Trading Psychology: How Automation Removes Emotion Risk

Fear, greed, and revenge trading destroy accounts. Learn how automation creates a structural solution to psychological failures that discipline can't fix.

Removing emotion from trading is the primary reason most retail traders turn to automation, recognizing that their own psychology undermines even well-designed strategies. Fear, greed, revenge trading, and analysis paralysis are not character flaws but predictable human responses that systematically destroy trading accounts. Automation offers a structural solution to these psychological challenges by executing predefined rules without the emotional interference that causes traders to deviate from their plans at the worst possible moments.

The statistics on retail trading failure are sobering. Studies consistently show that 70-90% of retail traders lose money over time, with psychological factors cited as the leading cause [1]. Traders know what they should do but cannot make themselves do it when real money is at stake. They move stops to avoid taking losses, cut winners short out of fear, chase trades after missing entries, and overtrade after both wins and losses. These behaviors are not random mistakes but systematic patterns rooted in how human brains evolved to handle risk and reward.

Trading psychology has traditionally been addressed through mental discipline, journaling, meditation, and coaching. While these approaches help some traders, they require constant vigilance and often fail under pressure. Automation takes a fundamentally different approach: rather than trying to fix human psychology, it removes humans from the execution loop entirely. The strategy runs as designed regardless of whether the trader feels confident, scared, or distracted. This structural solution addresses the root cause of psychological trading failures rather than treating symptoms.

Trading psychology failures cause the majority of retail trading losses, as fear, greed, and emotional reactions lead traders to deviate from sound strategies. Automation provides a structural solution by executing predefined rules without emotional interference, removing the human psychological weaknesses that undermine trading performance.

- Emotional trading errors follow predictable patterns: cutting winners short, holding losers too long, revenge trading after losses, and overtrading during excitement

- These psychological failures are not character flaws but evolutionary responses poorly suited to trading environments

- Traditional psychology solutions (discipline, journaling, coaching) require constant effort and often fail under pressure

- Automation provides structural protection by removing humans from execution decisions entirely

- Traders who struggle with discipline often perform better when they cannot interfere with their own trades

- The goal is not eliminating emotions but preventing them from affecting trade execution

- Why Emotions Destroy Trading Performance

- The Fear and Greed Cycle in Trading

- Common Psychological Trading Failures

- The Overtrading Problem and How Automation Solves It

- Analysis Paralysis: When Overthinking Kills Profits

- Revenge Trading and the Loss Recovery Trap

- Trading Discipline vs. Trading Automation

- How Automation Addresses Psychological Weaknesses

- Automation for Busy Professionals

- Building Trust in Your Automated System

- When Human Intervention Is Appropriate

- Frequently Asked Questions

Why Emotions Destroy Trading Performance

Emotions destroy trading performance because human brains evolved for survival in physical environments, not for making rational decisions about financial risk under uncertainty. The same psychological mechanisms that kept our ancestors alive on the savanna actively work against successful trading. Understanding why emotions are so destructive is the first step toward implementing effective solutions.

Behavioral Finance: A field of study examining how psychological influences and cognitive biases affect the financial behaviors of investors and traders. Behavioral finance explains why market participants often act irrationally despite having access to relevant information. Learn more

The core problem is that trading requires behaviors that feel deeply wrong to human psychology:

- Taking losses deliberately: Every survival instinct screams against voluntarily accepting a loss, even when holding creates larger losses

- Letting winners run: The fear of losing unrealized gains triggers premature exits, cutting off the large wins that make strategies profitable

- Waiting patiently: Action bias makes doing nothing feel irresponsible, leading to overtrading and forced entries

- Accepting uncertainty: Humans crave certainty, but trading offers only probabilities. This discomfort leads to analysis paralysis or premature position exits

- Treating each trade independently: Recent results inappropriately influence current decisions, causing revenge trading after losses and overconfidence after wins

Research by behavioral economists Daniel Kahneman and Amos Tversky demonstrated that humans feel losses approximately twice as intensely as equivalent gains, a phenomenon called loss aversion [2]. In trading, this means the pain of a $500 loss feels equivalent to the pleasure of a $1,000 gain. This asymmetry causes traders to take irrational actions to avoid the pain of losses, such as holding losing positions hoping they will recover or taking profits too quickly to lock in the good feeling of a win.

The trading environment amplifies these psychological vulnerabilities. Real-time price movements, profit and loss displays, and the isolation of individual decision-making create conditions that maximize emotional interference. Unlike a job where mistakes can be discussed with colleagues or corrected over time, trading delivers immediate, unambiguous feedback that triggers emotional responses.

