Automated Futures Trading for Retail Traders: 2026 Guide

Automate your futures strategies without coding. This guide covers platforms, broker setup, risk management, and how to trade ES, NQ, and more 24/5.

Automated futures trading is the use of computer programs and algorithms to execute futures contracts based on predefined rules, removing the need for manual order entry and real-time decision-making. This approach allows traders to participate in futures markets around the clock while eliminating emotional interference from their trading process. For retail traders juggling careers, families, and other commitments, automation transforms futures trading from a screen-intensive activity into a systematic, hands-off endeavor.

The futures market presents unique opportunities for automation. Unlike equities that trade during limited hours, futures contracts on indices like the E-mini S&P 500 (ES) and Nasdaq-100 (NQ) trade nearly 23 hours per day, five days per week. Gold futures (GC), crude oil (CL), and treasury instruments follow similar extended schedules. This creates a fundamental problem for discretionary traders: opportunities occur while they sleep, work, or spend time with family. Automation solves this by executing trades according to predetermined criteria regardless of whether the trader is actively monitoring markets.

The retail futures automation landscape has evolved dramatically since 2020. What once required institutional-grade infrastructure and programming expertise is now accessible through platforms designed specifically for individual traders. Modern automation connects charting platforms like TradingView to futures brokers, translating alert signals into executed orders within milliseconds. This democratization means traders can deploy systematic strategies without writing code or maintaining server infrastructure.

Automated futures trading uses rule-based systems to execute futures contracts without manual intervention, enabling retail traders to capture opportunities 24/5 while removing emotional decision-making. Modern platforms have made this technology accessible without requiring programming skills.

- Automated systems execute trades based on predefined rules, eliminating emotional interference and ensuring consistent strategy application

- Futures markets trade nearly 23 hours daily, making automation essential for capturing opportunities outside regular waking hours

- Modern no-code platforms connect TradingView alerts to futures brokers, removing the traditional programming barrier

- Automation does not guarantee profits—it ensures your strategy executes exactly as designed, whether that strategy is profitable depends on the strategy itself

- Key components include a charting platform for signals, an automation bridge for execution, and a compatible futures broker

- Risk management features like position sizing, stop losses, and maximum daily loss limits are critical safeguards in any automated system

- What Is Automated Futures Trading?

- How Automated Futures Trading Works

- Why Traders Automate Futures Strategies

- Essential Components of a Futures Automation System

- Types of Automated Futures Strategies

- How to Choose a Futures Automation Platform

- Getting Started with Futures Automation

- Risk Management in Automated Trading

- Common Mistakes to Avoid

- Automated vs. Manual Futures Trading

- The Future of Retail Futures Automation

- Frequently Asked Questions

What Is Automated Futures Trading?

Automated futures trading is a method of participating in futures markets where computer systems handle trade execution based on rules defined in advance by the trader. Instead of manually clicking buy or sell buttons, traders configure their criteria—entry conditions, position sizes, stop losses, and profit targets—and let software handle the mechanical aspects of trading.

Futures Contract: A standardized legal agreement to buy or sell a specific commodity or financial instrument at a predetermined price at a specified time in the future. Futures are traded on regulated exchanges like the CME Group. Learn more

The concept builds on decades of institutional trading technology. Investment banks and hedge funds have used algorithmic execution since the 1970s, with computerized trading becoming dominant by the 2000s [1]. What changed for retail traders is accessibility. Platforms now exist that translate the same systematic approach into tools usable by individuals without quantitative finance backgrounds.

Automated futures trading differs from manual discretionary trading in several fundamental ways:

- Execution speed: Automated systems can identify signals and execute orders in milliseconds, while human reaction time typically ranges from 200-300 milliseconds at best

- Consistency: Automation executes every qualifying signal identically, whereas human traders may hesitate, second-guess, or deviate from their plan

- Availability: Automated systems operate continuously during market hours without fatigue, attention lapses, or schedule conflicts

- Emotional neutrality: Computers do not experience fear after losses or greed after wins—they simply follow instructions

- Scalability: A trader can monitor and execute strategies across multiple instruments simultaneously, which would be impossible manually

Algorithmic Trading: A broader category encompassing any trading approach that uses computer algorithms to make decisions. Automated futures trading is a specific application of algorithmic trading focused on futures contracts. Learn more

It is important to understand what automation does and does not accomplish. Automation ensures your strategy executes exactly as designed—it does not transform a losing strategy into a winning one. The profitability of automated trading depends entirely on the underlying strategy's edge. A well-designed system trading a flawed strategy will lose money consistently and efficiently. This is why strategy development and backtesting remain critical even when using automated trading systems.

