How Algorithmic Trading Signals Work: Complete Automation Guide

Bridge the gap between analysis and action with algorithmic trading signals. Learn how webhooks and technical indicators automate execution in futures markets.

Algorithmic trading signals are automated notifications generated when predefined market conditions are met, triggering buy or sell decisions based on technical indicators, price patterns, or mathematical models. These signals work by continuously monitoring market data, evaluating rule-based criteria, and transmitting execution instructions to trading platforms—eliminating manual analysis delays and emotional decision-making in futures markets like ES, NQ, GC, and CL.

Key Takeaways

- Trading signals are generated when specific technical conditions (moving average crossovers, RSI thresholds, volume patterns) are met in real-time market data

- Signal-to-execution latency typically ranges from 50-500 milliseconds for retail systems, with institutional systems achieving sub-10ms speeds

- TradingView generates approximately 70% of retail algorithmic trading signals through Pine Script indicators and alert webhooks

- Effective signal systems combine multiple confirmation factors rather than relying on single indicators to reduce false positives

Table of Contents

- What Are Algorithmic Trading Signals?

- How Do Trading Signals Work in Practice?

- What Are the Main Types of Trading Signals?

- How Are Signals Generated and Transmitted?

- How Do Signals Connect to Automated Execution?

- What Makes a Trading Signal Effective?

- Frequently Asked Questions

- Conclusion

What Are Algorithmic Trading Signals?

Algorithmic trading signals are digital notifications that indicate when specific market conditions align with predefined trading rules. A signal represents the output of a rule-based system that continuously evaluates price action, volume, indicators, and other market data to identify potential trade opportunities.

Trading Signal: A machine-generated alert that specifies trade parameters (entry price, direction, stop loss, target) when predetermined technical or quantitative criteria are satisfied. Signals remove the manual chart-watching requirement from systematic trading approaches.

For futures traders, signals typically monitor contracts like ES (E-mini S&P 500), NQ (E-mini Nasdaq), GC (Gold), and CL (Crude Oil). These signals can originate from proprietary indicators, custom Pine Script code in TradingView, or third-party signal services. The core function is translating complex market analysis into binary action triggers—buy, sell, or remain flat.

Unlike discretionary trading where humans interpret charts subjectively, algorithmic signals apply consistent logic to every market condition. If price crosses above a 50-period moving average while RSI exceeds 60, the signal fires. No interpretation required. This consistency enables automated futures trading systems to execute strategies without human intervention.

How Do Trading Signals Work in Practice?

Trading signals operate through a continuous monitoring loop that evaluates market data against programmed conditions every few milliseconds to seconds. When all specified criteria align—such as a MACD crossover combined with specific volume thresholds—the system generates a signal containing trade instructions.

The process follows four stages: data ingestion, condition evaluation, signal generation, and transmission. Real-time price feeds from exchanges like CME Group flow into the analysis engine. The engine compares current market state against signal rules coded in platforms like TradingView. When conditions match, the system creates a signal object containing entry price, direction (long/short), position size, stop loss, and profit target.

Most retail traders use TradingView's alert system, which checks conditions at the close of each bar (1-minute, 5-minute, hourly, etc.). When an alert triggers, TradingView sends a webhook—an HTTP POST request—to an automation platform. That platform parses the signal data and routes it to the appropriate broker API for execution. The entire chain from signal generation to order placement typically completes in 50-500 milliseconds depending on network conditions and broker infrastructure.

