 seconds reading the data, analyzing the deviation from consensus, deciding position direction, and clicking to execute. By then, ES futures may have already moved 5-15 points, representing $62.50-$187.50 per contract in missed opportunity or increased slippage.

Automated systems process the data and execute within milliseconds. A properly configured TradingView automation setup receives the claims figure via data feed integration, compares it to consensus, evaluates your predefined rules, and transmits the order to your futures broker in under 100ms total. This speed advantage is particularly valuable during claims releases that significantly beat or miss expectations.

The other advantage is emotional discipline. Unemployment data sometimes triggers counterintuitive market reactions—bad news causing rallies due to expectations of continued Fed accommodation, or good news causing selloffs on taper concerns. Automated execution follows your predefined logic regardless of whether the price action "makes sense" in the moment, preventing hesitation that causes missed entries.

Execution MethodTypical SpeedConsistencyManual execution3-8 secondsVaries with emotionSemi-automated (alerts only)1-3 secondsModerateFully automated webhook50-150msExact rule following

Setup Requirements for Claims Automation

Setting up automated futures trading unemployment claims execution requires four core components working together. You need an economic data source that provides claims figures in real-time, a trading algorithm that defines your entry and exit rules, a broker that supports automated order routing, and a platform that connects these elements.

Your economic data source must deliver claims data within 1-2 seconds of the official 8:30 AM ET release. TradingView Economic Calendar provides this data and can trigger alerts based on the variance between actual and forecast figures. Alternative sources include Benzinga Pro or Trading Economics premium feeds, though these require additional integration work.

Economic Calendar Integration: The connection between real-time economic data releases and your trading platform that allows automated strategies to react to news events. Quality integration delivers data in under 2 seconds from official release.

Your futures broker must support API or automated order routing. According to broker compatibility requirements, platforms like TradeStation, NinjaTrader, and Tradovate offer the necessary API access. Verify your broker allows automated trading during news events, as some impose restrictions during high-volatility releases to manage risk.

