Algorithmic Trading: A Complete Guide for Beginners

Learn how algorithmic trading works, from institutional origins to no-code retail platforms. Covers strategy types, backtesting, futures automation, and more.

Algorithmic trading is the use of computer programs to execute trades based on predefined rules and mathematical models, removing human decision-making from the execution process. What began as an institutional tool used by investment banks and hedge funds has become accessible to retail traders through modern platforms that eliminate the traditional programming requirements. Today, individual traders can deploy algorithmic strategies across futures, stocks, and other markets without writing code, benefiting from the same systematic approach that has dominated professional trading for decades.

The term "algorithmic trading" encompasses a broad range of approaches, from simple rule-based automation to sophisticated machine learning systems. At its core, all algorithmic trading shares a common principle: defining trading logic in advance and letting computers handle execution. This removes the emotional interference, inconsistency, and physical limitations that undermine human traders. Whether the algorithm is as simple as "buy when price crosses above the 50-day moving average" or as complex as a neural network analyzing thousands of variables, the structural advantage remains the same.

For retail traders exploring algorithmic trading, futures markets offer particular advantages. Futures trade nearly 24 hours per day, creating opportunities that require automated monitoring. The standardized contracts, centralized exchanges, and deep liquidity of major futures instruments make them well-suited for algorithmic execution. Understanding algorithmic trading fundamentals provides the foundation for successful futures automation, whether you ultimately build custom strategies or use platforms that provide strategies for you.

Algorithmic trading uses computer programs to execute trades based on predefined rules, removing human emotion and inconsistency from trading decisions. Once exclusive to institutions, algorithmic approaches are now accessible to retail traders through platforms that eliminate programming requirements while preserving the systematic advantages.

- Algorithmic trading executes predefined rules automatically, eliminating emotional interference and ensuring consistent strategy application

- Approximately 70-80% of US equity market volume now comes from algorithmic trading, demonstrating institutional adoption [1]

- Retail algorithmic trading has become accessible through no-code platforms that handle technical complexity

- Futures markets are particularly suited for algorithmic trading due to extended hours, liquidity, and standardized contracts

- Successful algorithmic trading requires sound strategy logic; automation amplifies both good and bad strategies

- Modern platforms range from DIY signal-execution bridges to turnkey systems with strategies included

- What Is Algorithmic Trading?

- History and Evolution of Algorithmic Trading

- How Trading Algorithms Work

- Types of Algorithmic Trading Strategies

- Algorithmic Trading vs. Manual Trading

- Algorithmic Futures Trading

- How to Start Algorithmic Trading

- Algorithmic Trading Without Coding

- Building Your First Trading Algorithm

- Backtesting and Strategy Validation

- Risks and Limitations of Algorithmic Trading

- Frequently Asked Questions

What Is Algorithmic Trading?

Algorithmic trading, often called algo trading or automated trading, is a method of executing trades using computer programs that follow defined instructions for placing orders. These instructions, or algorithms, can incorporate timing, price, quantity, and any mathematical model to make trading decisions. The algorithm monitors market conditions continuously and executes trades when predefined criteria are satisfied, without requiring human intervention for each decision.

Algorithm: A step-by-step procedure or set of rules for solving a problem or accomplishing a task. In trading, algorithms define the specific conditions under which trades should be entered, managed, and exited. Learn more

The defining characteristic of algorithmic trading is the removal of human discretion from individual trade decisions. Rather than a trader deciding in real-time whether to buy or sell, the algorithm makes these decisions based on logic defined in advance. This distinction matters because human real-time decisions are subject to emotional bias, fatigue, and inconsistency, while algorithms execute identically every time their conditions are met.

Algorithmic trading encompasses several related but distinct concepts:

- Automated trading: Using software to execute trades automatically based on signals, which may come from algorithms or other sources

- Quantitative trading: Using mathematical and statistical models to identify trading opportunities, often implemented through algorithms

- High-frequency trading (HFT): A subset of algorithmic trading characterized by extremely high speeds and large trade volumes, typically requiring institutional infrastructure

- Systematic trading: Following a defined, repeatable process for trading decisions, which may or may not be fully automated

For retail traders, the practical distinction matters less than the core benefit: replacing emotional, inconsistent human execution with systematic, rule-based approaches. Whether called algorithmic trading, automated trading, or systematic trading, the outcome is the same: your strategy executes exactly as designed, every time.

History and Evolution of Algorithmic Trading

Algorithmic trading evolved from institutional necessity into a technology now accessible to individual traders worldwide. Understanding this history provides context for why algorithmic approaches dominate modern markets and how retail traders gained access to tools once reserved for Wall Street.