The Fear and Greed Cycle in Trading

The fear and greed cycle describes the predictable emotional pattern that causes traders to buy high and sell low, the exact opposite of profitable trading. This cycle operates at both market-wide and individual trader levels, creating systematic errors that automation can eliminate.

At the market level, the cycle unfolds predictably:

- Optimism: Prices rise, early buyers feel validated, and positive sentiment builds

- Excitement: Rising prices attract attention, more buyers enter, and greed begins dominating decision-making

- Euphoria: Everyone seems to be making money, fear of missing out peaks, and the last buyers enter at maximum prices

- Anxiety: Prices begin declining, early warning signs appear, but greed keeps many holding

- Denial: Significant losses accumulate, but traders refuse to accept the change, hoping for recovery

- Fear: Losses become undeniable, panic selling begins, and prices accelerate downward

- Capitulation: Maximum fear causes mass selling at the worst prices, often marking the bottom

- Depression: Traders who sold at the bottom watch prices recover, feeling hopeless about their ability to succeed

Loss Aversion: A cognitive bias where the psychological pain of losing is approximately twice as powerful as the pleasure of gaining. This causes traders to make irrational decisions to avoid realizing losses, often resulting in larger eventual losses. Learn more

Individual traders experience this cycle on compressed timeframes, sometimes multiple times per day. A morning winning streak creates confidence that leads to oversized positions. An afternoon reversal triggers fear and premature exits. By end of day, the trader has given back profits through emotionally-driven decisions that deviated from their original plan.

Automation breaks this cycle by removing the emotional component from execution. The system does not feel euphoric after wins or fearful after losses. It executes the same way whether the account is up 20% or down 10%. This consistency is impossible for humans to maintain but trivial for software. Automated trading systems execute based on predefined criteria regardless of recent results or market sentiment.

Common Psychological Trading Failures

Psychological trading failures follow predictable patterns that repeat across traders regardless of experience level, market traded, or strategy employed. Recognizing these patterns in your own trading is essential for understanding why automation may provide more benefit than continued attempts at psychological discipline.

Cutting Winners Short

Traders consistently exit winning trades too early, taking small profits while letting losses run. The psychological driver is the desire to lock in gains before they disappear. A trader up $300 on a position feels the anxiety of potentially losing that gain and exits, even though their strategy calls for holding to a larger target. Over hundreds of trades, this pattern transforms potentially profitable strategies into losing ones.

Holding Losers Too Long

The flip side of cutting winners is holding losing positions far beyond planned stop losses. Traders move stops, remove stops entirely, or add to losing positions hoping for recovery. The psychological driver is loss aversion and denial. Closing a losing position makes the loss real and final, while holding preserves the hope of recovery. This behavior turns manageable losses into account-threatening disasters.

Revenge Trading

After taking a loss, many traders immediately re-enter the market trying to make the money back. This revenge trading typically involves larger position sizes, looser criteria for entry, and heightened emotional stakes. The psychological driver is the urgent need to eliminate the pain of loss. Revenge trades have lower win rates than normal trades because they are taken for emotional rather than strategic reasons.

Overconfidence After Wins

Winning streaks create dangerous overconfidence. Traders increase position sizes, take marginal setups they would normally skip, and reduce attention to risk management. The psychological driver is the feeling of invincibility that success creates. Markets are random enough that winning streaks occur by chance, but traders attribute them to skill. The oversized positions taken during overconfidence often give back all streak profits and more.

Fear of Pulling the Trigger

Some traders develop an inability to enter trades even when their criteria are clearly met. After experiencing losses, every potential entry looks like another losing trade. The psychological driver is conditioned fear from past negative experiences. These traders watch their setups work repeatedly while remaining on the sidelines, compounding frustration and eroding confidence further.

Psychological FailureBehavior PatternPsychological DriverHow Automation Solves It Cutting winners shortExiting profitable trades too earlyFear of losing unrealized gainsHolds to predefined targets regardless of feelings Holding losers too longRefusing to exit losing positionsLoss aversion, denialExecutes stops without hesitation Revenge tradingImpulsive trades after lossesUrgent need to recoverOnly trades valid setups, ignores recent results OverconfidenceLarger sizes after winsFalse sense of invincibilityMaintains consistent position sizing Fear of entryMissing valid setupsConditioned fear from lossesEnters all qualifying signals automatically

The Overtrading Problem and How Automation Solves It

Overtrading is one of the most common and destructive psychological failures in retail trading, causing traders to take far more positions than their strategy justifies. The costs compound through commissions, spread payments, and the statistical certainty that more trades means more opportunities for emotional interference. Automation provides structural protection against overtrading that willpower alone cannot match.