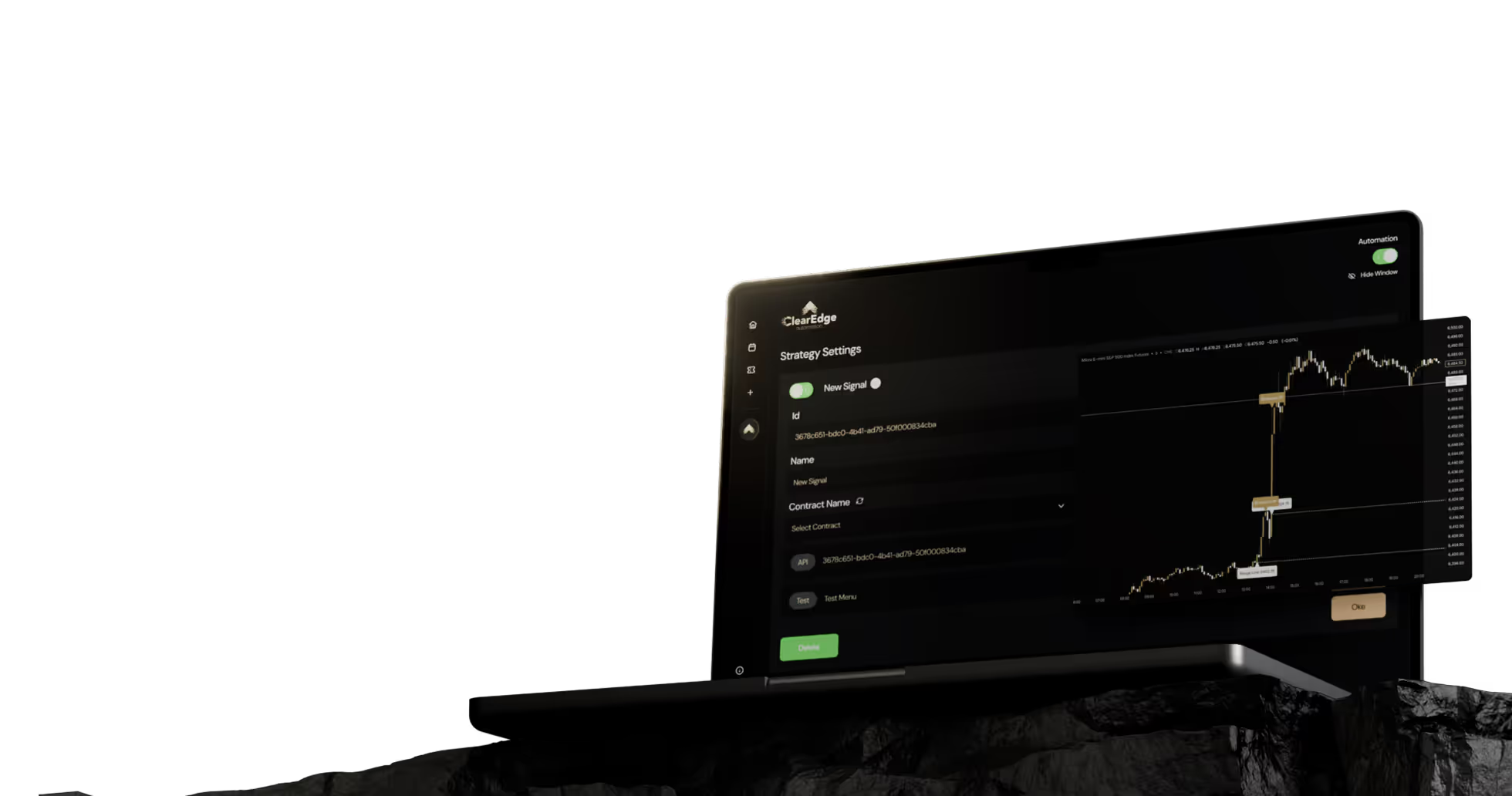

Webhook: An automated message sent from one application to another when a specific event occurs. In trading automation, webhooks transmit signal data from TradingView to execution platforms like ClearEdge Trading when alerts fire.

What Are the Main Types of Trading Signals?

Trading signals fall into three primary categories: indicator-based signals, pattern recognition signals, and time-based signals. Each type analyzes different market characteristics and serves distinct trading strategies.

Indicator-Based Signals

These signals trigger when technical indicators reach specific values or cross thresholds. Common examples include RSI crossing above 70 (overbought), moving average crossovers (50 EMA crossing 200 EMA), or MACD histogram changing from negative to positive. Indicator signals work well for trend-following and momentum strategies in liquid markets like ES and NQ futures.

Pattern Recognition Signals

Pattern signals identify specific price formations such as head-and-shoulders, double tops, engulfing candles, or breakouts from consolidation ranges. These signals typically require more complex programming logic to detect multi-bar patterns accurately. False positives are common, so many traders combine pattern signals with volume or indicator confirmation.