The Institutional Origins (1970s-1990s)

Algorithmic trading began in the 1970s when the New York Stock Exchange introduced designated order turnaround (DOT) systems, allowing electronic order transmission. Investment banks developed early algorithms primarily for executing large orders efficiently without moving markets. These algorithms broke large orders into smaller pieces, timing execution to minimize market impact.

The 1980s and 1990s saw expansion into more sophisticated strategies. Program trading, which executes baskets of stocks simultaneously, became common. The development of electronic communication networks (ECNs) and increasing market electronification created infrastructure for faster, more complex algorithms [2].

The High-Frequency Revolution (2000s)

The 2000s brought high-frequency trading, where firms competed on microsecond execution speeds. HFT firms invested heavily in technology infrastructure, including co-located servers placed physically close to exchange matching engines. By 2010, HFT accounted for over 50% of US equity volume [3].

This era also saw the rise of quantitative hedge funds using sophisticated mathematical models. Firms like Renaissance Technologies, DE Shaw, and Two Sigma demonstrated that systematic approaches could generate consistent returns, further legitimizing algorithmic methods.

High-Frequency Trading (HFT): A type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios. HFT firms use powerful computers to execute millions of orders in fractions of a second. Learn more

Retail Democratization (2010s-Present)

The 2010s began the democratization of algorithmic trading for retail participants. Several developments enabled this shift:

- Cloud computing: Eliminated the need for expensive server infrastructure

- API access: Brokers began offering programmatic account access to retail clients

- Platform development: TradingView, NinjaTrader, and similar platforms provided strategy development tools

- No-code solutions: Platforms emerged that eliminated programming requirements entirely

- Reduced costs: Commission-free trading and lower platform costs made algorithmic approaches economically viable for smaller accounts

Today, retail traders can access algorithmic trading through multiple paths: learning to code strategies themselves, using visual strategy builders, or subscribing to platforms that provide complete algorithmic systems. The technology gap between retail and institutional has narrowed dramatically, though institutional players retain advantages in speed and sophistication for certain strategies.

How Trading Algorithms Work

Trading algorithms work by continuously monitoring market data, evaluating predefined conditions, and executing orders when those conditions are satisfied. While the internal complexity varies enormously between simple and sophisticated algorithms, the basic operational framework remains consistent across all algorithmic trading systems.

The Algorithmic Trading Workflow

- Data ingestion: The algorithm receives real-time market data including prices, volumes, and potentially other information (news, economic indicators, etc.)

- Signal generation: The algorithm's logic evaluates whether current conditions match the criteria for trading action

- Order creation: When conditions are met, the algorithm generates order instructions specifying direction, quantity, price, and order type

- Order execution: Orders are transmitted to the broker/exchange and executed

- Position management: The algorithm monitors open positions for exit conditions, stop losses, and profit targets

- Risk management: Continuous evaluation of portfolio risk, position sizing, and exposure limits

Components of a Trading Algorithm

Entry logic: The conditions that trigger opening a new position. This might be technical indicators crossing thresholds, price breaking through levels, or complex multi-factor models generating signals.

Exit logic: The conditions for closing positions, including profit targets, stop losses, time-based exits, and signal-based reversals.

Position sizing: Rules determining how large each position should be, often based on account equity, volatility, or risk per trade.

Risk management: Safeguards including maximum position limits, daily loss limits, correlation controls, and exposure caps.

Execution logic: How orders are actually placed, including order types (market, limit, stop), timing considerations, and handling of partial fills.

Simple Algorithm Example

A basic moving average crossover algorithm illustrates these components:

- Entry logic: Buy when the 10-period moving average crosses above the 50-period moving average

- Exit logic: Sell when the 10-period moving average crosses below the 50-period moving average, or when stop loss is hit

- Position sizing: Risk 1% of account equity per trade

- Risk management: Stop loss at 2% below entry price; maximum one open position

- Execution logic: Use market orders for entries; limit orders for profit targets

Even this simple algorithm encapsulates the essential elements of algorithmic trading. More sophisticated algorithms add complexity to each component but maintain the same structural framework.

Types of Algorithmic Trading Strategies

Algorithmic trading strategies fall into several categories based on their underlying logic, time horizon, and market assumptions. Understanding these categories helps traders evaluate which approaches align with their goals and the characteristics of their target markets.

Trend Following Algorithms

Trend following algorithms identify and exploit directional price movements, entering positions in the direction of established trends and exiting when trends show signs of reversal. These algorithms assume that price movements tend to persist, a phenomenon documented in academic research across many markets [4].

Characteristics of trend following:

- Lower win rates (typically 40-50%) with larger average wins than losses

- Performs best in strongly trending markets

- Struggles during range-bound, choppy conditions

- Often uses moving averages, breakouts, or momentum indicators

Trend Following: A trading strategy that attempts to capture gains through analysis of an asset's momentum in a particular direction. Trend followers buy assets that are rising and sell assets that are falling. Learn more

Mean Reversion Algorithms

Mean reversion algorithms bet that prices will return to average levels after deviating significantly. When price moves too far too fast in one direction, these algorithms take positions expecting a snapback toward the mean.