Overtrading manifests in several forms:

- Frequency overtrading: Taking many more trades than the strategy calls for, often out of boredom or action bias

- Size overtrading: Using position sizes larger than risk management rules allow, typically after wins create overconfidence

- Criteria loosening: Accepting trades that almost meet entry criteria but not quite, rationalizing marginal setups

- Revenge scaling: Increasing trade frequency or size specifically to recover from recent losses

Action Bias: A psychological tendency to favor action over inaction, even when doing nothing would produce better outcomes. In trading, action bias leads to overtrading as traders feel compelled to "do something" rather than wait patiently for valid setups. Learn more

The financial impact of overtrading extends beyond obvious commission costs. Each additional trade carries statistical risk of loss. If a strategy has a 55% win rate, the more trades taken, the more likely results will regress to that percentage. Overtrading during periods of elevated confidence often means taking trades when the strategy is not actually signaling, which have win rates well below the strategy average.

Automation solves overtrading structurally by only taking trades that meet defined criteria. The system cannot get bored and enter a marginal trade. It cannot feel the urge to trade simply because the market is open. If no valid setup exists, no trade is taken, regardless of how long the system has been waiting. This enforced patience is impossible for most human traders to maintain but effortless for software.

Additional automation features that combat overtrading include:

- Maximum daily trade limits: Hard caps on how many trades can be taken per day

- Cooling-off periods: Enforced waiting time after losses before new entries are allowed

- Session restrictions: Trading only during defined hours with optimal conditions

- Strict entry criteria: No ambiguity about what qualifies as a valid setup

Analysis Paralysis: When Overthinking Kills Profits

Analysis paralysis occurs when traders become so focused on finding the perfect entry or gathering more information that they fail to act on valid opportunities. This overthinking pattern causes traders to miss trades they should take while often entering inferior trades later out of frustration at missing the good ones. Automation eliminates analysis paralysis by making entry decisions binary and automatic.

The overthinking trader recognizes the following patterns:

- A valid setup appears, but the trader wants to wait for one more confirmation indicator

- While waiting, the move happens without them

- Frustrated at missing the move, they enter late at a worse price or skip the trade entirely

- Later, feeling pressure to trade, they take a lower-quality setup that loses

- The cycle reinforces itself, creating more hesitation on future valid setups

Analysis paralysis often worsens over time as traders add more indicators, more conditions, and more complexity to their decision-making. Each addition feels like it should improve results by filtering out bad trades. In practice, the added complexity creates more opportunities for hesitation and second-guessing. The trader ends up with a system so complex that even valid setups generate uncertainty about whether all conditions are truly met.

Automation forces simplicity and decisiveness. The entry criteria must be defined precisely enough for software to evaluate. This requirement naturally eliminates the ambiguity that enables analysis paralysis. Either the conditions are met and the trade is taken, or they are not met and no trade occurs. There is no middle ground of "maybe" or "let me check one more thing."

For traders who struggle with analysis paralysis, the basics of trading automation provide a path forward that bypasses the overthinking entirely. The human role shifts from making execution decisions to designing and monitoring the system, a role that plays to human strengths rather than weaknesses.

Revenge Trading and the Loss Recovery Trap

Revenge trading is the impulsive pattern of taking additional trades specifically to recover from recent losses, typically with larger position sizes or looser entry criteria. This behavior transforms single losses into losing streaks and losing streaks into account blowups. The psychological urge to revenge trade is nearly universal among traders who have experienced losses, making structural prevention through automation essential.

The revenge trading pattern follows a predictable sequence:

- Initial loss: A legitimate trade following the strategy results in a loss

- Emotional response: The trader feels the urgent need to recover the loss immediately

- Criteria abandonment: The next trade is taken for emotional reasons rather than strategic ones

- Increased size: To recover faster, position size increases beyond normal risk parameters

- Second loss: The poorly-conceived revenge trade fails at higher probability than normal

- Escalation: Now facing larger losses, the urge to recover intensifies, leading to more revenge trades

- Account damage: The spiral continues until significant account damage forces the trader to stop

Tilt: A poker term adopted by traders describing the emotional state where frustration from losses leads to increasingly poor decisions. Being "on tilt" means trading emotionally rather than strategically, typically resulting in accelerating losses. Learn more

The insidious aspect of revenge trading is that it feels rational in the moment. The trader is not consciously thinking "I am revenge trading." Instead, they convince themselves that the next opportunity is genuinely valid, that increasing size makes sense given their conviction, and that they need to be aggressive to recover. This rationalization makes revenge trading difficult to prevent through willpower alone.

