Broker Integration Options For Futures Automation Platforms Guide

Stop settling for slow execution. Upgrade your futures automation with native broker APIs that deliver 3-40ms latency for more reliable ES and NQ trading.

Broker integration options for automation platforms determine which futures commission merchants (FCMs) and brokers you can connect to execute automated trades. Key factors include supported broker protocols (FIX, REST APIs), execution speeds ranging from 3-40ms, account types compatible with automation, and whether the platform offers native integrations versus third-party workarounds. Understanding these integration capabilities helps traders select automation platforms that work seamlessly with their preferred brokers for futures contracts like ES, NQ, GC, and CL.

Key Takeaways

- Broker integration quality directly impacts execution speed, with native integrations typically offering 3-40ms latency versus 100-500ms for third-party solutions

- Most no-code automation platforms support 10-25 major futures brokers including TradeStation, NinjaTrader, and Interactive Brokers

- Direct API connections provide better reliability than platforms requiring manual credential sharing or browser-based authentication

- Verify your specific broker supports automated order types needed for your strategy before committing to a platform

Table of Contents

- What Broker Integration Means for Automation Platforms

- Types of Broker Integration Architecture

- How to Evaluate Supported Broker Lists

- Execution Protocols and Speed Factors

- Account Type Compatibility and Restrictions

- Selecting Platforms Based on Your Broker

- Frequently Asked Questions

- Conclusion

What Broker Integration Means for Automation Platforms

Broker integration refers to the technical connection between your automation platform and your futures broker's trading infrastructure. This connection determines how quickly your TradingView alerts or algorithm signals convert into actual orders at your broker, and what order types and risk controls are available during execution.

Broker Integration: The technical method by which an automation platform communicates with a futures commission merchant (FCM) to execute trades. Integration quality affects execution speed, order type support, and connection reliability during volatile market conditions.

Different platforms use different integration methods. Some connect directly via broker-provided APIs using FIX protocol or REST endpoints. Others use indirect methods like screen scraping or simulated keystrokes. The integration method impacts your trading results more than most traders realize.

A trader using a platform with native TradeStation API integration might see 5-15ms execution times. The same trader using a workaround solution that simulates mouse clicks could experience 200-800ms delays. During fast-moving markets like FOMC announcements, this difference determines whether your stop loss executes at your intended price or experiences significant slippage.

Types of Broker Integration Architecture

Automation platforms use three primary integration architectures: native API connections, broker plugin frameworks, and third-party bridging solutions. Native API integrations connect directly to broker systems using official protocols like FIX 4.2/4.4 or broker-specific REST APIs, offering the fastest and most reliable execution.

Broker plugin frameworks like those from NinjaTrader or TradeStation let automation platforms operate as certified add-ons within the broker's trading software. These integrations typically offer 10-30ms execution speeds and full access to advanced order types including bracket orders, trailing stops, and OCO (one-cancels-other) configurations.

Integration TypeTypical LatencyReliabilityOrder Type SupportNative API (FIX/REST)3-40msHighFullBroker Plugin10-50msHighFullThird-Party Bridge100-500msMediumLimitedScreen Automation200-1000msLowVery Limited

Third-party bridging solutions act as intermediaries between your automation platform and broker. These add latency layers but can enable connections to brokers without official API access. Screen automation represents the lowest quality integration, using simulated user interface interactions to place trades. Avoid platforms relying primarily on screen automation for live futures trading.