Characteristics of mean reversion:

- Higher win rates (typically 55-70%) with smaller average wins relative to losses

- Performs best in range-bound, oscillating markets

- Struggles during strong trends when "extreme" conditions persist

- Often uses oscillators like RSI, Bollinger Bands, or statistical deviation measures

Arbitrage Algorithms

Arbitrage algorithms exploit price discrepancies between related instruments or markets. Pure arbitrage involves simultaneous buying and selling to capture risk-free profits from pricing inefficiencies. Statistical arbitrage uses historical relationships to identify and trade relative mispricings.

Characteristics of arbitrage:

- Very high win rates when true arbitrage opportunities exist

- Opportunities are rare and quickly exploited in modern markets

- Requires fast execution and often institutional infrastructure

- Retail access is limited to less competitive forms of relative value trading

Market Making Algorithms

Market making algorithms provide liquidity by simultaneously quoting bid and ask prices, profiting from the spread between them. Market makers facilitate trading for others while managing their own inventory risk.

Characteristics of market making:

- High trade frequency with small profits per trade

- Requires sophisticated inventory and risk management

- Generally requires institutional infrastructure and regulatory designation

- Not accessible to retail traders in meaningful form

Momentum and Breakout Algorithms

Momentum algorithms identify assets with strong recent performance and bet on continuation. Breakout algorithms specifically trigger when price moves beyond significant levels like prior highs, support/resistance zones, or consolidation boundaries.

Characteristics of momentum/breakout:

- Related to trend following but often with shorter holding periods

- Vulnerable to false breakouts requiring careful filter design

- Often incorporates volume confirmation

- Well-suited to futures markets with their extended trading hours

Strategy Comparison

Strategy TypeWin RateBest Market ConditionsRetail Accessibility Trend Following40-50%Strong directional marketsHigh Mean Reversion55-70%Range-bound marketsHigh Momentum/Breakout45-55%Volatile, directional marketsHigh Statistical Arbitrage60-75%Stable relationshipsModerate Pure Arbitrage95%+Market inefficienciesLow Market Making65-80%Liquid marketsVery Low

Algorithmic Trading vs. Manual Trading

Algorithmic and manual trading represent fundamentally different approaches to market participation, each with distinct advantages and limitations. Understanding these differences helps traders choose the approach that matches their situation, skills, and goals.

Key Differences

FactorAlgorithmic TradingManual Trading Decision makingPredefined rules executed automaticallyReal-time human judgment Emotional influenceNone (emotions cannot affect execution)Constant (requires psychological discipline) SpeedMilliseconds to secondsSeconds to minutes ConsistencyPerfect (same conditions = same actions)Variable (depends on mental state) Market coverage24/7 across multiple instrumentsLimited by human attention and schedule AdaptabilityRequires reprogramming for new conditionsInstant adaptation to novel situations Startup effortHigh (strategy development, setup)Low (can start trading immediately) Ongoing effortLow (monitoring and occasional adjustment)High (constant attention during trading)

When Algorithmic Trading Excels

- Rule-based strategies: When trading logic can be precisely defined, algorithms execute flawlessly

- Extended market hours: Futures and forex trade nearly around the clock; algorithms do not sleep

- Multiple instruments: Algorithms can monitor and trade many markets simultaneously

- Psychological challenges: Traders who struggle with discipline, revenge trading, or emotional decisions benefit from algorithmic execution

- Time constraints: Professionals with careers cannot monitor markets during trading hours

- Backtestable strategies: Algorithms enable rigorous historical testing before risking capital

When Manual Trading Excels

- Novel situations: Humans can recognize and adapt to unprecedented market conditions

- Discretionary judgment: Some trading approaches rely on pattern recognition that resists precise codification

- Low-frequency decisions: Long-term investors making occasional trades gain little from automation

- Learning phase: New traders benefit from hands-on experience before automating

- Qualitative factors: Fundamental analysis incorporating non-quantifiable information

The Hybrid Approach

Many successful traders combine algorithmic and manual elements:

- Algorithmic execution, manual strategy selection: Human decides overall market exposure; algorithm handles execution

- Algorithmic signals, manual confirmation: Algorithm identifies opportunities; human approves execution

- Algorithmic risk management: Human enters trades; algorithm manages stops and position sizing

- Multiple approaches: Some strategies automated, others traded manually based on their nature

Algorithmic Futures Trading

Futures markets offer characteristics that make them particularly well-suited for algorithmic trading. The combination of extended trading hours, deep liquidity, standardized contracts, and favorable execution costs creates an environment where algorithmic advantages can be fully realized.