Automation prevents revenge trading through several mechanisms:

- Emotional blindness: The system does not know or care about recent results when evaluating new entries

- Fixed position sizing: Size cannot be increased based on recent losses

- Consistent criteria: Entry requirements remain unchanged regardless of account status

- Daily loss limits: Maximum daily loss thresholds stop all trading before spiral damage accumulates

- Cooling-off periods: Enforced delays after losses prevent immediate re-entry

Traders who recognize revenge trading tendencies in themselves should consider automation not as an admission of weakness but as intelligent risk management. Professional trading firms enforce similar structural controls on their traders precisely because they understand psychology affects everyone.

Trading Discipline vs. Trading Automation

Traditional trading psychology emphasizes developing discipline through mental training, journaling, meditation, and coaching. While these approaches have merit, they share a fundamental limitation: they require continuous effort and are most likely to fail precisely when they are most needed. Automation offers an alternative that works regardless of the trader's mental state.

FactorDiscipline-Based ApproachAutomation-Based Approach Effort requiredContinuous, every tradeFront-loaded in setup, minimal ongoing Failure modeBreaks down under stressPerforms identically under all conditions ConsistencyVaries with emotional statePerfect consistency by design Time requirementConstant attention during tradingRuns independently of trader presence ScalabilityLimited by human attentionMultiple instruments simultaneously Improvement pathDifficult to measure progressClear metrics and adjustable parameters Skill transferabilityInternal, hard to replicateExternal, can be shared or modified

When Discipline Works

Discipline-based trading can work for traders who:

- Genuinely enjoy the process of active trading and decision-making

- Have demonstrated consistent rule-following over extended periods

- Trade infrequently enough that each decision receives full attention

- Have sufficient psychological distance from their trading capital

- Can dedicate focused time without interruption during trading hours

When Automation Works Better

Automation provides superior results for traders who:

- Recognize patterns of emotional interference in their trading history

- Cannot dedicate consistent attention during market hours

- Want to trade multiple instruments or strategies simultaneously

- Find the execution process stressful rather than enjoyable

- Have repeatedly broken their own rules despite knowing better

- View trading as a means to financial goals rather than an activity for its own sake

Many successful traders use hybrid approaches, maintaining automation for core strategy execution while reserving discretionary decisions for higher-level choices like market exposure or system modifications. This division plays to human strengths (pattern recognition, adaptation) while protecting against human weaknesses (emotional execution, consistency).

How Automation Addresses Psychological Weaknesses

Automation addresses psychological trading weaknesses by removing humans from the execution loop where their emotions cause the most damage. Rather than trying to make humans better at controlling their emotions, automation acknowledges human limitations and works around them. This structural approach provides protection that discipline-based methods cannot match.

The Execution Firewall

Automation creates a firewall between the trader's emotions and actual trade execution. The trader's role shifts from making real-time decisions under pressure to designing and monitoring systems that make those decisions automatically. This separation means that even if the trader feels fear, greed, or revenge, those feelings cannot affect what trades are actually taken.

Consider a scenario: price drops sharply after entry, and the position shows a significant loss. A manual trader experiences:

- Fear that the loss will grow larger

- Urge to exit before the stop is hit

- Temptation to move the stop to avoid being stopped out

- Anxiety about whether the original analysis was correct

An automated system experiences none of this. It holds the position until either the stop or target is reached, exactly as designed. If the price recovers, the target is hit. If the price continues falling, the stop is hit. No intermediate emotional interference is possible.

Consistent Position Sizing

Human traders naturally vary position sizes based on confidence, recent results, and emotional state. After wins, they size up; after losses, they either size down (gun-shy) or size up dramatically (revenge). This inconsistency ensures that the largest positions correlate with the worst decision-making states.

Automation maintains consistent position sizing based on predefined rules, typically risking the same percentage of equity on each trade. This consistency means position size is determined by strategy design rather than emotional state. Large winning trades receive the same size as trades following losses, creating the mathematical consistency that profitable trading requires.

