TradingView Alert Delay Causes And Solutions Guide

Minimize TradingView alert delays and beat slippage. Learn to reduce latency from seconds to milliseconds by optimizing your Pine Script, webhooks, and brokers.

TradingView alert delays occur due to several factors: server processing time, webhook transmission latency, broker API response times, and network routing issues. Most delays range from 100-500 milliseconds under normal conditions, but can spike to 2-5 seconds during high-volume periods or when TradingView servers experience load. Understanding the delay chain—from alert trigger to broker execution—helps traders optimize their automation setup and set realistic expectations.

Key Takeaways

- TradingView alert delays typically range from 100-500ms but can spike to 2-5 seconds during market volatility or server congestion

- The delay chain includes four stages: alert condition detection, webhook transmission, automation platform processing, and broker execution

- Network routing, broker API performance, and TradingView server load are the primary bottlenecks

- Traders can reduce delays by using faster brokers, optimizing webhook configuration, and avoiding overly complex alert conditions

Table of Contents

- What Causes TradingView Alert Delays?

- Understanding the Delay Chain

- How to Measure Alert Latency

- Common Sources of Delay

- How to Reduce Alert Delays

- When Do Delays Actually Matter?

- Frequently Asked Questions

- Conclusion

What Causes TradingView Alert Delays?

TradingView alert delays result from the cumulative latency across multiple systems: TradingView's server infrastructure, internet routing, webhook receiver processing, and broker API execution. Each component adds 25-200ms of latency under optimal conditions. When any single component experiences load or network congestion, delays compound quickly.

The most common causes include TradingView server processing during high-volume periods (like FOMC announcements or market opens), network routing inefficiencies when data crosses multiple geographic regions, and broker API throttling during volatile price action. According to TradingView automation best practices, understanding each delay source helps you optimize what's controllable and accept what isn't.

Webhook Latency: The time required for an HTTP POST request to travel from TradingView's servers to your automation platform. This typically ranges from 50-300ms depending on server location and network conditions.