Why Futures for Algorithmic Trading

Extended trading hours: Major futures contracts like the E-mini S&P 500 (ES) and E-mini Nasdaq-100 (NQ) trade nearly 23 hours per day. Algorithms can capture opportunities during Asian and European sessions that manual traders would miss while sleeping.

Liquidity and execution: Popular futures contracts offer exceptional liquidity with tight bid-ask spreads. The E-mini S&P 500 is one of the most liquid instruments in the world, ensuring algorithms receive quality fills even for larger orders.

Standardized contracts: Unlike stocks where each company is unique, futures contracts are standardized by the exchange. One ES contract is identical to any other ES contract, simplifying algorithmic implementation.

Centralized exchange: Futures trade on regulated exchanges (CME Group for most US futures) rather than fragmented venues, providing consistent data and execution.

Leverage efficiency: Futures provide capital-efficient exposure to major markets, allowing algorithmic strategies to deploy capital effectively.

Popular Futures for Algorithmic Trading

ContractSymbolCharacteristicsAlgo Suitability E-mini S&P 500ESHighest liquidity, moderate volatilityExcellent E-mini Nasdaq-100NQHigh volatility, tech sector exposureExcellent GoldGCSafe-haven asset, 23-hour tradingVery Good Crude OilCLHighest volatility, event-drivenGood (requires caution) Treasury BondsZBInterest rate exposure, Fed sensitivityVery Good Euro FX6ECurrency exposure, 24-hour tradingExcellent

Futures Algorithm Considerations

When developing or selecting algorithms for futures trading:

- Session behavior: Futures behave differently during US, European, and Asian sessions; consider session-specific parameters

- Roll management: Futures contracts expire periodically; algorithms must handle rollovers to new contracts

- News sensitivity: Economic releases move futures rapidly; include news event handling

- Volatility scaling: Futures volatility varies significantly; consider dynamic position sizing

- Micro contracts: Micro futures (MES, MNQ, etc.) enable algorithmic trading with smaller capital

The algorithmic trading resources on ClearEdge provide futures-specific guidance for traders implementing systematic approaches.

How to Start Algorithmic Trading

Starting algorithmic trading requires following a structured path that builds knowledge and skills progressively. Rushing to live trading without adequate preparation leads to preventable losses. This section outlines the steps from complete beginner to live algorithmic trading.

Step 1: Build Foundational Knowledge

Before writing or selecting any algorithm, understand the basics:

- Market mechanics: How orders work, different order types, market microstructure

- Trading concepts: Support/resistance, trends, volatility, risk management

- Futures fundamentals: Contract specifications, margin, expiration, settlement

- Statistical concepts: Probability, expected value, variance, correlation

Resources include books, online courses, broker educational materials, and reputable trading websites. Invest time here before touching any trading platform.

Step 2: Choose Your Path

Algorithmic trading offers multiple entry points:

Coding path: Learn Python, R, or another programming language and build algorithms from scratch. This provides maximum flexibility but requires significant time investment and technical aptitude.

No-code platform path: Use visual strategy builders (TradingView Pine Script, NinjaTrader Strategy Builder) to create algorithms without traditional programming. Lower barrier to entry but some limitations.