Elimination of Selective Execution

Manual traders unconsciously filter which signals they actually trade, taking the ones that "feel right" and skipping others. This selective execution often inverts strategy performance: traders skip the scary entries that precede big moves and take the comfortable entries that precede mean reversion. The result is worse performance than the strategy would deliver if every signal were taken.

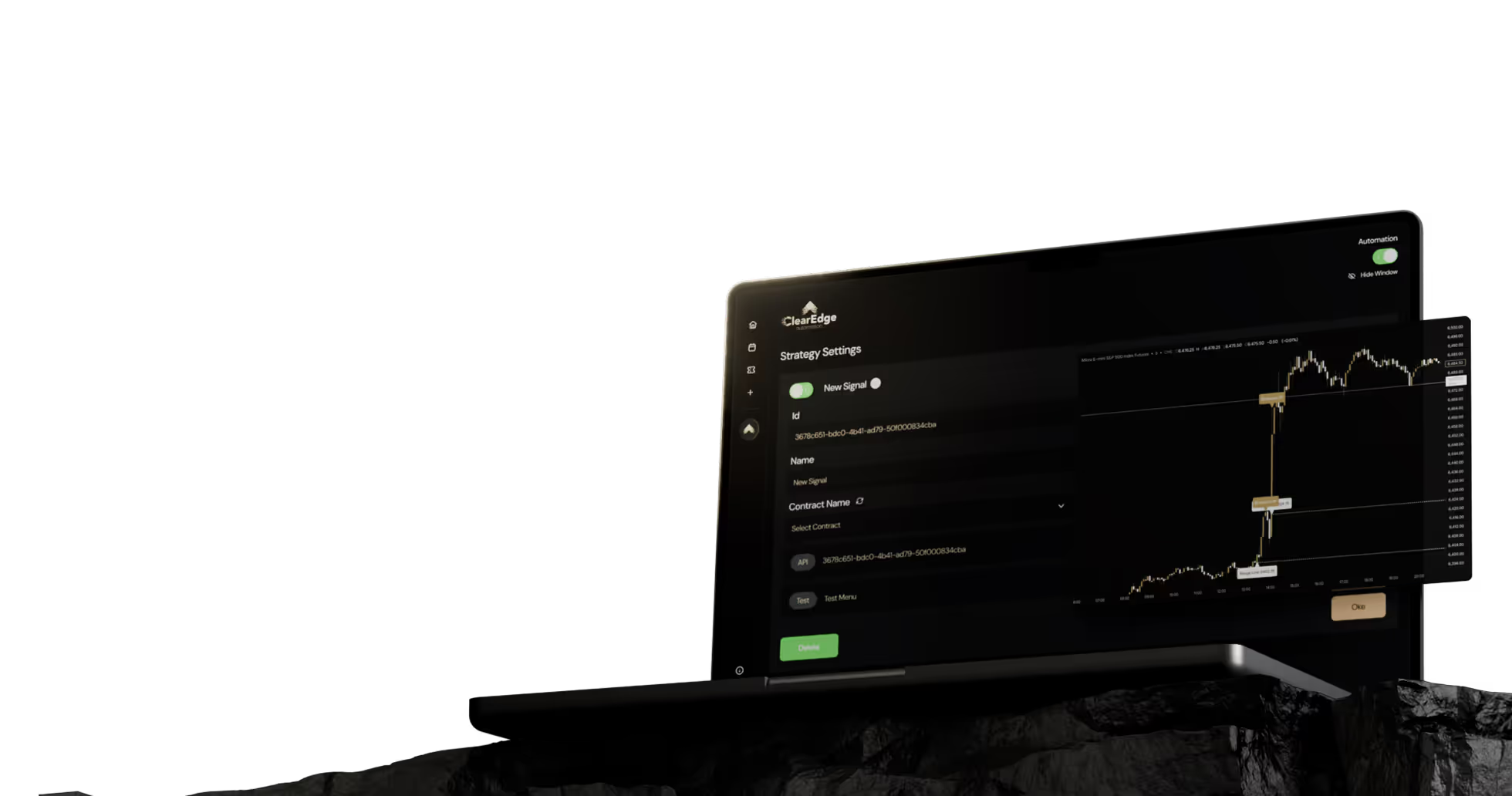

Automated systems execute every qualifying signal without selectivity. This captures the full strategy performance including the uncomfortable trades that often generate the largest profits. Platforms like ClearEdge execute all signals from their predefined strategies without human filtering, ensuring that psychological comfort does not override strategy design.