How Automated Futures Trading Works

Automated futures trading operates through a chain of connected components that translate market conditions into executed orders without human intervention. The process begins with market data analysis, proceeds through signal generation, and culminates in order execution at your futures broker.

The typical automation workflow follows this sequence:

- Data ingestion: Your charting platform (commonly TradingView) receives real-time price data from exchanges

- Condition monitoring: The platform continuously evaluates whether predefined conditions are met—such as a moving average crossover, RSI reaching oversold levels, or price breaking through support

- Signal generation: When conditions are satisfied, the platform generates an alert containing trade instructions

- Signal transmission: The alert is sent via webhook (an automated message between applications) to an automation platform

- Order construction: The automation platform translates the alert into a properly formatted order with specified quantity, order type, and risk parameters

- Broker execution: The order is transmitted to your futures broker via API and executed on the exchange

- Confirmation and management: Position information flows back through the chain, and the system monitors for exit conditions

Webhook: An automated message sent from one application to another when a specific event occurs. In trading automation, webhooks transmit alert signals from charting platforms to execution systems. Learn more

This entire process typically completes in milliseconds to seconds, depending on the platforms involved and network conditions. Execution speed matters in futures trading because prices can move significantly during delays, particularly during high-volatility periods around economic releases or market opens.

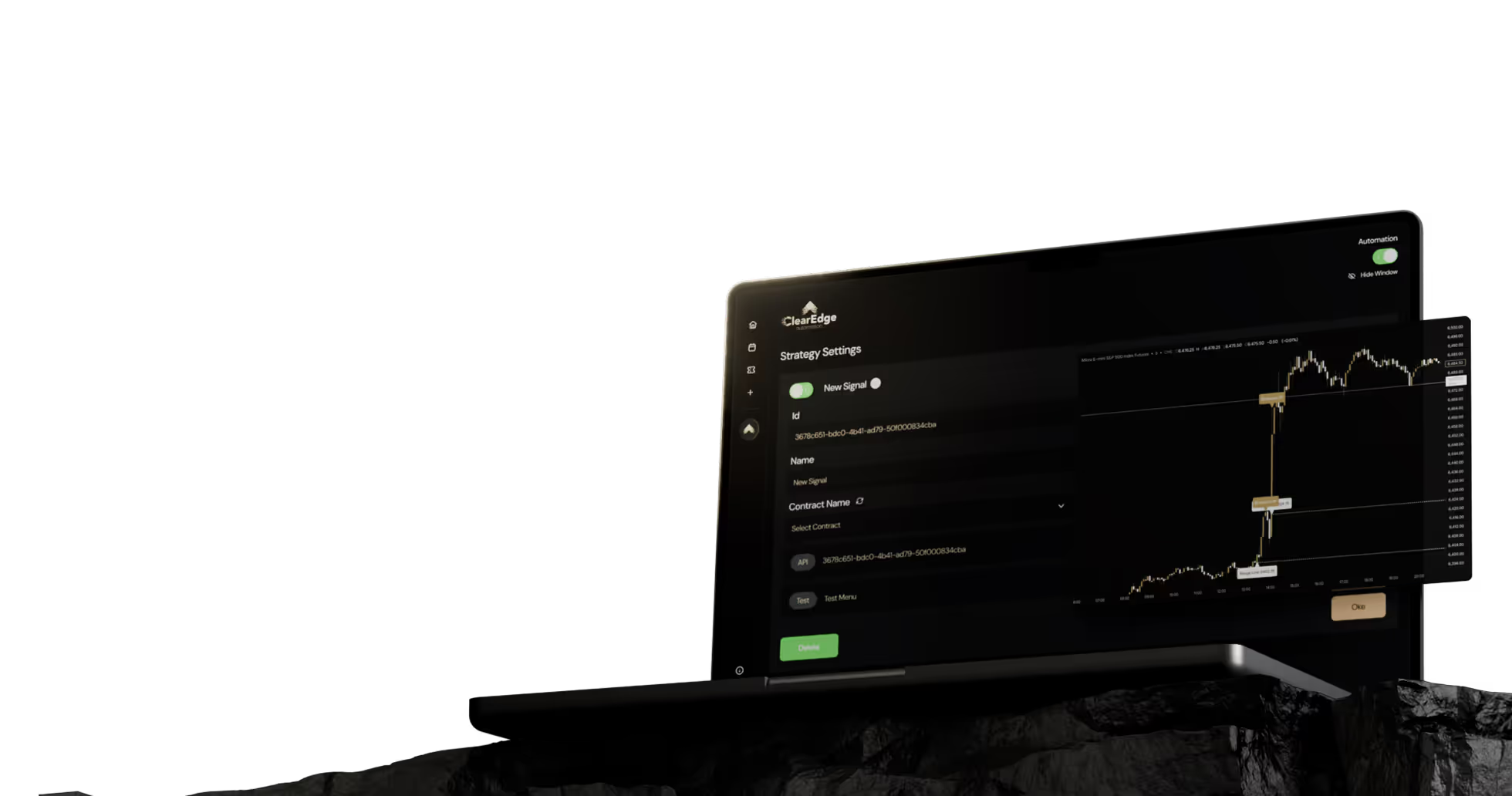

Modern retail automation platforms have simplified this workflow considerably. Rather than building custom webhook handlers and broker integrations, traders can use purpose-built platforms that handle the technical infrastructure. Platforms like ClearEdge connect directly to major futures brokers including Tradovate, NinjaTrader, and Interactive Brokers, managing the entire signal-to-execution pipeline without requiring users to write code or maintain servers.

Understanding this architecture helps troubleshoot issues when they arise. A trade that does not execute as expected could stem from problems at any link in the chain: incorrect alert syntax, webhook delivery failures, platform connectivity issues, or broker-side rejections. Quality automation platforms provide logging and monitoring to identify where breakdowns occur.

Why Traders Automate Futures Strategies

Traders automate futures strategies primarily to remove themselves as the weakest link in their trading system. Human psychology creates consistent, predictable errors that undermine even well-designed strategies: hesitating on entries, moving stops to avoid losses, cutting winners short, and overtrading after drawdowns. Automation eliminates these failure modes by executing the plan exactly as written.

The case for automation becomes clearer when examining why discretionary traders fail:

- Emotional interference: Fear and greed are not character flaws—they are evolutionary survival mechanisms that actively work against trading success. A study published in the Journal of Finance found that individual investors systematically sell winning positions too early and hold losing positions too long, a pattern called the disposition effect [2]