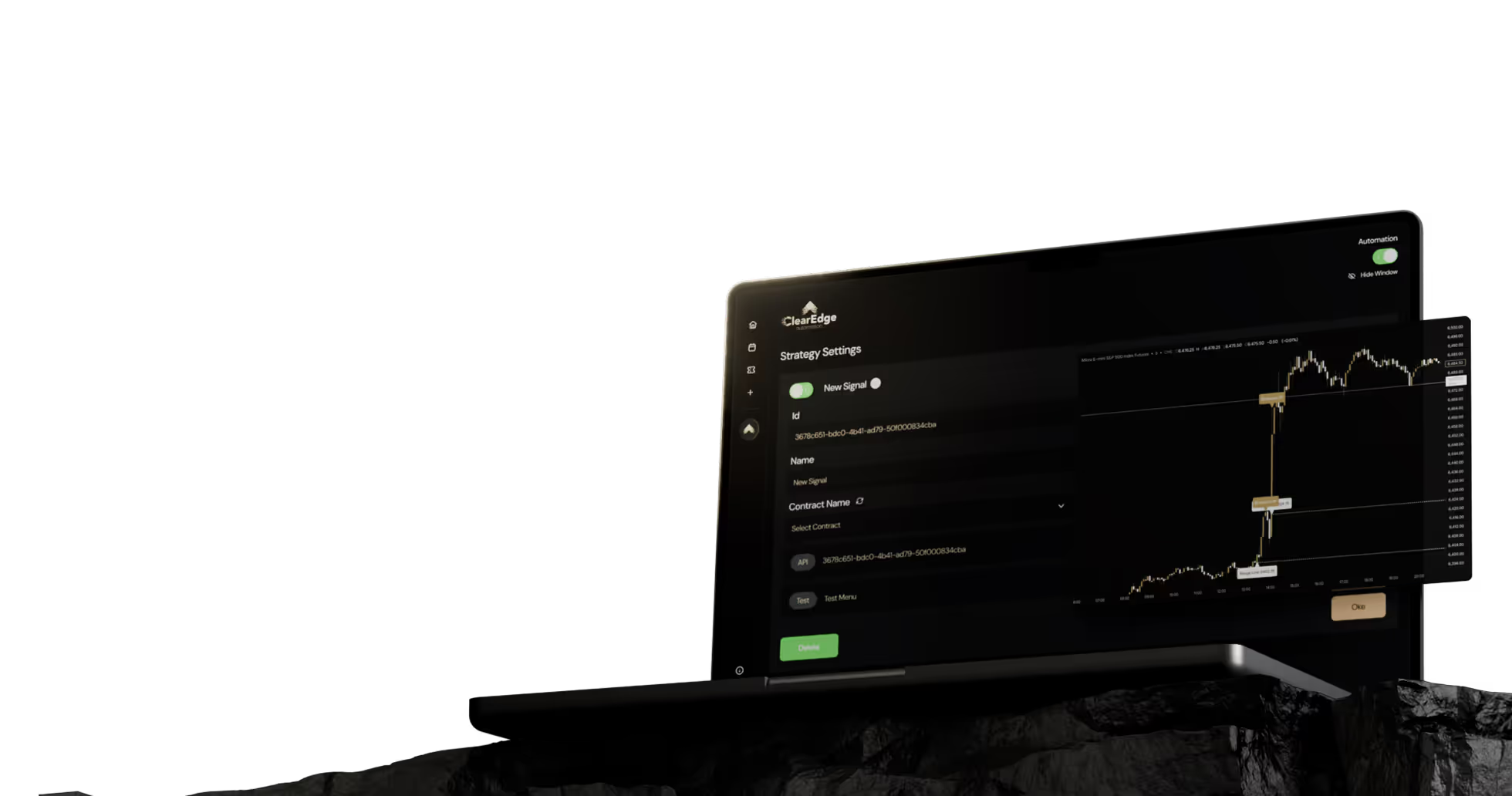

The automation platform bridges your data source to your broker. No-code solutions like ClearEdge Trading connect TradingView alerts to broker APIs via webhooks, eliminating the need for custom programming. This approach allows traders to define strategy logic in TradingView Pine Script and handle execution through the automation layer.

Pre-Launch Checklist

- ☐ Verify broker allows automated trading during economic releases

- ☐ Confirm economic data feed delivers within 2 seconds of 8:30 AM ET

- ☐ Test webhook latency between TradingView and broker (target under 100ms)

- ☐ Set account-level risk limits for maximum daily loss

- ☐ Configure position size based on typical claims-day volatility (ES often moves 10-20 points)

- ☐ Schedule paper trading test for next Thursday's release

How to Configure Your Claims Trading Strategy

A functional unemployment claims automation strategy starts with defining your deviation threshold—the minimum difference between actual and forecast claims that triggers a trade. Many traders use a 10,000-claim threshold because smaller deviations often produce minimal market reaction. Data from the Department of Labor shows the standard deviation of claims forecast errors averages 8,000-12,000 claims, making a 10,000+ deviation statistically significant.

Your directional logic should account for market context. The traditional relationship is simple: claims higher than expected (weak labor market) triggers long positions in bonds and short positions in equity futures, while lower-than-expected claims (strong labor market) does the opposite. However, this relationship inverts when the Federal Reserve is in tightening mode and the market wants weaker data to reduce rate hike probability.

Entry timing determines whether you catch the initial spike or wait for confirmation. Immediate entry at 8:30:00 AM captures the first price movement but risks whipsaw if the data includes revisions or if market interpretation shifts within the first 30 seconds. Delayed entry at 8:30:15 or 8:30:30 misses some movement but trades with slightly more price confirmation.

Whipsaw: A rapid price reversal that triggers a trade entry in one direction before immediately reversing and hitting your stop loss. Common during economic releases when initial algorithmic reactions differ from human trader interpretation.

Exit configuration requires both profit targets and stop losses calibrated to unemployment claims volatility. Historical analysis of ES futures during claims releases shows average true range expansion of 8-12 points in the first five minutes. Setting take profit at 6-8 points and stop loss at 4-5 points provides a favorable risk-reward ratio while accounting for typical price behavior.

Strategy ElementConservative SettingAggressive SettingDeviation threshold15,000+ claims8,000+ claimsEntry delay30 seconds post-releaseImmediate (0-5 sec)Take profit (ES)6 points ($75/contract)10 points ($125/contract)Stop loss (ES)4 points ($50/contract)6 points ($75/contract)

Risk Management for Economic Data Trading

Risk management for unemployment claims automation centers on limiting exposure during the unpredictable 30-90 seconds following the release. Position sizing should account for the possibility of immediate adverse movement beyond your stop loss due to slippage in fast markets. Many traders limit claims-day automation to 1-2 contracts regardless of account size, even if their normal position size would be larger.

Daily loss limits become critical when automating economic event trading. Set a maximum loss threshold of 1-2% of account value specifically for claims-day trades, separate from your overall daily limit. If Thursday morning trades hit this threshold, the automation should disable itself from taking additional claims-based entries for the remainder of the day.

Time-based risk controls prevent runaway losses if your strategy encounters unexpected market conditions. Configure your automation to only accept signals between 8:29:45 AM and 8:35:00 AM ET on Thursdays. This five-minute window covers the release and initial reaction while preventing the system from taking positions during the regular trading session when your claims-specific logic doesn't apply.