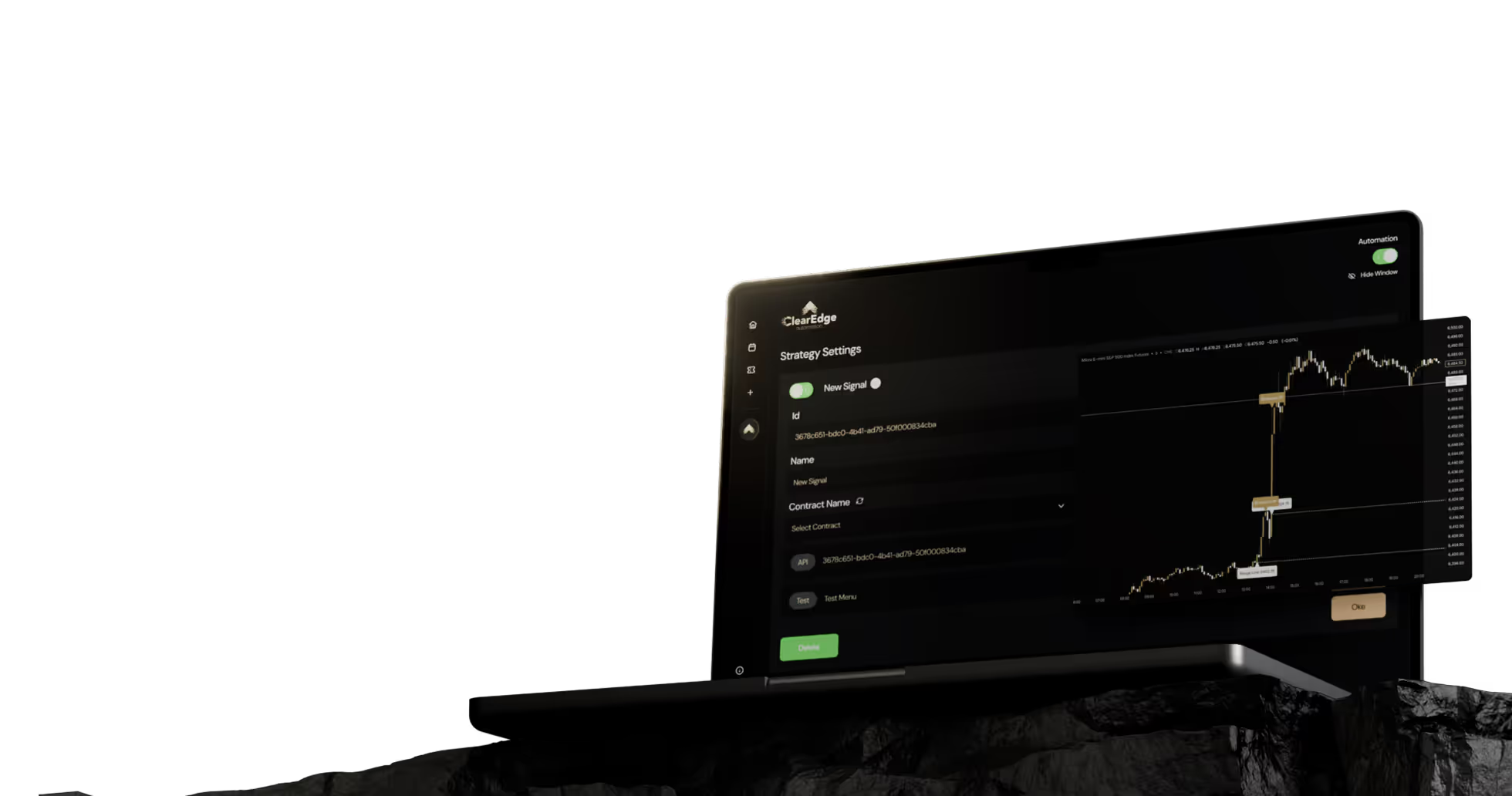

Turnkey solution path: Subscribe to platforms that provide complete algorithmic systems. Fastest to live trading but least customization. Platforms like ClearEdge fall into this category, offering pre-built algorithmic strategies that users can deploy without development.

Step 3: Paper Trading and Simulation

Before risking real capital:

- Paper trade for minimum 2-4 weeks: Simulate algorithmic trading to verify systems work correctly

- Test through various market conditions: Trending, ranging, volatile, quiet

- Verify all parameters: Position sizing, stop losses, order execution

- Track performance metrics: Win rate, profit factor, drawdown, expectancy

Step 4: Live Trading with Minimal Size

When transitioning to live trading:

- Start with minimum position sizes: One micro contract allows live testing with minimal risk

- Expect differences from simulation: Slippage, partial fills, and execution timing affect live results

- Maintain detailed records: Track every trade for analysis

- Scale gradually: Increase size only after demonstrating consistent live performance

Step 5: Ongoing Optimization and Management

Algorithmic trading requires ongoing attention:

- Regular performance review: Weekly analysis of results versus expectations

- Market condition monitoring: Strategies may need adjustment as conditions evolve

- System maintenance: Software updates, broker changes, and technical issues

- Continuous learning: Markets evolve; successful traders evolve with them

Algorithmic Trading Without Coding

Algorithmic trading without coding has become increasingly viable through platforms that abstract away programming complexity. These no-code and low-code solutions enable traders without technical backgrounds to implement and deploy trading algorithms.

No-Code Platform Options

Visual strategy builders: Platforms like NinjaTrader's Strategy Builder allow creating algorithms by connecting logic blocks visually rather than writing code.

Pine Script on TradingView: While technically a scripting language, Pine Script is simpler than general-purpose programming languages and designed specifically for trading strategy creation. Many traders without programming backgrounds successfully use Pine Script.

Rule-based automation platforms: Platforms that let you define rules through form-based interfaces: "If price crosses above X, then buy Y contracts."

Strategy-included platforms: Platforms like ClearEdge that provide complete algorithmic strategies eliminate development entirely. Users select and configure existing strategies rather than building their own.