- Inconsistent execution: Manual traders execute the same setup differently depending on recent results, market conditions, and their emotional state. This inconsistency makes it impossible to evaluate whether a strategy actually works

- Physical limitations: Humans cannot monitor markets continuously. Futures trade nearly around the clock, but traders need sleep, have jobs, and maintain relationships. Every hour away from screens is a missed opportunity

- Attention constraints: Even during active trading hours, humans can effectively monitor only one or two instruments. Automation scales to dozens of markets simultaneously

- Fatigue effects: Decision quality degrades over time. A trader who has been watching charts for eight hours makes worse decisions than they did in hour one

Disposition Effect: A behavioral finance phenomenon where investors tend to sell assets that have increased in value while holding assets that have decreased in value. This pattern leads to suboptimal returns over time. Learn more

Beyond psychological benefits, automation enables strategies that are impossible to execute manually. Scalping strategies that require sub-second entries and exits, multi-instrument correlation plays, and round-the-clock trend following all depend on automated execution. Advanced automation strategies often combine multiple timeframes and instruments in ways no human could track in real time.

For traders with demanding careers or family obligations, automation transforms trading from a second job into a passive income stream. The system works while you are in meetings, at your child's soccer game, or asleep. This lifestyle benefit often matters more than any technical advantage—trading should support your life, not consume it.

Essential Components of a Futures Automation System

A complete futures automation system requires four core components working together: a charting platform for signal generation, an automation bridge for execution handling, a compatible futures broker, and properly configured risk management. Each component serves a specific function, and weaknesses in any element compromise the entire system.

Charting Platform

The charting platform analyzes price data and generates trading signals based on your defined conditions. TradingView dominates this category for retail traders due to its accessibility, extensive indicator library, and built-in alert functionality with webhook support. Other options include NinjaTrader, Sierra Chart, and MetaTrader, each with different strengths and learning curves.

Key charting platform requirements for automation:

- Webhook or API alerts: The platform must send signals to external systems, not just display on-screen notifications

- Reliable uptime: Alert generation depends on the platform running continuously

- Sufficient alert capacity: Free tiers often limit active alerts, constraining multi-instrument strategies

- Backtesting capabilities: Testing strategies on historical data before live deployment

Automation Bridge Platform

The automation bridge receives signals from your charting platform and translates them into orders at your broker. This middleware layer handles the technical complexity of broker APIs, order formatting, position tracking, and risk enforcement. Without it, you would need to build custom integrations for each broker.