Advantages of Automated Risk Controls

- Enforces stop losses without hesitation during volatile price action

- Prevents position sizing errors during high-stress moments

- Automatically disables trading after daily loss limits are reached

Limitations to Consider

- Extreme volatility can cause slippage beyond programmed stop loss levels

- System latency during high-volume moments may delay stop execution by 100-300ms

- Automation cannot adapt to black swan events outside historical parameters

According to CFTC data, automated trading systems account for approximately 70% of futures volume during major economic releases. This concentration of algorithmic activity can create brief liquidity gaps where bid-ask spreads widen from typical 0.25-point ES spreads to 1.0-2.0 points. Your risk parameters must account for this expanded slippage potential.

Testing and Validation Before Live Trading

Backtesting unemployment claims strategies requires at least 52 weeks of historical data to capture a full year of labor market conditions, including seasonal variations in claims patterns. The Department of Labor provides historical claims data dating back decades, though you'll need to pair it with corresponding futures price data from your broker or a data vendor to reconstruct actual trading conditions.

Paper trading provides real-time validation but presents a timing challenge—you only get one unemployment claims release per week. This means validating your automation in live market conditions takes 4-8 weeks minimum to gather sufficient data across different claim deviation scenarios. Use this period to verify webhook execution speed, confirm your broker's order routing during the 8:30 AM volatility spike, and validate that your risk parameters trigger correctly.

Paper Trading: Simulated trading using real market data and real-time execution but without actual capital at risk. Essential for validating automated strategies before committing real money.

Forward testing with minimal position size offers a middle ground between paper trading and full deployment. Trade one micro contract (MES instead of ES, representing 1/10 the risk) for 4-6 weeks to validate strategy performance with actual capital exposure but limited downside. This approach reveals execution issues that paper trading might miss while keeping losses manageable during the validation period.

The futures instrument automation guide provides additional context on testing strategies across different contract specifications. Pay particular attention to how unemployment claims affect ES versus NQ, as technology-heavy Nasdaq futures sometimes show different sensitivity to labor market data than broad S&P 500 futures.

Frequently Asked Questions

1. What unemployment claims deviation is large enough to trade?

Most quantitative strategies use a minimum threshold of 10,000-15,000 claims deviation from consensus to trigger trades, as smaller variances often produce minimal market reaction. Historical data shows deviations below 8,000 claims generate statistically insignificant price movements in ES futures (typically under 3 points).

2. How much capital do you need for unemployment claims automation?

Minimum recommended capital is $5,000-$7,500 for trading MES micro contracts, or $15,000-$25,000 for standard ES contracts with proper risk management. This allows position sizing at 1-2% risk per trade while maintaining required broker margin ($1,320 for ES, $132 for MES as of 2025).

3. Can you automate unemployment claims trading without coding?

Yes, platforms like ClearEdge Trading connect TradingView's economic calendar alerts to broker execution via webhooks, requiring no programming. You configure the claims deviation threshold and direction logic in TradingView's visual interface, then connect it to your broker through the automation platform.

4. What is the typical win rate for automated claims strategies?

Well-designed unemployment claims strategies typically achieve 55-65% win rates over 52-week periods, according to systematic trading research. The edge comes from speed of execution rather than directional accuracy—capturing the initial move before manual traders react.

5. Do all brokers allow automated trading during economic releases?

No, some brokers restrict automated trading during high-volatility news events to manage their risk exposure. Check your broker's automated trading policy specifically for economic calendar events—TradeStation, NinjaTrader, and Tradovate generally permit it with proper risk disclosures.

Conclusion

Automated futures trading unemployment claims setup provides a systematic approach to trading weekly labor market data, leveraging execution speed advantages that manual trading cannot match. Success requires careful configuration of deviation thresholds, directional logic appropriate to current Fed policy context, and robust risk management to handle the volatility concentration around 8:30 AM ET releases.

Start with paper trading for 4-8 weeks to validate your strategy across different claims scenarios, then transition to minimal position sizes using micro contracts before scaling to full deployment. For additional guidance on connecting economic data to automated execution, see our complete automated futures trading guide.

Want to automate your economic event trading? Read our complete guide to automated futures trading for detailed setup instructions across multiple data releases and market conditions.

References

- U.S. Department of Labor. "Unemployment Insurance Weekly Claims Report." https://www.dol.gov/ui/data.pdf

- CME Group. "E-mini S&P 500 Futures Contract Specifications." https://www.cmegroup.com/markets/equities/sp/e-mini-sandp500.html

- Bureau of Labor Statistics. "Economic News Release Schedule." https://www.bls.gov/schedule/news_release/empsit.htm

- CFTC. "Rule 4.41 - Hypothetical Performance Results Disclaimer." https://www.cftc.gov/LawRegulation/CommodityExchangeAct/index.htm

Disclaimer: This article is for educational and informational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.