How to Evaluate Supported Broker Lists

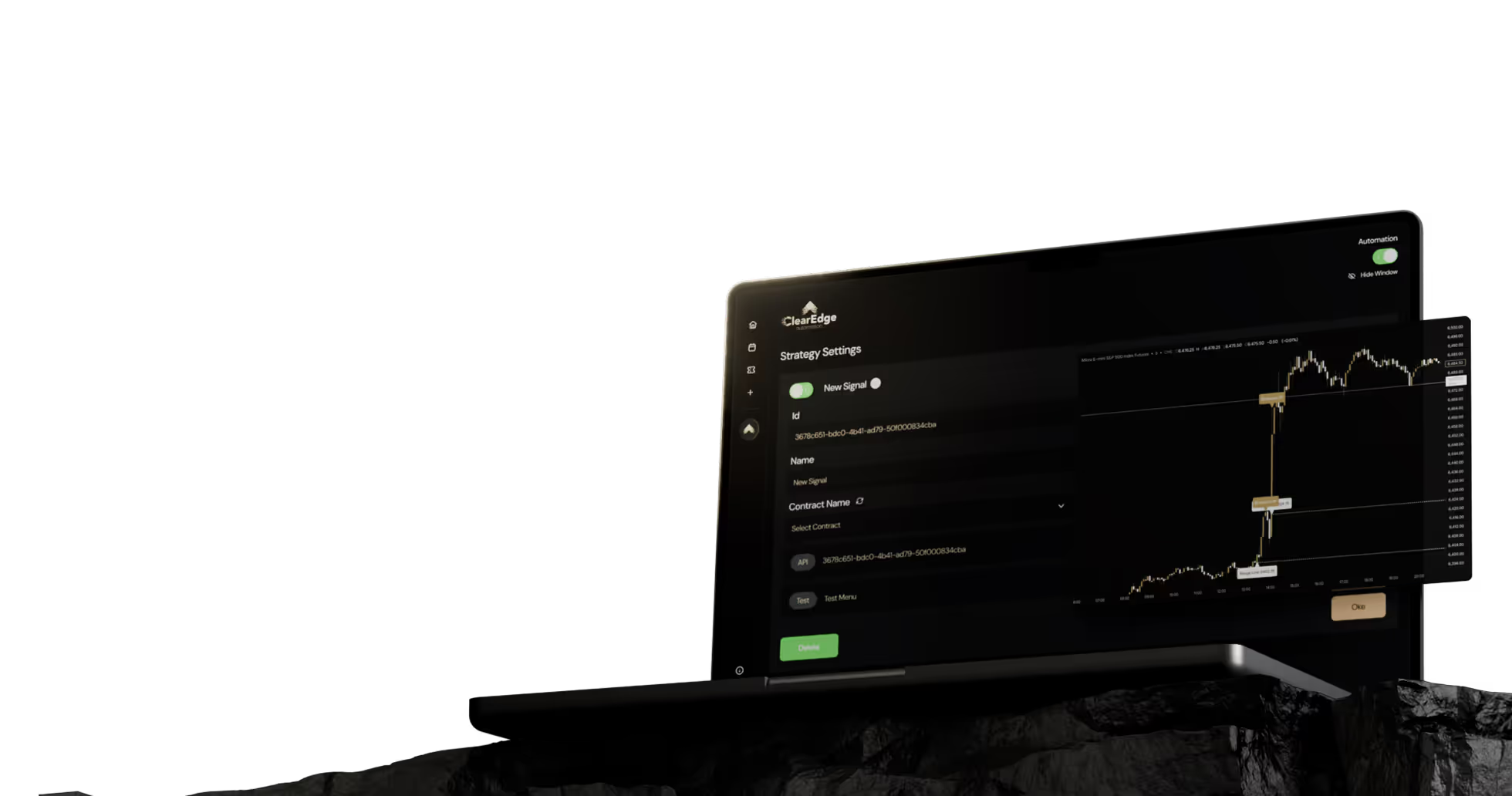

Most futures automation platforms advertise supported broker counts ranging from 5 to 25+ brokers. The raw number matters less than whether your specific broker appears on the list with full feature support. Platforms like ClearEdge Trading support 20+ brokers including major FCMs used by retail futures traders.

When evaluating broker support, distinguish between "supported" and "fully integrated." A broker might be listed as supported but only offer basic market and limit orders. Another broker might offer complete integration including advanced order types, position management, and real-time P&L tracking.