Platform TypeProsConsBest For Signal-to-execution bridges (e.g., TradersPost, PickMyTrade)Easy setup, multiple broker support, no coding requiredMonthly fees, dependent on third-party uptimeTraders who want simplicity and bring their own strategies Strategy-included platforms (e.g., ClearEdge)Proprietary strategies included, no strategy development required, simple configurationLess customization, strategies are predefinedTraders who want turnkey automation without building strategies Custom developmentComplete control, no recurring platform feesRequires programming skills, ongoing maintenanceDevelopers who want maximum flexibility

Futures Broker

Your futures broker executes orders on regulated exchanges and holds your trading capital. Broker selection significantly impacts automation effectiveness through execution speed, API reliability, commission costs, and margin requirements. Popular futures brokers supporting automation include Tradovate, NinjaTrader Brokerage, Interactive Brokers, and AMP Futures.

Critical broker considerations for automated trading:

- API access: Not all brokers offer API connectivity, and API quality varies significantly

- Execution speed: Latency between order submission and execution affects fill quality

- Reliability: Broker outages during volatile markets can cause significant losses

- Commission structure: High-frequency strategies are particularly sensitive to per-contract costs

- Platform compatibility: Verify your automation platform supports your chosen broker

Risk Management Configuration

Risk management is not optional—it is the most important component of any automated system. Without proper safeguards, a malfunctioning strategy or unexpected market condition can devastate an account before you become aware of the problem. Every properly designed automation system includes multiple layers of protection.

Types of Automated Futures Strategies

Automated futures strategies fall into several categories based on their underlying logic, holding period, and market conditions they exploit. Understanding these categories helps traders evaluate which approaches align with their goals and risk tolerance.

Trend Following

Trend following strategies identify and ride directional price movements, entering in the direction of established trends and exiting when the trend shows signs of reversal. These strategies typically have lower win rates (40-50% of trades profitable) but capture large moves when correct. Trend following works best in markets that exhibit persistent directional behavior.

Common trend following signals include moving average crossovers, breakouts above recent highs, and momentum indicator confirmations. The challenge lies in distinguishing genuine trends from random noise, and trend followers must endure frequent small losses while waiting for occasional large wins.

Mean Reversion

Mean reversion strategies bet that prices will return to an average or equilibrium level after deviating significantly. When price moves too far too fast in one direction, these strategies take positions expecting a snapback. Mean reversion typically shows higher win rates but smaller profits per trade compared to trend following.

Automated mean reversion often uses indicators like RSI (Relative Strength Index), Bollinger Bands, or statistical deviation from moving averages to identify overextended conditions. The risk is that sometimes "extreme" conditions become the new normal—a strategy betting on reversion during a genuine trend change can suffer significant drawdowns.

Mean Reversion: A financial theory suggesting that asset prices and returns eventually move back toward their long-term average or mean level. Trading strategies based on this concept buy when prices are below average and sell when prices are above average. Learn more

Scalping and High-Frequency

Scalping strategies seek small, frequent profits by exploiting minor price inefficiencies. Holding periods range from seconds to minutes, and profitability depends on high accuracy and minimal execution costs. True high-frequency trading requires institutional infrastructure, but retail scalping automation captures similar concepts on accessible timeframes.

Scalping demands the fastest possible execution and lowest possible commissions. Slippage (the difference between expected and actual fill prices) and commissions can easily exceed the small profit targets scalping seeks. This category is generally the most challenging for retail traders to execute profitably.

Breakout Trading

Breakout strategies enter positions when price moves beyond significant levels such as prior day highs/lows, consolidation boundaries, or key support/resistance zones. The logic is that breakouts often lead to continuation as stops are triggered and momentum traders pile in.

False breakouts present the primary challenge—price temporarily exceeds a level before reversing back. Successful breakout strategies incorporate filters to distinguish genuine breakouts from fake-outs, often requiring volume confirmation or waiting for a candle close beyond the level before entering.

News and Event-Driven

Event-driven strategies trade around scheduled economic releases, earnings announcements, or Fed decisions. Automation is particularly valuable here because price moves during major releases occur faster than human reaction time allows. Strategies might position before releases, trade the immediate reaction, or fade overreactions.