Time-Based Signals

These signals activate at specific times regardless of price action—most commonly for Opening Range (OR) and Initial Balance (IB) strategies. For example, a signal might trigger at 9:30 AM ET when ES futures open for regular trading hours, or at 9:00 AM ET to mark the overnight high and low. Time signals often combine with price levels to create conditional entries like "if price breaks above the opening range high within the first 30 minutes, go long."

Signal TypeBest ForTypical FrequencyFalse Positive RateIndicator-BasedTrend following, momentum2-5 per day30-50%Pattern RecognitionReversal, breakout1-3 per day40-60%Time-BasedOpening range, session breaks1-2 per day25-40%

How Are Signals Generated and Transmitted?

Signal generation begins with defining precise entry conditions in code. In TradingView Pine Script, this looks like: longCondition = ta.crossover(ta.sma(close, 20), ta.sma(close, 50)). When this condition evaluates to true at bar close, TradingView creates an alert event.

The alert contains a customizable message field where traders encode trade parameters. A typical webhook message includes: {"ticker": "ES", "action": "buy", "quantity": 1, "stop": 5100, "target": 5120}. This JSON-formatted data provides all information needed for execution without human interpretation.

Transmission happens through TradingView's webhook URL field in alert settings. Traders paste their automation platform's unique webhook endpoint. When the alert fires, TradingView sends the message to that URL via HTTPS POST request. Platforms like ClearEdge Trading receive the webhook, validate the format, and translate it into broker-specific order syntax within milliseconds.

For strategies requiring multiple simultaneous signals—such as pairs trading or portfolio approaches—traders typically set up separate alerts for each instrument. Each alert webhook contains unique identifiers so the automation platform can route orders to the correct contract and account. Some advanced setups use Python scripts or Node.js servers to aggregate signals from multiple sources before execution.

How Do Signals Connect to Automated Execution?

The connection between signal and execution requires three components: a signal source (TradingView), a translation layer (automation platform), and a broker API (TradeStation, NinjaTrader, AMP, etc.). The TradingView automation workflow handles this chain automatically.

When a webhook arrives at the automation platform, the system first validates the message structure and authentication token. It then parses the trade parameters and checks them against any configured risk limits—daily loss caps, maximum position size, restricted trading times. If all checks pass, the platform constructs a broker-specific order object.

For ES futures through AMP, this might translate to: Order Type = Market, Quantity = 1, Symbol = ESH4 (March 2024 contract). The platform submits this order via the broker's API. Execution confirmation flows back through the same pathway—broker confirms fill, platform logs the execution, and the user sees the completed trade in their dashboard. Round-trip latency from signal to fill confirmation averages 100-300ms for most retail setups.

Latency: The time delay between signal generation and order execution. Lower latency reduces slippage—the difference between intended and actual fill prices. Retail automation systems typically achieve 50-500ms latency, while institutional systems operate under 10ms.

Multi-account execution allows one signal to drive trades across multiple broker accounts simultaneously. This is particularly useful for traders managing personal accounts alongside prop firm challenges, where each account may have different position sizing rules but follows the same signal logic. Platforms supporting multiple broker integrations handle this coordination automatically.

What Makes a Trading Signal Effective?

Effective signals balance three characteristics: accuracy (low false positive rate), clarity (unambiguous trade parameters), and timeliness (minimal lag between condition and execution). Accuracy above 45% is considered strong for most systematic strategies, as risk management and position sizing determine profitability more than raw win rate.

Clarity requires signals to specify all five execution parameters explicitly: entry price or condition, direction, quantity, stop loss level, and profit target. Vague signals like "buy ES if bullish" cannot be automated. Precise signals like "buy 1 ES at market if close > 5110, stop 5105, target 5120" execute without interpretation.

Timeliness matters most in fast-moving markets. During FOMC announcements or NFP releases (first Friday monthly, 8:30 AM ET), ES can move 20-30 points in seconds. A signal delayed by 5 seconds might enter 10+ ticks away from intended price—$125+ slippage per contract. Real-time signal evaluation and low-latency execution infrastructure minimize this issue.