Understanding the Delay Chain

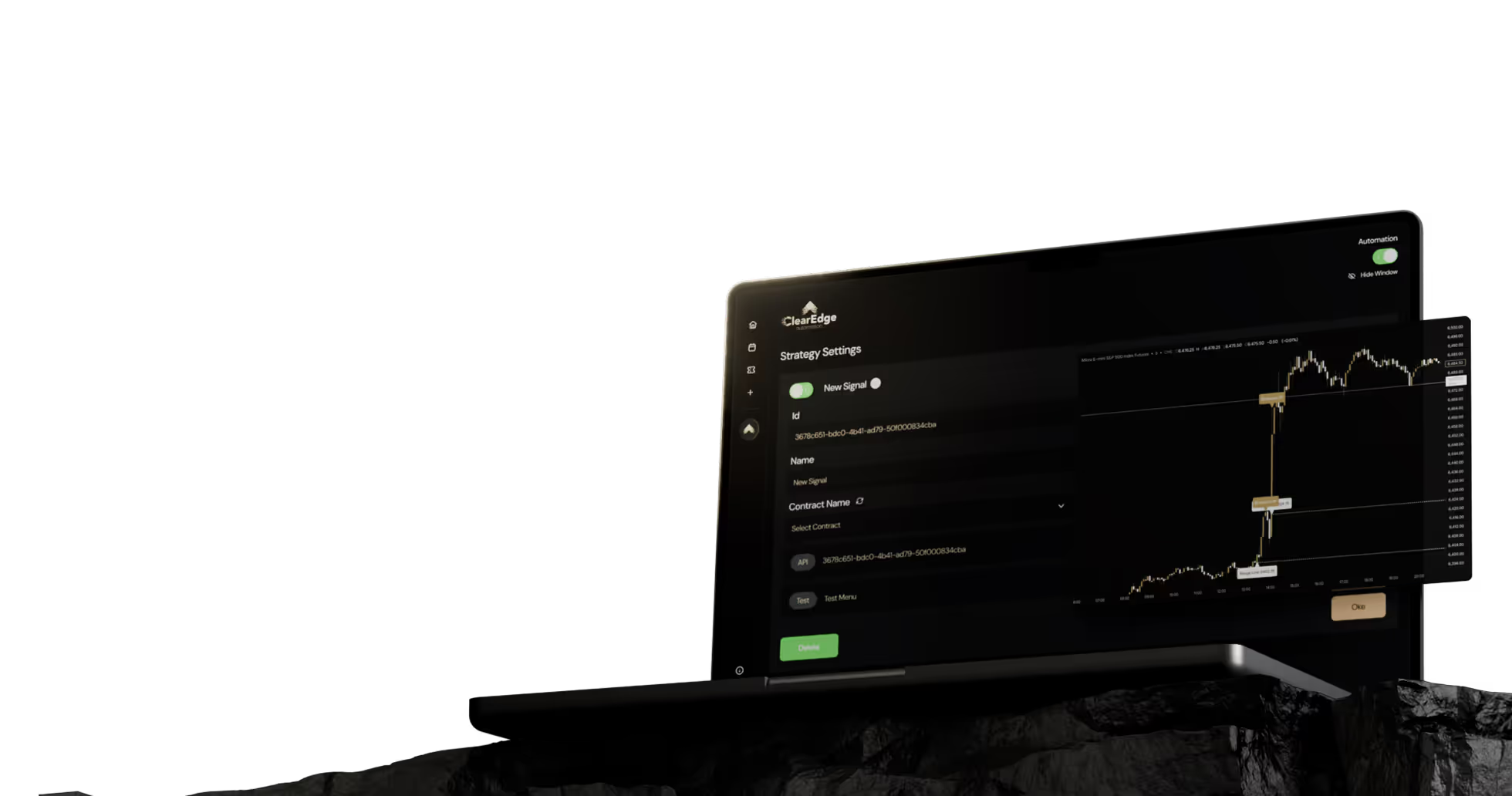

The complete alert-to-execution process involves four distinct stages. Alert condition detection happens when TradingView's server processes your Pine Script logic against incoming market data—this adds 25-100ms. Webhook transmission occurs next, sending your alert payload to the automation platform—this adds 50-300ms. Platform processing includes parsing the JSON payload, applying risk checks, and formatting the broker order—this adds 3-50ms for efficient platforms like ClearEdge Trading. Finally, broker execution involves API authentication, order routing, and exchange confirmation—this adds 50-500ms depending on broker infrastructure.

Each stage operates independently, meaning optimization at one stage doesn't compensate for bottlenecks elsewhere. A 10ms automation platform paired with a 2-second broker API still results in 2+ second total latency.

StageTypical LatencySpike LatencyControllableAlert Detection25-100ms200-1,000msPartialWebhook Transmission50-300ms500-2,000msLimitedPlatform Processing3-50ms50-200msYesBroker Execution50-500ms500-5,000msBroker choice

How to Measure Alert Latency

Accurate latency measurement requires timestamping at each stage of the delay chain. TradingView includes a timestamp in webhook payloads showing when the alert fired. Your automation platform should log receipt time, processing time, and broker submission time. Most brokers provide order acknowledgment timestamps through their API responses.

Compare the TradingView alert timestamp to your broker's fill timestamp to calculate end-to-end latency. Run this test during different market conditions—overnight sessions typically show 100-300ms total latency, while RTH sessions during economic releases can spike to 2-5 seconds. Test over 50-100 alerts to establish your baseline and identify outliers.

Fill Latency: The total time from alert trigger to confirmed order fill at your broker. This differs from order submission latency, which only measures time to broker API acceptance, not actual execution in the market.

Common Sources of Delay

TradingView server load spikes during major market events when thousands of alerts fire simultaneously. The first Friday of each month at 8:30 AM ET (Non-Farm Payrolls) consistently shows 500ms-2s alert delays compared to 100-300ms baseline. FOMC announcements at 2:00 PM ET show similar patterns.

Complex Pine Script alert conditions add processing time. Alerts using multiple timeframe.security() calls or scanning large lookback periods (500+ bars) can add 50-200ms versus simple price crossover conditions. Broker API throttling during volatile periods introduces the largest variable delays—some brokers limit API requests to 10-20 per second, causing queuing delays when multiple alerts fire rapidly.

Geographic routing matters more than most traders realize. A U.S.-based trader using a European broker routes webhook data across the Atlantic twice (TradingView to platform, platform to broker), adding 100-200ms compared to U.S.-to-U.S. routing. Check your broker's server location relative to your automation platform.

Delay Factors You Control

- Broker selection (API performance varies 10x between brokers)

- Alert condition complexity (simpler = faster)

- Automation platform efficiency (3-50ms range)

- Network quality (stable connection vs. WiFi)

Delay Factors Outside Your Control

- TradingView server load during market events

- Internet backbone routing congestion

- Exchange latency during high volume

- Broker infrastructure capacity limits

How to Reduce Alert Delays

Optimize your alert conditions by avoiding unnecessary complexity. Replace multi-timeframe security() calls with pre-calculated variables where possible. Limit historical bar lookback to what's essential—scanning 5,000 bars versus 100 bars adds measurable latency. Use "Once Per Bar Close" alert frequency instead of "Once Per Bar" to reduce server processing load by 80-90%.