Broker Integration Evaluation Checklist

- ☐ Verify your broker appears on the platform's official supported broker list

- ☐ Confirm integration method (API vs plugin vs bridge)

- ☐ Test whether advanced order types work (brackets, trailing stops)

- ☐ Check if position sizing automation is supported for your account type

- ☐ Verify the platform supports your specific contract types (micros, standard, options on futures)

- ☐ Confirm whether the integration supports multiple accounts if you plan to scale

Common brokers supported by major automation platforms include TradeStation, Interactive Brokers, NinjaTrader Brokerage, AMP Futures, TopstepX, and Tradovate. Prop firm traders should verify whether platforms support their specific funded account broker before purchasing subscriptions.

Execution Protocols and Speed Factors

Execution speed depends on the communication protocol between your automation platform and broker. FIX (Financial Information Exchange) protocol remains the industry standard for institutional trading, offering sub-10ms message transmission when implemented correctly. Retail-focused brokers often use REST APIs with 15-40ms typical response times.

FIX Protocol: Financial Information Exchange protocol is an industry-standard electronic communication protocol for real-time exchange of securities transactions and market data. In futures automation, FIX connections provide the fastest execution speeds and most reliable order routing.

Your total execution time includes multiple components: platform processing time (1-5ms for well-optimized platforms), network transmission to broker (2-20ms depending on geography and server proximity), broker order routing (5-15ms), and exchange acknowledgment (3-10ms). These components sum to the total latency you experience.

Geographic location affects execution speed. A trader in Chicago connecting to CME data centers experiences lower latency than a trader in Europe. Some platforms offer multiple server locations to minimize geographic latency. For high-frequency strategies or scalping during news events, every millisecond matters.

During peak volatility like NFP releases (first Friday monthly at 8:30 AM ET), broker systems experience higher load. Platforms with robust broker integration maintain consistent execution speeds during these periods, while lower-quality integrations may experience 3-10x normal latency.

Account Type Compatibility and Restrictions

Not all broker integrations support all account types. Individual cash accounts typically have full automation support, while IRA accounts at many brokers have restrictions on automated trading. Margin requirements and leverage rules vary by account type and affect automation platform configuration.

Prop firm accounts introduce additional complexity. Platforms must support the specific broker used by your prop firm (common ones include Rithmic, CQG, and TopstepX infrastructure). Some prop firms explicitly prohibit automation or require approval before connecting third-party platforms. Verify your prop firm's automation policy before purchasing a platform subscription.

Account TypeAutomation SupportCommon RestrictionsIndividual CashFullNone typicallyIndividual MarginFullOvernight margin requirementsIRA/RetirementLimitedMay prohibit automated tradingProp Firm FundedVariesFirm-specific rules applyJoint AccountsLimitedBroker-dependent restrictions

Micro contracts (MES, MNQ) have identical automation support as standard contracts (ES, NQ) at most brokers. Some platforms charge per contract or per trade, making micros more cost-effective for testing automation before scaling to standard contracts. Our futures instrument automation guide covers contract-specific configuration details.

Selecting Platforms Based on Your Broker

Start platform selection by identifying your current or intended broker, then filter automation platforms supporting that broker with native integration. If you're broker-agnostic, prioritize platforms with the widest quality broker support rather than raw broker count.

For TradeStation users, platforms offering native TradeStation API integration provide the best performance. Interactive Brokers traders should verify platforms support IBKR's Gateway API rather than relying on TWS (Trader Workstation) screen automation. NinjaTrader users benefit from platforms built as NinjaTrader add-ons for seamless integration.