Advantages of No-Code Approaches

- Faster time to live trading: Skip months or years of programming education

- Focus on strategy logic: Concentrate on what to trade rather than how to implement

- Lower barrier to entry: Anyone can access algorithmic trading benefits

- Reduced technical maintenance: Platform handles infrastructure complexity

Limitations of No-Code Approaches

- Reduced flexibility: Cannot implement strategies that platform does not support

- Platform dependency: Locked into chosen platform's capabilities and limitations

- Limited advanced features: Complex strategies may require coding regardless

- Potential performance constraints: Some platforms impose execution or complexity limits

Choosing the Right No-Code Approach

Choose strategy-included platforms if:

- You want to start trading quickly without strategy development

- You prefer turnkey solutions over building from scratch

- You lack confidence in strategy development abilities

- You value simplicity over maximum customization

Choose visual builders/Pine Script if:

- You have specific strategy ideas you want to implement

- You enjoy the strategy development process

- You want to learn algorithmic concepts progressively

- You need capabilities beyond what turnkey platforms offer

The ClearEdge approach specifically targets traders who want algorithmic trading benefits without the development complexity, providing ready-to-trade strategies that users can deploy immediately.

Building Your First Trading Algorithm

For traders choosing to build their own algorithms rather than using pre-built strategies, the development process follows a structured approach. Even simple algorithms benefit from methodical development to ensure robust, reliable trading systems.

Define Your Trading Hypothesis

Every algorithm starts with a hypothesis about market behavior:

- Clear premise: "Markets tend to continue in the direction of strong momentum"

- Testable conditions: "When the 20-period RSI exceeds 70, price tends to continue rising for the next 5 periods"

- Edge source: Why should this work? What behavioral or structural factor creates the opportunity?

Vague hypotheses produce vague algorithms. The clearer your initial thinking, the better your resulting system.

Specify Entry and Exit Rules

Convert your hypothesis into precise rules:

Entry conditions must be unambiguous:

- Exactly which conditions trigger a trade?

- What must be true simultaneously for entry?

- At what price or signal level does the entry occur?

Exit conditions must be equally precise:

- When does the algorithm close a profitable position?

- Where is the stop loss placed?

- Are there time-based exits?

- What happens if an opposing signal occurs?

Position Sizing and Risk Management

Define how much to risk on each trade:

- Fixed fractional: Risk a set percentage of equity per trade (e.g., 1%)

- Volatility-based: Adjust size based on current market volatility

- Kelly criterion: Mathematical approach to optimal sizing based on edge and variance

Also specify safeguards:

- Maximum position size limits

- Daily loss limits that halt trading

- Maximum consecutive losses before pause

- Correlation limits if trading multiple instruments

Implementation Considerations

Data requirements: What data does your algorithm need? Price bars, volume, other instruments, economic data?

Execution approach: Market orders for speed? Limit orders for price improvement? How to handle partial fills?

Frequency: How often does the algorithm evaluate conditions? Every tick? Every bar close? Different answers suit different strategies.

Documentation

Document your algorithm thoroughly:

- Trading hypothesis and rationale

- Complete entry and exit rules

- Position sizing methodology

- Risk management parameters

- Expected performance characteristics

- Conditions under which the strategy should be reviewed or stopped

Good documentation enables you to evaluate whether the algorithm is performing as designed and facilitates future modifications.

Backtesting and Strategy Validation

Backtesting applies trading algorithms to historical data to evaluate how they would have performed. While essential for algorithm development, backtesting carries significant pitfalls that can mislead traders into deploying flawed strategies. Understanding both the value and limitations of backtesting is critical.

Backtesting: The process of testing a trading strategy on historical data to assess how it would have performed in the past. Backtesting helps identify flawed strategies before risking capital but cannot guarantee future performance. Learn more

The Value of Backtesting

- Strategy validation: Confirms whether the basic logic works historically

- Parameter optimization: Tests different indicator settings, stop distances, etc.

- Risk assessment: Reveals historical drawdowns and losing periods

- Expectancy calculation: Determines theoretical expected value per trade

- Confidence building: Provides data supporting (or refuting) strategy viability

Common Backtesting Mistakes

Overfitting: Optimizing parameters so precisely to historical data that the strategy captures noise rather than genuine patterns. Overfitted strategies show spectacular backtests but fail in live trading [5].

Signs of overfitting:

- Too many optimized parameters

- Dramatic performance difference between in-sample and out-of-sample periods

- Rules that seem arbitrary or complex without clear rationale

- Exceptional backtest results (if it seems too good to be true, it probably is)

Survivorship bias: Testing on data that only includes assets that survived to present day, excluding failed companies or delisted instruments.

Look-ahead bias: Inadvertently using information that would not have been available at the time of the simulated trade.

Ignoring execution costs: Backtests often assume perfect fills; real trading involves slippage and commissions.