Risk is elevated during events due to potential gaps, widened spreads, and extreme volatility. Many automated strategies explicitly avoid trading during high-impact news releases rather than trying to profit from them.

How to Choose a Futures Automation Platform

Choosing the right automation platform requires evaluating technical capabilities, ease of use, supported brokers, cost structure, and the level of strategy development you want to undertake. The "best" platform depends entirely on your specific needs and technical comfort level.

Start by answering these questions about your situation:

- Do you have existing strategies you want to automate, or do you need help developing them?

- What is your technical skill level—are you comfortable with webhooks and JSON formatting?

- Which futures broker do you use or plan to use?

- How much time can you dedicate to setup and ongoing management?

- What is your budget for automation tools?

If you already have profitable strategies from manual trading or backtesting, signal-to-execution bridges let you automate those existing approaches. Platforms in this category assume you bring your own edge and simply need execution infrastructure. The learning curve involves correctly formatting alerts and understanding order types.

If you do not have existing strategies—or have struggled to develop profitable approaches—platforms that include proprietary strategies may provide a faster path to live trading. ClearEdge falls into this category, offering pre-built strategies developed by experienced traders alongside the automation infrastructure. The trade-off is less customization in exchange for eliminating strategy development entirely.

Beyond strategy approach, evaluate these platform characteristics:

- Supported brokers: Verify compatibility with your preferred broker before committing

- Execution speed: Request or research typical latency from signal to fill

- Risk controls: What safeguards exist for maximum position size, daily loss limits, and error handling?

- Reliability history: Search for user reports of outages or execution issues

- Support quality: How responsive is the team when problems arise?

- Cost structure: Understand all fees—platform subscriptions, data fees, and whether pricing scales with account size or volume

Getting Started with Futures Automation

Beginning futures automation requires methodical preparation rather than rushing to live trading. The setup process typically takes several days to several weeks depending on your starting point, and shortcuts here lead to costly mistakes later.

Step 1: Establish Your Foundation

Before touching automation, ensure you understand futures trading fundamentals. This means knowing how margin works, understanding contract specifications for your target instruments, and being familiar with the brokers and platforms involved. If you have never traded futures manually, spend time learning the mechanics before adding automation complexity.

Required foundation elements:

- Funded futures brokerage account with API access enabled

- TradingView subscription with webhook-capable alerts (Pro plan or higher)

- Basic understanding of order types (market, limit, stop)

- Familiarity with your target instruments' trading hours and characteristics

Step 2: Select and Configure Your Automation Platform

Choose an automation platform based on your evaluation criteria. Create your account and follow the platform's setup process to connect your futures broker. This typically involves generating API credentials at your broker and entering them into the automation platform.

Test the connection before proceeding. Most platforms offer a "test order" or paper trading mode—use it. Confirm that orders flow correctly from the platform to your broker before risking capital.

Step 3: Configure Your Strategy

If using a strategy-included platform like ClearEdge, this step involves selecting which strategies to deploy and configuring position sizes appropriate for your account. If using a signal-execution bridge, you will set up your TradingView alerts with the correct webhook URL and message format.

Critical configuration elements:

- Position sizing: Start smaller than you think necessary—you can always scale up

- Risk limits: Set maximum daily loss limits that force the system to stop trading if breached

- Trading hours: Consider whether to trade during all sessions or limit to higher-liquidity periods

- Alert syntax: For webhook-based systems, precise formatting is essential—a single typo can cause failed executions

Step 4: Paper Trade and Validate

Run your system in paper trading or simulation mode before going live. This validates that signals generate correctly, orders execute as expected, and risk parameters function properly. Watch for issues like duplicate orders, missing exits, or incorrect position sizes.

The ClearEdge FAQ addresses common setup questions, but regardless of which platform you use, paper trading validation is non-negotiable. Minimum recommended paper trading duration is two weeks or 20+ trades—enough to see the system perform in various market conditions.

Step 5: Go Live Carefully

When transitioning to live trading, reduce position sizes further. Your first live trades should use the minimum contract size your broker allows (often one micro contract). This limits damage from any remaining configuration issues while generating real execution data.

Increase size gradually as you build confidence in the system. A common approach is to double position size after each two-week period of problem-free operation, up to your target allocation.

Risk Management in Automated Trading

Risk management separates sustainable automated trading from eventual account destruction. Automation executes faster and more consistently than humans—but this applies to losses as well as profits. A malfunctioning system or poorly designed strategy can generate catastrophic losses in minutes without proper safeguards.