Automation for Busy Professionals

For traders with demanding careers, families, and other commitments, automation solves a practical problem beyond psychology: the simple impossibility of monitoring markets during trading hours. These busy professionals often have the capital and analytical ability to trade successfully but lack the time for active market engagement. Automation transforms trading from a second job into a truly passive activity.

The Time Constraint Reality

Consider the schedule of a typical professional interested in futures trading:

- Futures markets trade nearly 23 hours per day, five days per week

- Key US session hours overlap with work hours for most professionals

- Family commitments consume evenings and weekends

- Sleep requirements eliminate overnight session participation

- Even available time is fragmented by meetings, obligations, and fatigue

Manual trading under these constraints means either missing most opportunities or trading while distracted by other responsibilities. Neither approach is sustainable. Automation allows the strategy to execute during optimal market hours regardless of the trader's schedule.

What Automation Provides Busy Professionals

- 24/5 market coverage: Strategies execute during all sessions without requiring trader presence

- No schedule conflicts: Important meetings, family events, and other commitments do not mean missed trades

- Reduced stress: No anxiety about what the market is doing while away from screens

- Better work performance: Focus on career without trading distraction during work hours

- Sustainable lifestyle: Trading supports life rather than consuming it

The ClearEdge approach was specifically designed for traders who do not have time to watch charts all day. The platform handles execution while traders maintain normal lives, checking results at convenient times rather than being chained to screens. This model appeals to professionals who want market participation without the lifestyle sacrifice of active trading.

Managing Automation as a Busy Professional

Effective automation management requires surprisingly little time:

- Daily review: 5-10 minutes reviewing overnight and daily performance

- Weekly analysis: 30-60 minutes assessing strategy performance and any needed adjustments

- Monthly evaluation: 1-2 hours reviewing comprehensive performance metrics against goals

- Quarterly optimization: Half-day session evaluating whether strategy changes are warranted

This time investment is manageable even for highly-committed professionals and produces better results than sporadic active trading squeezed between other obligations.

Building Trust in Your Automated System

Transitioning from manual to automated trading requires building trust in the system, which takes time and deliberate effort. Many traders intellectually understand automation's benefits but emotionally struggle to let go of control. This trust-building process is essential for realizing automation's full psychological benefits.

The Trust Development Process

Trust in automation develops through stages:

- Intellectual acceptance: Understanding why automation makes sense logically

- Paper trading validation: Watching the system execute correctly without real money at risk

- Small live validation: Running with minimal position sizes to verify live execution

- Gradual scaling: Increasing size as confidence grows through observed performance

- Full trust: Allowing the system to operate without interference through normal drawdowns

Rushing this process often leads to premature interference when the first drawdown occurs. Traders who have not built sufficient trust will override their automation at exactly the wrong time, typically stopping the system just before it would have recovered.

Trust-Building Best Practices

- Extended paper trading: Run for at least 2-4 weeks in simulation before live trading, long enough to see drawdowns

- Start smaller than comfortable: Initial live positions should feel almost trivially small

- Define intervention rules in advance: Specify exactly what conditions would warrant stopping the system

- Track temptation to interfere: Journal moments when you wanted to override but did not

- Review why automation is running: When temptation strikes, revisit your reasons for automating

- Celebrate non-interference: Recognize and reinforce behavior when you let the system work through difficulty

When Trust Wavers

Even with solid trust-building, drawdowns will test confidence. Prepare for these moments by:

- Understanding historical drawdown characteristics before they occur

- Having predetermined thresholds for acceptable drawdown versus system failure

- Creating barriers to impulsive intervention (delayed access, confirmation requirements)

- Having an accountability partner who can provide perspective during difficult periods

When Human Intervention Is Appropriate

While automation's power lies in removing human interference, there are legitimate situations where human judgment should override automated systems. Understanding these situations prevents both inappropriate intervention and inappropriate passivity.

Legitimate Intervention Scenarios

Technical failures: If the automation platform, broker connection, or data feed malfunctions, human intervention to flatten positions or disable trading is appropriate.

Unprecedented market conditions: Events like flash crashes, exchange halts, or liquidity crises may require human judgment about whether to continue normal operation.

Known upcoming risks: Major events like Fed announcements, elections, or geopolitical crises may warrant reducing or eliminating exposure regardless of what the automation would do.

Strategy invalidation signals: If performance deviates dramatically from backtested expectations over a statistically significant sample, investigating before continuing is reasonable.