Validation Best Practices

- Out-of-sample testing: Develop on one data period, validate on a separate period never used during development

- Walk-forward analysis: Progressively optimize on rolling windows and test on subsequent periods

- Monte Carlo simulation: Randomize trade order to assess strategy robustness

- Paper trading: Test in real-time simulation before live capital

- Minimal parameters: Simpler strategies with fewer optimized parameters typically generalize better

Interpreting Backtest Results

Key metrics to evaluate:

MetricWhat It MeasuresGood Values (General) Win RatePercentage of profitable tradesStrategy-dependent; context matters Profit FactorGross profits / Gross lossesAbove 1.5 Sharpe RatioRisk-adjusted returnsAbove 1.0 Maximum DrawdownLargest peak-to-trough declineAcceptable to your risk tolerance ExpectancyAverage profit per tradePositive after costs Number of TradesStatistical significanceMinimum 100, preferably 500+

Risks and Limitations of Algorithmic Trading

Algorithmic trading offers significant advantages but is not without risks and limitations. Understanding these helps traders set realistic expectations and implement appropriate safeguards.

Strategy Risks

Strategy failure: Algorithms that worked historically may stop working as market conditions change or as the edge becomes crowded. No strategy works forever; periodic review and adaptation is necessary.

Overfitting: As discussed, strategies optimized too precisely on historical data fail in live trading. This is the most common cause of algorithmic strategy failure.

Black swan events: Algorithms designed for normal market conditions may perform poorly during extreme events (flash crashes, circuit breakers, liquidity crises).

Regime changes: Strategies designed for one market regime (trending, low volatility) may fail when regimes shift. Regime detection is difficult and often apparent only in hindsight.

Technical Risks

System failures: Servers crash, internet connections fail, platforms experience outages. Technical problems can leave positions unmanaged at critical moments.

Coding errors: Bugs in algorithm code can cause unintended behavior, including incorrect order sizes, wrong direction trades, or failure to exit positions.

Data issues: Bad data feeds can trigger false signals. Algorithms cannot distinguish between genuine price moves and data errors.

Broker/exchange issues: Broker outages, exchange halts, and connectivity problems affect execution.

Execution Risks

Slippage: The difference between expected and actual execution prices. Fast markets, illiquid instruments, and large orders increase slippage.

Partial fills: Limit orders may only partially fill, leaving unintended position sizes or orphaned stop orders.

Latency: Time delays between signal generation and order execution. Significant for short-term strategies but less important for longer-term approaches.

Mitigation Strategies

- Diversification: Multiple uncorrelated strategies and instruments reduce single-strategy risk

- Position sizing: Conservative sizing ensures no single failure is catastrophic

- Broker-level stops: Stop orders at the broker execute even if your systems fail

- Monitoring: Regular system checks catch problems early

- Kill switches: Ability to quickly halt all trading when problems arise

- Redundancy: Backup systems and alternative execution paths for critical strategies

The common automation mistakes guide provides additional risk mitigation guidance.

Frequently Asked Questions

1. What is the difference between algorithmic trading and automated trading?

The terms overlap significantly and are often used interchangeably. Technically, algorithmic trading refers to using computer algorithms to make trading decisions, while automated trading refers to executing trades automatically without manual intervention. In practice, automated trading typically implements algorithms, and algorithmic strategies are typically executed automatically. For retail traders, the distinction is largely semantic; both terms describe systematic, computer-driven trading approaches.

2. Do I need to know how to code for algorithmic trading?

No, coding is no longer required for algorithmic trading. While programming skills provide maximum flexibility, modern platforms offer multiple no-code paths. Visual strategy builders create algorithms through drag-and-drop interfaces. Pine Script on TradingView is simpler than traditional programming. Platforms like ClearEdge provide complete algorithmic strategies that require no coding or strategy development at all. Choose your path based on your goals: coding for maximum customization, no-code tools for moderate customization, or turnkey platforms for fastest deployment.

3. How much money do I need to start algorithmic trading?

Minimum capital depends on your chosen market and approach. Futures trading with micro contracts can begin with $3,000-5,000, though $10,000+ provides better flexibility. Platform costs add $50-200/month depending on your choice. Commission and data costs vary by broker. More important than minimum capital is having enough to survive normal drawdowns without risking your ability to continue trading. A strategy with 20% historical drawdown should not be traded with capital you cannot afford to see decline 20%.

4. Is algorithmic trading profitable?

Algorithmic trading can be profitable, but success is not guaranteed. The profitability of algorithmic trading depends entirely on the quality of the strategies being executed. Automation amplifies results in both directions: a good strategy produces consistent profits, while a flawed strategy produces consistent losses. Professional quantitative funds have demonstrated that algorithmic approaches can generate sustained returns, but retail traders face challenges including limited research resources, higher relative costs, and less sophisticated infrastructure. Realistic expectations and rigorous strategy validation are essential.