Every automated system requires multiple layers of risk controls:

Position-Level Controls

Position-level risk management governs individual trades. Essential controls include:

- Stop losses: Every position should have a defined exit point that limits losses. Hard stops execute regardless of market conditions

- Position sizing: Risk no more than 1-2% of account equity on any single trade

- Maximum position size: Set absolute limits on how large any position can grow, preventing runaway scaling

Daily and Session Controls

These controls limit cumulative damage within a trading day:

- Maximum daily loss: If losses exceed a threshold (commonly 3-5% of account), automation stops trading for the remainder of the day

- Maximum daily trades: Limits prevent overtrading during choppy conditions

- Session-specific rules: Some traders disable automation during high-risk periods like major news releases

System-Level Controls

System-level safeguards protect against technical failures:

- Connection monitoring: Alerts when connectivity to the broker is lost

- Position reconciliation: Regular verification that the automation platform's position records match actual broker positions

- Emergency stop: A manual kill switch to halt all trading immediately

- Broker-side stops: Configure your broker's own risk limits as a backstop

Drawdown: The decline from a peak in account equity to a subsequent trough. Maximum drawdown measures the largest peak-to-trough decline over a period and indicates the worst-case scenario experienced by a strategy. Learn more

Proper risk management means accepting that losses are part of trading. The goal is not to eliminate losses but to ensure no single loss, day, or week can threaten your ability to continue trading. Even excellent strategies experience drawdowns—avoiding common automation mistakes includes sizing positions to survive inevitable losing periods.

Common Mistakes to Avoid

Understanding common pitfalls prevents repeating mistakes that have derailed countless automated trading endeavors. These errors span strategy development, technical implementation, and psychological traps.

Overfitting Strategies to Historical Data

Overfitting occurs when a strategy is optimized so precisely to past data that it captures noise rather than genuine patterns. An overfitted strategy shows spectacular backtesting results but fails in live trading because the specific patterns it exploited were random and non-repeating. Signs of overfitting include exceptional backtesting performance, a large number of optimized parameters, and significant degradation in out-of-sample testing [3].

Inadequate Testing Before Going Live

Eager traders rush from backtesting to live trading without proper paper trading validation. This skips the critical step of verifying that the complete system—from signal generation through execution—works correctly. Syntax errors, webhook configuration issues, and broker API quirks often only appear during real-time operation.

Ignoring Execution Costs

Backtests often assume perfect fills at exact prices, but live trading involves slippage and commissions. Strategies with small profit targets are particularly vulnerable—a scalping strategy showing net profitability in backtesting may lose money after real execution costs. Always include realistic commission and slippage estimates in strategy evaluation.

Over-Leveraging

Futures offer significant leverage, and automation makes it easy to trade larger sizes than prudent. Position sizing should be based on account risk tolerance, not margin availability. Just because your broker allows 20x leverage does not mean using it is wise.

Abandoning Strategy During Drawdowns

Every trading strategy experiences losing periods. Traders who abandon their automated systems during normal drawdowns never realize long-term profitability. Before deploying any strategy, understand its historical drawdown characteristics and commit to riding through similar conditions live. If you cannot tolerate a 20% drawdown, do not trade a strategy that has historically experienced 20% drawdowns.

Set-and-Forget Mentality

While automation reduces daily involvement, it does not mean ignoring your system entirely. Regular monitoring—daily account review, weekly performance analysis—catches problems before they escalate. Markets evolve, and strategies may require periodic adjustment.

Automated vs. Manual Futures Trading

Neither automated nor manual trading is universally superior—each approach suits different trader profiles, market conditions, and goals. Understanding the trade-offs enables informed decisions about which approach to adopt.

FactorAutomated TradingManual Trading Emotional controlEliminates emotional interference entirelyRequires constant psychological discipline Time requirementMinimal daily involvement after setupRequires active screen time during trades AdaptabilityFollows fixed rules; slow to adapt to regime changesCan adjust to unusual market conditions in real-time Opportunity captureTrades 24/5 without breaksLimited to trader's available hours Skill developmentFront-loaded in strategy developmentContinuous pattern recognition improvement Initial complexityHigher technical setup requirementsLower barrier to begin trading ScalingEasily monitor multiple instrumentsHuman attention limits instrument coverage CostPlatform fees, data costsTypically lower fixed costs

Many successful traders use hybrid approaches. Discretionary analysis identifies high-probability setups or market regimes, while automation handles execution and position management. This captures human pattern recognition strengths while eliminating execution weaknesses.