Personal circumstances: Life events that would make monitoring impossible (extended travel, medical situations) may warrant temporary shutdown.

Inappropriate Intervention Patterns

These intervention patterns indicate emotional trading under the guise of legitimate judgment:

- Stopping the system after 3-5 losing trades without evaluating whether this is within normal expectations

- Overriding a stop loss because "this time is different"

- Adding to positions that the automation has not signaled

- Removing risk controls because recent wins suggest they are unnecessary

- Shutting down during news events that fall within the strategy's designed parameters

The ClearEdge FAQ addresses common scenarios where traders wonder whether intervention is appropriate. A useful test: if the urge to intervene arose from recent losses rather than objective system evaluation, the intervention is likely emotional rather than strategic.

Creating an Intervention Protocol

Document intervention rules before they are needed:

- Specific conditions that warrant immediate shutdown (technical failures, extreme volatility beyond parameters)

- Conditions that warrant position reduction but continued operation

- Review triggers for strategy evaluation (drawdown thresholds, consecutive loss counts)

- Required cooling-off period before any non-emergency intervention

- Who else should be consulted before major intervention decisions

Having this protocol prevents in-the-moment rationalization of emotional decisions.

Frequently Asked Questions

1. How does automation actually remove emotion from trading?

Automation removes emotion from trading by creating a structural barrier between your feelings and trade execution. The system operates based on predefined rules programmed before any trade occurs, executing entries, exits, and position sizing exactly as specified regardless of how you feel in the moment. You might experience fear during a drawdown or excitement during a winning streak, but those emotions cannot influence what trades are taken because you are not the one placing the orders. The emotional experience remains, but its ability to damage your trading is eliminated.

2. Will I still feel stress if my trading is automated?

Most traders report significantly reduced stress with automation, though some stress remains. The elimination of real-time decision-making removes the acute stress of execution choices. However, you will still experience some stress watching positions move, particularly during drawdowns. The difference is that this stress cannot cause you to make poor decisions because the decisions are already made. Over time, as trust in the system builds and you observe it performing as expected, even this residual stress typically decreases substantially.

3. What if I have a strong feeling about the market that contradicts my automation?

Strong feelings about market direction are precisely what automation protects against. Research consistently shows that trader intuition is unreliable and often inversely correlated with actual market moves. The feeling that "this time is different" appears before most major trading mistakes. Your automation represents your best thinking done calmly before any position was at risk. Trust that version of yourself over the version experiencing strong feelings with money on the line. If your intuition proves consistently correct over time, that pattern can be incorporated into future strategy design.

4. Can automation help if I am addicted to trading?

Automation can be part of addressing problematic trading behavior, but it is not a complete solution for trading addiction. By removing the constant decision-making that feeds addictive patterns, automation reduces the stimulation that compulsive traders seek. However, traders with genuine addiction may find ways to circumvent their automation or develop other problematic behaviors. If you believe your trading has become compulsive, professional help from a therapist familiar with behavioral addictions is recommended alongside any automation implementation.

5. How long does it take to trust an automated system?

Building genuine trust typically takes 2-6 months of live operation, including experiencing at least one significant drawdown period. Initial intellectual trust develops quickly, but emotional trust requires watching the system perform through challenging conditions without your interference. The trust-building process should not be rushed. Start with position sizes small enough that drawdowns do not trigger intervention urges, and scale up gradually as your confidence grows through observed performance. Traders who skip this process often interfere with their automation at the worst possible times.

6. What is the difference between removing emotion and suppressing emotion?

Suppressing emotions means feeling them but forcing yourself not to act on them, which requires constant effort and typically fails under pressure. Removing emotions from trading means structuring your approach so emotions cannot affect outcomes regardless of whether you feel them. With automation, you may still feel fear during losses or greed during wins, but those feelings have no pathway to affect actual trading decisions. This distinction matters because suppression is exhausting and unreliable, while structural removal is sustainable and consistent.

7. How does ClearEdge specifically address trading psychology?

ClearEdge addresses trading psychology through several mechanisms. The platform executes predefined strategies without requiring user intervention, eliminating the opportunity for emotional interference. Position sizing is determined by configuration rather than real-time judgment. Stop losses and profit targets execute automatically without the possibility of being moved or removed. Daily loss limits prevent spiral losses from revenge trading. The overall design assumes that traders will be better served by removing execution decisions from their control entirely rather than expecting them to maintain perfect discipline.