5. What are the best markets for algorithmic trading?

Liquid markets with extended trading hours suit algorithmic trading best. Futures markets (ES, NQ, GC, CL) offer nearly 24-hour trading, deep liquidity, and standardized contracts. Forex markets provide similar benefits with even longer trading hours. Major stock indices and large-cap equities offer sufficient liquidity for most retail algorithmic strategies. Less liquid markets (small-cap stocks, exotic derivatives) present challenges including wider spreads, difficulty executing larger orders, and limited historical data for backtesting.

6. How long does it take to develop a profitable algorithm?

Development timelines vary dramatically based on approach and prior experience. Building algorithms from scratch requires learning programming (3-12 months for competency), understanding markets and strategy concepts (ongoing), and developing/testing specific strategies (months to years per strategy with no guarantee of success). Using no-code platforms shortens the timeline to weeks or months. Using turnkey platforms with included strategies enables live trading within days. Most traders underestimate development time; expect the process to take longer than anticipated.

7. Can algorithmic trading beat the market?

Some algorithmic strategies beat the market, but not all, and not consistently forever. Academic research documents several persistent market anomalies that systematic strategies can exploit, including momentum and trend-following effects [4]. However, as more capital pursues the same strategies, edges diminish. Beating the market requires either exploiting less-known inefficiencies, accepting different risk/return profiles, or continuous strategy evolution. Claims of guaranteed market-beating returns should be viewed skeptically.

8. What is the failure rate for algorithmic traders?

Precise failure rates are difficult to determine, but the same factors causing high retail trading failure rates (psychology, poor risk management, insufficient capital) affect algorithmic traders. Algorithmic approaches may have slightly better odds by removing emotional execution errors, but strategy quality remains the determining factor. Traders using well-designed strategies with proper risk management succeed at higher rates than those with flawed strategies regardless of whether trading is manual or algorithmic.

Conclusion

Algorithmic trading has evolved from an institutional monopoly into an accessible approach for retail traders seeking systematic, emotion-free trading. The core advantage remains constant regardless of sophistication level: algorithms execute predefined rules consistently, removing the psychological interference that undermines most manual traders. Whether implemented through custom code, no-code platforms, or turnkey solutions, algorithmic approaches provide structural benefits that discretionary trading cannot match.

Success in algorithmic trading requires respecting its limitations alongside embracing its advantages. Algorithms are not magic; they execute their programming faithfully, which means flawed strategies lose money just as consistently as good strategies make it. The technology eliminates execution errors but cannot create trading edge where none exists. Rigorous strategy development, thorough backtesting with awareness of its pitfalls, proper risk management, and realistic expectations separate successful algorithmic traders from those who automate their way to consistent losses.

For traders exploring algorithmic futures trading, multiple paths exist. Those with programming skills can build custom solutions offering maximum flexibility. Those preferring visual development can use platforms like TradingView or NinjaTrader's strategy builders. Those wanting turnkey solutions can use platforms like ClearEdge that provide complete algorithmic strategies.

References

- Securities and Exchange Commission. (2014). Equity Market Structure Literature Review Part II: High Frequency Trading. SEC Staff Report. https://www.sec.gov/marketstructure/research/hft_lit_review_march_2014.pdf

- Hendershott, T., Jones, C. M., & Menkveld, A. J. (2011). Does Algorithmic Trading Improve Liquidity? The Journal of Finance, 66(1), 1-33. https://doi.org/10.1111/j.1540-6261.2010.01624.x

- Brogaard, J., Hendershott, T., & Riordan, R. (2014). High-Frequency Trading and Price Discovery. The Review of Financial Studies, 27(8), 2267-2306.

- Moskowitz, T. J., Ooi, Y. H., & Pedersen, L. H. (2012). Time Series Momentum. Journal of Financial Economics, 104(2), 228-250. https://doi.org/10.1016/j.jfineco.2011.11.003

- Bailey, D. H., Borwein, J. M., Lopez de Prado, M., & Zhu, Q. J. (2014). Pseudo-Mathematics and Financial Charlatanism: The Effects of Backtest Overfitting on Out-of-Sample Performance. Notices of the American Mathematical Society, 61(5), 458-471.

- Commodity Futures Trading Commission. (2025). Algorithmic Trading and Automated Execution. https://www.cftc.gov/

- CME Group. (2025). Electronic Trading Resources. https://www.cmegroup.com/education.html

This content is for educational purposes only and does not constitute financial advice. Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance of any trading system or strategy is not indicative of future results.

RISK WARNING: Futures trading carries a high level of risk and may not be suitable for all investors. You could lose more than your initial investment. Only trade with capital you can afford to lose. Automated trading systems cannot guarantee profits and may experience periods of drawdown.

ClearEdge Automation is a futures automation platform. This content may reference ClearEdge products and services where contextually relevant to the educational material.

Published: December 2025 · Last updated: 2025-12-04

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.