The automation question often comes down to lifestyle fit. If you can dedicate full-time attention to markets during trading hours and genuinely enjoy the process, manual trading remains viable. If you have other commitments—career, family, interests—that compete for your time, automation enables participation that would otherwise be impossible.

Consider also your psychological makeup. Some traders thrive on the engagement of manual trading; others are tortured by it. If you consistently break your own rules, move stops, or overtrade, automation removes these self-sabotage opportunities. There is no shame in acknowledging that you trade better when you are not actually making real-time decisions.

The Future of Retail Futures Automation

Retail futures automation continues to evolve rapidly, with accessibility increasing and barriers falling. Several trends will shape the landscape over the coming years.

Continued Democratization

What required programming expertise five years ago now requires only button clicks. This trend will continue as platforms compete for retail traders by simplifying setup processes. The future of trading automation involves even more abstraction of technical complexity, eventually making sophisticated automation indistinguishable from using any other consumer software.

Integration of Artificial Intelligence

Machine learning and AI are increasingly incorporated into strategy development and signal generation. While retail traders will not build their own neural networks, they will access AI-enhanced strategies through platforms that do the heavy lifting. Skepticism is warranted here—many "AI trading" products are marketing hype—but genuine applications are emerging.

Regulatory Evolution

Regulators like the CFTC continue to monitor automated trading practices. Future regulations may impose requirements around risk controls, testing standards, or disclosure for automation platforms. The National Futures Association (NFA) already requires certain disclosures from managed futures programs, and similar requirements could extend to automation tools [4].

Prop Firm Integration

The intersection of futures automation and proprietary trading firm challenges is growing rapidly. Traders use automation to pass prop firm evaluations and trade funded accounts without violating firm rules. Platforms are increasingly building features specifically for prop firm compliance, and this market segment shows no signs of slowing.

Frequently Asked Questions

1. What is the minimum capital needed to start automated futures trading?

Most futures brokers require $2,000-$5,000 minimum to open an account, though micro contracts allow trading with less. The CME's micro E-mini S&P 500 contract (MES) has approximately $1,300 margin requirements as of late 2025, meaning you could technically trade with a $3,000-$5,000 account [5]. However, proper position sizing for a sustainable approach suggests having at least 10x your margin requirement, pointing toward $10,000-$15,000 for comfortable micro contract trading. Account size ultimately depends on your risk tolerance, strategy drawdown characteristics, and position sizing rules.

2. Do I need programming skills to automate futures trading?

No, modern automation platforms eliminate the programming requirement for most use cases. Platforms like ClearEdge offer complete automation with no coding, while TradingView's alert system uses a simple text-based syntax rather than programming. If you want to build highly custom solutions, programming helps, but it is not necessary to benefit from automation. The basics of trading automation are accessible to anyone comfortable using computer software.

3. How much does automated futures trading cost?

Total costs include brokerage commissions (typically $0.50-$2.50 per contract per side), automation platform fees ($50-$200/month for most retail platforms), and data feed costs ($10-$50/month if not included with your broker). Using ClearEdge as an example, plans range from $129-$179 monthly and include the automation platform and proprietary strategies. Annual costs for a complete automation setup typically range from $1,500-$4,000 depending on platform choice and trading volume.

4. Can automated trading guarantee profits?

No. Automated trading ensures consistent execution of your strategy, but profitability depends entirely on the strategy itself. A losing strategy executed automatically will lose money efficiently. Automation removes human error from execution—it does not create trading edge where none exists. Any platform or service claiming guaranteed profits should be viewed with extreme skepticism, as such claims likely violate CFTC regulations [6].

5. What happens if my internet connection drops during automated trading?

The impact depends on your system architecture. If your automation runs locally on your computer, an internet outage prevents new signals from executing and may leave positions unmanaged. Cloud-based automation platforms continue operating because they run on servers independent of your home connection. Regardless of setup, always use stop-loss orders that exist at the broker level—these execute even if your automation system loses connectivity.

6. Is automated futures trading legal?

Yes, automated trading is legal for retail traders in the United States and most jurisdictions. Futures trading is regulated by the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA), and no regulations prohibit retail traders from using automation tools. However, if you manage others' money or offer trading signals commercially, different regulations apply. Always trade through properly registered brokers to ensure regulatory compliance [7].