Characteristics of Strong Signals

- Multiple confirmation factors (indicator + volume + price action)

- Clear entry and exit rules with specific numerical thresholds

- Backtested across 2+ years of historical data

- Positive expectancy (average win size > average loss size × win rate)

- Aligned with market conditions (trend-following signals in trending markets)

Common Signal Weaknesses

- Over-optimization (works perfectly on past data, fails live)

- Lag (lagging indicators like moving averages miss turning points)

- No context awareness (fires during illiquid overnight sessions)

- Single-indicator dependency (higher false positive rate)

- Ignores market regime changes (volatility expansion/contraction)

Signal effectiveness also depends on the underlying market. ES futures with 1.5 million average daily volume provide tight spreads and reliable fills. Thinly traded contracts may see wide spreads where signal accuracy becomes less relevant than execution quality. Test any signal system in appropriate futures instruments during paper trading before risking capital.

Frequently Asked Questions

1. Can I use TradingView signals without knowing how to code?

Yes, TradingView's Community Scripts library contains thousands of pre-built indicators with alert capabilities. You can apply these to your charts and configure alerts without writing Pine Script. However, customizing signal logic or combining multiple conditions requires basic Pine Script knowledge or using no-code automation platforms that provide template strategies.

2. How many signals per day is typical for futures trading strategies?

Conservative trend-following strategies generate 1-3 signals per day per instrument. Scalping strategies may produce 10-30 signals daily. More signals don't necessarily mean better results—transaction costs (commissions plus slippage) accumulate quickly. Most profitable retail futures strategies average 2-5 trades per day on contracts like ES and NQ.

3. What happens if my signal fires during a news event like NFP?

Most automation platforms allow time-based filters to block signals during high-impact news. You can configure "no-trade windows" around scheduled events like Non-Farm Payrolls (first Friday, 8:30 AM ET) or FOMC announcements (2:00 PM ET on meeting days). Without these filters, signals during news often experience severe slippage as bid-ask spreads widen dramatically.

4. Do algorithmic trading signals work better on certain timeframes?

Signal effectiveness varies by strategy type rather than universal timeframe rules. Mean reversion signals often work better on 5-15 minute charts where short-term deviations correct quickly. Trend-following signals typically perform better on 1-hour to daily charts where noise is filtered. Backtest your specific signal logic across multiple timeframes to identify optimal bar periods for your approach.

5. How do I know if my trading signal has stopped working?

Monitor key metrics weekly: win rate, average profit factor, maximum drawdown, and trade frequency. If win rate drops 10+ percentage points below backtest results, or drawdown exceeds historical maximums by 50%, the signal may have degraded. Market regime changes (volatility shifts, correlation breakdowns) cause most signal failures. Many traders use rolling 30-day performance reviews to catch deterioration early.

Conclusion

Algorithmic trading signals transform market analysis into executable trade instructions through systematic condition evaluation, webhook transmission, and broker API integration. Effective signals combine multiple confirmation factors, specify precise entry and exit parameters, and execute with minimal latency to reduce slippage in fast-moving futures markets.

For traders implementing signal-based automation, start with simple single-indicator signals during paper trading, measure actual performance against backtest expectations, and gradually add complexity only when simpler approaches prove robust. The complete guide to algorithmic trading covers strategy development and testing in greater depth.

Ready to automate your signal execution? Explore ClearEdge Trading to see how webhook-based automation connects TradingView signals to your futures broker in milliseconds.

References

- CME Group. "E-mini S&P 500 Futures Contract Specs." https://www.cmegroup.com/markets/equities/sp/e-mini-sp500.html

- TradingView. "Pine Script v5 User Manual - Alerts." https://www.tradingview.com/pine-script-docs/en/v5/concepts/Alerts.html

- Commodity Futures Trading Commission. "Automated Trading." https://www.cftc.gov/LawRegulation/DoddFrankAct/Rulemakings/DF_23_AutomatedTrading/index.htm

- Futures Industry Association. "FIA Annual Volume Survey 2024." https://www.fia.org/resources/fia-annual-volume-survey

Disclaimer: This article is for educational and informational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About Us

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.