8. Can I customize how much control I give up to automation?

Most automation platforms, including ClearEdge, allow varying levels of automation. Some traders automate only entries while managing exits manually. Others automate exits but select entries discretionarily. Full automation handles everything from signal detection through position management. The appropriate level depends on where your psychological weaknesses lie. If you struggle with entry hesitation, automate entries. If you struggle with holding winners or taking stops, automate exits. Most traders with significant psychological challenges benefit from full automation that removes them from all execution decisions.

9. What happens if the automation takes a trade I disagree with?

Disagreeing with individual trades is normal and expected. Automated systems take every trade meeting their criteria, including trades that feel wrong in the moment. These uncomfortable trades often perform better than average because they occur at points of maximum fear or uncertainty, which frequently precede significant moves. If you find yourself consistently disagreeing with what the automation does, this may indicate either a need for system modification or, more likely, that your intuition reflects the same emotional biases that caused problems in manual trading.

10. Is automation just avoiding the problem of trading psychology rather than solving it?

Automation is a practical solution to trading psychology, not an avoidance of the problem. The goal is not psychological growth for its own sake but profitable trading. If automation achieves profitable trading while bypassing psychological challenges, that is a valid solution. Some traders view this as avoidance; others view spending years on psychological development that may never succeed as the real avoidance of practical solutions. Both paths can lead to success, but automation offers a more reliable timeline for traders who have already demonstrated psychological trading difficulties.

Conclusion

Trading psychology destroys more accounts than bad strategies ever will. The predictable patterns of emotional trading, from cutting winners short to revenge trading after losses, repeat across traders regardless of intelligence, education, or market knowledge. Traditional approaches emphasizing discipline and mental training help some traders but fail most, particularly under the pressure of actual losses. Automation offers a fundamentally different solution: rather than trying to fix human psychology, it removes humans from the execution loop where their emotions cause damage.

The psychological benefits of automation extend beyond simply preventing mistakes. Reduced stress, eliminated decision fatigue, and freedom from screen-watching transform the trading experience from exhausting to sustainable. Busy professionals gain the ability to participate in markets without sacrificing careers or relationships. Traders who have repeatedly broken their own rules finally find a structure that enforces consistency. The shift from fighting your psychology to working around it represents a practical maturity that many successful traders eventually reach.

If you recognize your own patterns in the psychological failures described in this guide, automation deserves serious consideration. Not as an admission of weakness, but as intelligent acknowledgment of human limitations and implementation of structural solutions. The traders who succeed long-term are not those with superhuman discipline but those who build systems that compensate for normal human psychology. Automation is such a system, and for many traders, it represents the difference between eventual account destruction and sustainable profitability.

References

- Barber, B. M., Lee, Y., Liu, Y., & Odean, T. (2017). Do Day Traders Rationally Learn About Their Ability? University of California, Davis Working Paper. https://faculty.haas.berkeley.edu/odean/papers/Day%20Traders/Day%20Trading%20and%20Learning.pdf

- Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291. https://doi.org/10.2307/1914185

- Odean, T. (1998). Are Investors Reluctant to Realize Their Losses? The Journal of Finance, 53(5), 1775-1798. https://doi.org/10.1111/0022-1082.00072

- Barber, B. M., & Odean, T. (2000). Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. The Journal of Finance, 55(2), 773-806.

- Shefrin, H., & Statman, M. (1985). The Disposition to Sell Winners Too Early and Ride Losers Too Long: Theory and Evidence. The Journal of Finance, 40(3), 777-790.

- Commodity Futures Trading Commission. (2025). Customer Advisory: Understanding the Risks of Trading. https://www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/index.htm

- National Futures Association. (2025). Investor Resources: Trading Psychology. https://www.nfa.futures.org/investors/investor-resources/index.html

This content is for educational purposes only and does not constitute financial advice. Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance of any trading system or strategy is not indicative of future results.

RISK WARNING: Futures trading carries a high level of risk and may not be suitable for all investors. You could lose more than your initial investment. Only trade with capital you can afford to lose. Automated trading systems cannot guarantee profits and may experience periods of drawdown.

ClearEdge Automation is a futures automation platform. This content may reference ClearEdge products and services where contextually relevant to the educational material.

Published: December 2025 · Last updated: 2025-12-04

Author: ClearEdge Team, 100+ years combined trading and development experience, including 29-year CME floor trading veteran

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript

Steal the PlaybooksOther TradersDon’t Share

Every week, we break down real strategies from traders with 100+ years of combined experience, so you can skip the line and trade without emotion.