Choose brokers with documented low-latency APIs. TradeStation, Interactive Brokers, and specialized futures brokers like Tradovate consistently show 50-150ms API response times versus 300-1,000ms for slower brokers. Test broker performance during RTH sessions, not just overnight when everything performs well.

Webhook URL configuration affects transmission speed. Use HTTPS endpoints geographically close to TradingView's servers (U.S. West Coast). Avoid webhook receivers that add authentication overhead—OAuth token validation can add 50-100ms versus API key authentication. Platforms offering direct broker integration eliminate the webhook transmission stage entirely, reducing total latency by 50-300ms.

Alert Delay Optimization Checklist

- ☐ Simplify Pine Script alert conditions (remove unnecessary security() calls)

- ☐ Set alerts to "Once Per Bar Close" instead of "Once Per Bar"

- ☐ Test broker API performance during RTH sessions

- ☐ Use automation platform with <50ms processing time

- ☐ Verify webhook URL uses HTTPS and is geographically optimized

- ☐ Monitor alert-to-fill latency over 100+ trades to establish baseline

- ☐ Avoid triggering alerts during known high-load periods unless necessary

When Do Delays Actually Matter?

For scalping strategies targeting 2-4 ticks on ES futures ($25-50 per contract), a 500ms delay costs approximately 0.25-0.50 ticks during normal volatility—$3-6 per contract. During fast markets, 500ms can mean 1-2 ticks ($12.50-25). Whether this matters depends on your profit targets and trade frequency.

Opening Range breakout strategies on ES typically target 8-15 ticks and hold for 15-60 minutes. A 300ms delay represents 0.01% of the trade duration and rarely affects profitability. Swing strategies holding multiple days see virtually no impact from sub-second delays. News trading strategies (NFP, FOMC) face the highest delay impact—2-5 second spikes during announcement volatility can move price 5-20 ticks before execution.

According to data from futures automation testing, strategies with profit targets below 6 ticks should target end-to-end latency under 250ms. Strategies targeting 10+ ticks remain profitable with 500-1,000ms latency. Position trading strategies show no statistically significant performance difference between 100ms and 2,000ms execution delays.

Slippage Tolerance: The difference between intended entry price and actual fill price your strategy can absorb while remaining profitable. Higher slippage tolerance reduces sensitivity to alert delays.

Frequently Asked Questions

1. What is the typical TradingView alert delay?

Under normal conditions, TradingView alert delays range from 100-300ms from alert trigger to webhook delivery. During high-volume periods or market events like FOMC announcements, delays can spike to 1-5 seconds.

2. Why do my TradingView alerts sometimes arrive late?

Late alerts result from TradingView server congestion during high alert volume, complex Pine Script conditions requiring more processing time, or network routing delays. Broker API throttling during volatile markets also contributes to perceived late arrivals.

3. How can I test my TradingView alert speed?

Compare the timestamp in your webhook JSON payload to your broker's fill timestamp over 50-100 trades. Calculate the average and note outliers during different market sessions to establish your baseline latency.

4. Do TradingView webhooks have latency limits?

TradingView doesn't publish guaranteed latency SLAs, but webhook delivery typically completes within 50-300ms under normal conditions. No hard latency limit exists—delays depend on server load and network conditions.

5. Which brokers have the fastest API for TradingView automation?

TradeStation, Interactive Brokers, and Tradovate consistently show 50-150ms API response times. Check supported brokers and test during RTH sessions, as overnight performance doesn't reflect peak-hour latency.

Conclusion

TradingView alert delays stem from multiple components in the automation chain, with typical end-to-end latency of 200-800ms and spikes to 2-5 seconds during high-load periods. Traders can optimize alert conditions, choose low-latency brokers, and use efficient automation platforms to minimize controllable delays.

Test your specific setup across different market conditions to establish realistic latency expectations. For detailed webhook configuration to minimize transmission delays, see our TradingView automation guide.

Want to dig deeper? Read our complete guide to TradingView automation for webhook setup instructions and latency optimization strategies.

References

- TradingView - Webhook Documentation

- CME Group - Market Data Specifications

- Interactive Brokers - API Performance

- TradeStation - API Trading Documentation

Disclaimer: This article is for educational purposes only. It is not trading advice. ClearEdge Trading executes trades based on your rules—it does not provide signals or recommendations.

Risk Warning: Futures trading involves substantial risk. You could lose more than your initial investment. Past performance does not guarantee future results. Only trade with capital you can afford to lose.

CFTC RULE 4.41: Hypothetical results have limitations and do not represent actual trading.

By: ClearEdge Trading Team | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.