7. How long does it take to set up futures automation?

Initial setup typically takes 2-4 hours for account connections and basic configuration. If using a strategy-included platform, you can be paper trading within a day. If building your own strategy with custom alerts, add time for strategy development and alert configuration—this varies widely based on complexity. The recommended paper trading period of 2-4 weeks means going from zero to live trading takes approximately one month for thorough preparation.

8. What is the difference between automated trading and algorithmic trading?

The terms overlap significantly but have subtle distinctions. Algorithmic trading refers broadly to using computer algorithms for any trading decisions—this includes institutional high-frequency market making, statistical arbitrage, and complex quantitative strategies. Automated trading specifically emphasizes the execution aspect: automatically entering and exiting positions based on signals. In retail contexts, the terms are often used interchangeably. ClearEdge and similar platforms provide algorithmic trading capabilities through automated execution.

9. Can I use automated trading with a prop firm?

Yes, most prop firms allow automated trading, though specific rules vary by firm. Common restrictions include banning certain high-frequency behaviors, requiring that automation not trade during news events, and prohibiting strategies that exploit evaluation-specific conditions. Always verify your automation approach complies with your prop firm's rules before deployment. The combination of futures automation and prop firm trading has become increasingly popular, allowing traders to access larger capital without personal risk.

10. How do I know if my automated strategy is working?

Evaluate strategy performance through multiple metrics beyond simple profit/loss. Key performance indicators include win rate (percentage of profitable trades), profit factor (gross profits divided by gross losses), maximum drawdown (largest peak-to-trough decline), and Sharpe ratio (risk-adjusted returns). Compare live results to backtested expectations—significant divergence suggests either overfitting in backtests or execution issues in live trading. Maintain detailed records and review performance at least monthly to identify degradation before it becomes critical.

Conclusion

Automated futures trading represents a fundamental shift in how retail traders can participate in derivatives markets. By removing emotional interference, ensuring consistent execution, and enabling 24-hour market access, automation addresses the core challenges that cause most discretionary traders to fail. The technology that was once exclusive to institutions is now accessible to individuals through platforms designed specifically for retail use.

Success in automated futures trading still requires work—understanding your strategy's logic, properly configuring risk management, and monitoring performance over time. Automation is not a magic solution that transforms losing approaches into winning ones. Rather, it is infrastructure that allows good strategies to perform as designed without human psychology undermining them.

For traders ready to explore automation, the path forward involves honest assessment of your goals and technical comfort, careful platform selection, thorough testing before live deployment, and commitment to ongoing monitoring. Start smaller than you think necessary, validate at each step, and scale up gradually as you build confidence in your system. The traders who succeed with automation are those who treat it as a serious endeavor requiring preparation rather than a shortcut to easy profits.

References

- Securities and Exchange Commission. (2014). Equity Market Structure Literature Review Part II: High Frequency Trading. SEC Staff Report. https://www.sec.gov/marketstructure/research/hft_lit_review_march_2014.pdf

- Odean, T. (1998). Are Investors Reluctant to Realize Their Losses? The Journal of Finance, 53(5), 1775-1798. https://doi.org/10.1111/0022-1082.00072

- Bailey, D. H., Borwein, J. M., Lopez de Prado, M., & Zhu, Q. J. (2014). Pseudo-Mathematics and Financial Charlatanism: The Effects of Backtest Overfitting on Out-of-Sample Performance. Notices of the American Mathematical Society, 61(5), 458-471.

- National Futures Association. (2025). NFA Compliance Rules. https://www.nfa.futures.org/rulebook/

- CME Group. (2025). Micro E-mini S&P 500 Futures Contract Specifications. https://www.cmegroup.com/markets/equities/sp/micro-e-mini-sandp-500.contractSpecs.html

- Commodity Futures Trading Commission. (2025). Customer Advisory: Beware of Promises of Easy Profits from Forex or Futures Trading. https://www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/fraudadv_forex.html

- National Futures Association. (2025). Registration Requirements. https://www.nfa.futures.org/registration-membership/

This content is for educational purposes only and does not constitute financial advice. Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance of any trading system or strategy is not indicative of future results.

RISK WARNING: Futures trading carries a high level of risk and may not be suitable for all investors. You could lose more than your initial investment. Only trade with capital you can afford to lose. Automated trading systems cannot guarantee profits and may experience periods of drawdown.

ClearEdge Automation is a futures automation platform. This content may reference ClearEdge products and services where contextually relevant to the educational material.

Published: December 2025 · Last updated: 2025-12-04

Author: ClearEdge Team, 100+ years combined trading & development experience, including 29-year CME floor trading veteran

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.