Advantages of Multi-Broker Platforms

- Switch brokers without changing your entire automation infrastructure

- Run multiple funded prop accounts using different brokers from one interface

- Compare execution quality across brokers using identical strategies

- Maintain continuity if a broker discontinues services or changes policies

Limitations of Multi-Broker Platforms

- May not support every advanced feature of specialized single-broker platforms

- Slightly higher complexity in initial setup and configuration

- Pricing models may charge per-broker connection in some cases

Test broker integration quality during your platform trial period. Execute test trades during different market sessions including overnight and high-volatility periods. Verify your specific order types work correctly and that stop losses execute at expected price levels. Check supported brokers for current integration details.

For traders using TradingView strategies, platforms offering direct webhook integration simplify setup. ClearEdge Trading connects TradingView alerts to broker execution via webhooks, removing the need for intermediate services. This reduces potential failure points in your automation chain. More details in our TradingView automation guide.

Frequently Asked Questions

1. Can I use one automation platform with multiple brokers simultaneously?

Yes, most no-code automation platforms support connecting multiple broker accounts to a single platform instance. This lets you run different strategies on different brokers or manage multiple prop firm accounts from one interface, though some platforms charge per-broker connection fees.

2. Do broker integration quality differences really matter for swing trading?

For swing traders holding positions for days or weeks, execution speed differences of 50-100ms typically have minimal impact on results. However, integration reliability during order placement and modification remains important regardless of timeframe, as connection failures during entry or stop loss placement can significantly impact trade outcomes.

3. How do I know if my broker's API supports the order types I need?

Review your broker's API documentation or contact their support team to verify supported order types. Most major futures brokers support market, limit, stop, and stop-limit orders via API, but advanced types like trailing stops, bracket orders, or iceberg orders may have limited API support depending on the broker.

4. Will connecting an automation platform to my broker account violate their terms of service?

Using platforms with official API integrations or certified broker add-ons typically complies with broker terms of service. However, screen automation or credential-sharing solutions may violate policies at some brokers. Always review your broker's automation and third-party platform policies before connecting automated trading software.

5. What happens if the connection between my platform and broker drops during a trade?

Connection handling varies by platform and integration method. Quality platforms maintain order states and reconnect automatically, resuming monitoring of open positions. Lower-quality solutions may lose track of orders placed before disconnection, requiring manual intervention. Test disconnect scenarios during your trial period with small position sizes.

Conclusion

Broker integration quality determines execution speed, reliability, and feature availability in futures automation platforms. Prioritize platforms offering native API or broker plugin integrations for your specific broker over those relying on third-party bridges or screen automation. Verify integration quality during trial periods by testing during various market conditions.

Select platforms supporting multiple quality brokers to maintain flexibility as your trading scales. For comprehensive platform selection guidance, see our futures automation platform comparison covering features, pricing, and broker support across major platforms.

Ready to explore broker integration options? View ClearEdge Trading's supported brokers to see integration details for 20+ futures commission merchants and prop firm platforms.

References

- CME Group. "Trading System Latency Specifications." https://www.cmegroup.com/globex/technology.html

- FIX Trading Community. "FIX Protocol Documentation." https://www.fixtrading.org/

- Interactive Brokers. "API Order Types Documentation." https://www.interactivebrokers.com/en/index.php?f=5278

- NinjaTrader. "Broker Adapter Development Guide." https://ninjatrader.com/support/helpGuides/nt8/

Disclaimer: This article is for educational and informational purposes only. It does not constitute trading advice, investment advice, or any recommendation to buy or sell futures contracts. ClearEdge Trading is a software platform that executes trades based on your predefined rules—it does not provide trading signals, strategies, or personalized recommendations.

Risk Warning: Futures trading involves substantial risk of loss and is not suitable for all investors. You could lose more than your initial investment. Past performance of any trading system, methodology, or strategy is not indicative of future results. Before trading futures, you should carefully consider your financial situation and risk tolerance. Only trade with capital you can afford to lose.

CFTC RULE 4.41: HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY.

By: ClearEdge Trading Team | 29+ Years CME Floor Trading Experience | About

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.